This article was co-authored with Saaraa Alimahomed.

After two years of research and engagement, the Voluntary Carbon Markets Integrity Initiative (VCMI) launched its finalised Claims Code of Practice (Claims Code of Practice) on 28 June 2023. The finalised Claims Code of Practice built upon the Provisional Claims Code of Practice circulated in June 2022 as we have previously reported on here.

The Claims Code of Practice covers the demand side of carbon markets, and can be viewed as the counterpart to the work produced by the Integrity Council for the Voluntary Carbon Markets which published its Core Carbon Principles earlier this year as we have previously reported here.

Objective of Claims Code of Practice

The VCMI recognises that the true potential of carbon finance can only be realised if the voluntary carbon market operates with high integrity, and on the demand side this means that the use of carbon credits by companies increases overall greenhouse gas reductions or removals rather than substituting for existing actions. The Claims Code of Practice sets out guidance and key steps for companies on the credible use of carbon credits as part of their climate commitments and on the associated claims that may be publicly made regarding the use of those credits. The outcome of a company complying with the Claims Code of Practice and related documentation, is a VCMI Claim.

A key aspect of the Claims Code of Practice is the idea of ‘beyond value chain mitigation’. This means that carbon credits are not counted as internal emissions reductions, but must be climate mitigation, which is additional to that already taking place within a company’s value chain, therefore ensuring that the company contributes both to its own climate goals and the collective global effort to reach net zero.

As well as assisting companies, the Claims Code of Practice also assists buyers of goods and services to make climate-friendly purchases, and assists investors in determining the credibility of a company’s decarbonisation actions. Importantly, it also assists governments and regulatory authorities in developing company reporting requirements and other standards or policies regarding the credible use of carbon credits by companies.

VCMI Claims

Companies can make a VCMI Claim by following four steps:

1. Comply with Foundational Criteria

Companies must comply with the Foundational Criteria before they can make a VCMI Claim. The Foundational Criteria are designed to be aligned with the long-term goals of the Paris Agreement and represent best practice formulated by global initiatives such as the Science Based Targets Initiative.

The Foundational Criteria require:

- maintaining and publicly disclosing an annual greenhouse gas emissions inventory;

- setting and publicly disclosing validated science-based near-term emissions reduction targets;

- demonstrating that the company is on track to meet a near-term emissions reduction target; and

- ensuring that the company’s public policy advocacy is Paris Agreement-aligned and does not represent a barrier to ambitious climate regulation.

2. Making a VCMI Claim

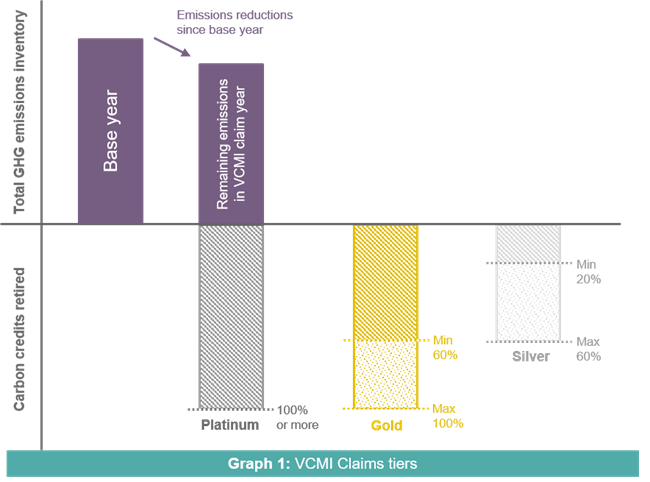

Once the Foundational Criteria are met, the Claims Code of Practice sets out three tiers of claims that companies can make about their use of carbon credits in contributing towards efforts to reach global net zero by 2050. The tiers comprise:

- VCMI Silver: The lowest tier, requiring the purchase and retirement of carbon credits in an amount greater than 20% and less than 60% of a company’s remaining emissions once it has demonstrated progress towards its near-term targets;

- VCMI Gold: Requiring the purchase and retirement of carbon credits in an amount equal to or greater than 60%, and less than 100%, of a company's remaining emissions once it has demonstrated progress towards its near-term targets; and

- VCMI Platinum: The highest tier, requiring the purchase and retirement of high-quality carbon credits equal to or greater than 100% of remaining emissions.

Each tier requires the purchase and retirement of high-quality carbon credits proportionate to the remaining emissions once a company has demonstrated progress towards meeting its near-term targets. This essentially means the amount of carbon credits retired for the purposes of the VCMI Claim is proportionate to the remaining emissions in the year that the company makes a VCMI Claim. VCMI defines remaining emissions as emissions that remain in a given year as a company progresses towards the delivery of its near and long-term targets and should be above and beyond companies’ internal decarbonisation efforts.

These carbon credits therefore cannot be counted towards the achievement of within-value chain or internal emissions reduction targets, but instead represent a contribution to both the company’s climate goals and global efforts to mitigate climate change. This includes activities that avoid or reduce GHG emissions, and those that remove and store GHGs from the atmosphere. The below graph visualises this showing VCMI Claims tiers Silver, Gold and Platinum and their respective thresholds that represent the amount of credits retired, proportional to the remaining emissions in the year that a company makes a claim, having reduced emissions in comparison to the base year:

The percentage of carbon credits to be purchased and retired must also increase in each subsequent year after the company makes a VCMI Silver or Gold Claim. Companies are also required to make a public statement that they have complied with the Foundational Criteria and all additional requirements in the Claims Code of Practice in order to make the chosen VCMI Claim.

3. Meet the required carbon credit use and quality thresholds

The carbon credits which may be used in each tier must of the highest quality, and therefore must be carbon credits that meet the ICVCM’s Core Carbon Principles and which qualify under the ICVCM’s Assessment Framework.

In addition to meeting the quality thresholds for carbon credit use, companies are required to publicly disclose key information related to each carbon credit retired, such as the host country, credit vintage, methodology and project type for the credit and whether or not the carbon credit is associated with a corresponding adjustment in accordance with Article 6 of the Paris Agreement. If the carbon credit is reported as being associated with a corresponding adjustment, applied presently or in the future, this shall be evidenced by authorisation by a participating Party, including information on the authorised use and the timings of the authorisation, and the application of the corresponding adjustment.

4. Obtain third-party assurance following the VCMI Monitoring, Reporting & Assurance (MRA) Framework

Finally, companies must obtain third party assurance that follows the VCMI Monitoring, Reporting and Assurance (MRA) Framework (which will be published in November 2023). The metrics that companies must report, and which must be subject to independent, third party assurance, are set out in Annex F of the Claims Code of Practice and include the different elements of the Foundational Criteria as well as the metrics relating to the carbon credits used by the company.

It is intended that reporting must be made publicly available to stakeholders on a company’s website, in a standalone report or within a more comprehensive report (such as a sustainability report).

Next steps

From July 2023, the VCMI will release additional modules to complement the Claims Code of Practice. It will also hold consultations and create the VCMI Stakeholder Forum, which is a marketing sounding board to guide the ongoing evolution of the Claims Code of Practice.

The VCMI intends to develop special provisions for specific industries such as hard-to-abate sectors, specific geographies such as developing countries, and specific corporate demographics such as small and medium-sized enterprises. The VCMI aims to align these provisions to existing widely accepted standards, such as the Green Guide as well as new guidelines such as the Green Claims Code developed by the UK Competition and Markets Authority and the proposed EU Green Claims Directive.

The VCMI has also released supplementary guidance which provides further instructions on the common taxonomy for categorising climate claims, such as the mode of communication, claim length, level of quality control, scope of claim and the stage of a claim. This guidance also sets out principles for climate mitigation claims credibility, which include aspects like transparency, traceability, accurateness, conservative, informative, relevant and not misleading.

Of note, the VCMI recommends that companies refrain from using claims such as “carbon neutral”, given emerging regulations and guidance that make it more challenging to make such a claim, such as the proposed EU Green Claims Directive.

In the Provisional Claims Code of Practice, VCMI set out guidance for companies to make carbon-neutral brand, product or service level claims. The public consultation which followed the release of the Provisional Claims Code of Practice raised concerns about such claims in terms of potential greenwashing risk. Accordingly, VCMI intends to undertake a more thorough evaluation of these types of claims, having regard to existing and emerging standards.

How we can help

For more information on the implications of the VCMI’s Claims Code of Practice or participating in the voluntary carbon market please contact a member of our climate change and sustainability team.