Introduction

On July 27, 2017, the UK Financial Conduct Authority (FCA) announced that it would no longer

compel or persuade banks to make submissions to LIBOR as from the end of 2021. In the wake of

the LIBOR manipulation scandal, regulators found that there were few transactions taking place to

support some of the currencies and tenors for which LIBOR was published. Submissions, it was felt,

were based more on expert judgment rather than transaction data, making it subject to potential

manipulation, which in turn led to a number of criminal actions around the world.

LIBOR will cease as a benchmark by the

end of 2021. The insurance industry is

exposed to this.

This focused the attention of global regulators on benchmark

reform more generally. The IOSCO Principles of Financial

Benchmarks struggled with banks reluctant to make

submissions, and this prompted regulators needing to

convince banks to make submissions just to keep LIBOR

going. In 2014, the Financial Stability Board had already made

recommendations that financial institutions transition away

from LIBOR. The implementation of Regulation (EU) 2016/1011

in 2016 on indices used in benchmarks in financial instruments

and contracts to measure the performance of investment funds

provided further impetus for reform. Written plans were required

setting out actions that will be followed, in the event that a

benchmark changes or ceases to be provided. It also set out

processes which could lead to a national competent authority

declaring a relevant benchmark as unrepresentative.

The ICE Benchmark Administrator (IBA) which is the

administrator of LIBOR has taken steps to reform LIBOR.

IBA has also indicated the intention to continue to work with

panel banks to see if LIBOR can continue post 2021. However

they said that banks should not rely upon the continuation of

LIBOR and in the United Kingdom, the FCA has warned that

even if LIBOR continues, it will have changed as a rate and as

such there is “a high probability that it would no longer pass

regulatory tests of representativeness”. The Bank of England’s

Working Group on Sterling Risk Free Reference Rates has set

a target of end of Q3 2020 to cease issuance of GBP-LIBOR

based cash products, with tenors past the end of 2021.

This means that LIBOR will cease as a benchmark by the

end of 2021.

The insurance industry is exposed to this. Insurers have huge

sums invested and are counterparties to many financial

instruments which will remain in force after the end of 2021, and which have LIBOR (or another benchmark which will

be amended or replaced) as the benchmark for applicable

interest rates, and triggers for hedging contracts and swaps.

In addition, insurers may insure trade credit arrangements

where the underlying financial contracts use LIBOR (or another

benchmark which will be amended or replaced). They are

insuring financial institutions who, as the issuers of financial

instruments, may have their own exposures arising from this,

the directors and officers of businesses that may also be at risk

from the same issues in financial contracts that their businesses

have, and the likes of pension funds and investment managers.

The list goes on.

The regulators want to know what the insurance industry is

doing to manage its exposure to benchmark reform, across its

investment portfolios and in considering the risks that it writes.

After focusing for much of the year on the issues arising from

COVID-19, most regulators have resumed work on LIBOR from

June 1, 2020.

What do regulators expect insurers to do with exposure to

LIBOR references? In most EU member states there have been

clear statements requiring market participants, including the

managers of insurance companies, to address the exposure

to the demise of LIBOR (and other benchmarks). This work

needs to be undertaken as soon as possible if it is not already

underway.

This short paper looks at the issues for insurers and explains

how Norton Rose Fulbright can assist in managing the risk

associated with benchmark reform by identifying where

contracts need to be renegotiated and with innovative and cost

efficient solutions. We can also assist in the risk management

analysis of the risks written as part of the underlying business.

Regulators want to know what the

insurance industry is doing to manage

its exposure to benchmark reform.

Regulatory risks and expectations relating to LIBOR

What do regulators expect insurers to do with exposure to LIBOR references? Most regulators have

made clear statements requiring financial institutions like insurance companies to address the

exposure to the demise of LIBOR (and other benchmarks). This work needs to be undertaken as

soon as possible if it is not already underway.

The change from LIBOR (or other relevant benchmarks) will

have implications for insurance company risk management and

therefore is of concern to regulatory authorities. Insurers hold

a number of long-dated instruments to cover their liabilities.

Life insurers and annuity providers rely on derivatives to hedge

exposure to differences in the values of assets and liabilities

over long time horizons. According to the UK regulator, the

Prudential Regulation Authority, insurance companies in

the UK have entered into around £323bn of LIBOR-linked

derivative contracts. References to LIBOR can also be found

in commercial loans, company pension scheme documents,

reinsurance contracts, commercial contracts, intra-group loans

and discount rates used in valuations. A small change to the

discount rate could significantly impact long-term liabilities.

Changes to LIBOR may have a knock-on impact for reinsurance

collateral arrangements.

Contracts that insurance companies have entered into may

contain “fall-back” terms that specify the position should LIBOR

not be available. Insurers should review contractual terms and

“re-paper” these documents with an alternative risk-free rate.

Insurance companies use a number of internal tools to measure,

monitor and report based on LIBOR rates or yield curves. Under

Solvency II insurers are required to discount liabilities using

risk-free rate curves that are derived from LIBOR. In February

2020, the European Insurance and Occupational Pensions

Authority (EIOPA) launched a discussion on the impact of IBOR

transition on the risk-free rate environment. Following feedback

EIOPA is planning to make recommendations for suitable steps

to reduce insurers’ exposure to the transition.

Some regulators are quite active and have written to insurance

companies to seek assurance that managers understand the

risks associated with the transition and are taking appropriate

action to move over to alternative rates by the end of 2021.

The PRA in the UK, for example, has set out initial expectations

for transition progress during 2020. The PRA has asked

insurance companies to engage actively with the wider

transition efforts in the market. Plans should include targets

in project milestones to ensure that management information

is available to track progress. Regulators expect to see

momentum on transition and will need to see evidence

of this over the course of 2020.

Findings from the UK review of firms’ preparations has revealed

that although firms have looked at exposure on their balance

sheet, they have not always looked beyond this towards wider

risk management issues such as pricing, FX-related risks,

liquidity risk and valuation.

Some firms lacked information on where their current

exposures were and did not have appropriate tools to monitor

exposure. Strong responses to regulatory requests for

information showed a commitment to reducing the risk of a

“cliff-edge” at the end of 2021. These firms were undertaking

due diligence on their contracts and exposures and transferring

over to alternative risk free rates in advance.

Insurance companies are expected to understand where they

are exposed to dependence upon LIBOR and ensure that any

such dependence is removed. They should have in place robust

governance arrangements for managing and monitoring the

risk to their business. Regulators will be expecting firms to

make progress on preparations for the end of LIBOR over the

course of the next few months

As the immediate challenges of COVID-19

subside, the regulators have renewed

efforts to ensure that firms are getting

ready for the changes.

Insurance companies should already be considering how to

meet their obligations in the context of LIBOR transition. If they

have not done so this should be addressed as a priority. Actions

might include keeping appropriate records of management

meetings or committees that demonstrate they have acted

with due skill, care and diligence in their overall approach to

LIBOR transition. Firms should also undertake a review of their

existing financial instruments and reinsurance agreements

for references to LIBOR and produce an assessment of the

consequences of the references no longer being valid.

As the immediate challenges of COVID-19 subside, a number

of regulators have renewed efforts to ensure that firms are

getting ready for the changes, announcing that from June 2020

LIBOR-exposure is back on the agenda.

Underwriting

There are also the risks that insurers write. Consideration

may also need to be given to whether certain underlying

risks might be higher than perceived. If a risk has insured

exposures which themselves could be increased by underlying

contracts referencing LIBOR, this could lead to higher claims

or a line of claims that was not expected. This may apply to

say Financial Institutions or certain advisors or investment

managers who are recommending or arranging investments,

or advising on transactions. Directors and Officers may be

exposed if their business suffers as a result of failure to manage

LIBOR exposures. Perhaps some trade credit insurances have

underlying financial instruments with LIBOR exposure.

How we can help

At a practical level there are two activities for insurers in responding to the legal challenges raised

by IBOR:

Step 1 is to understand institutional exposure

Step 2 is to implement a plan to deal with that exposure

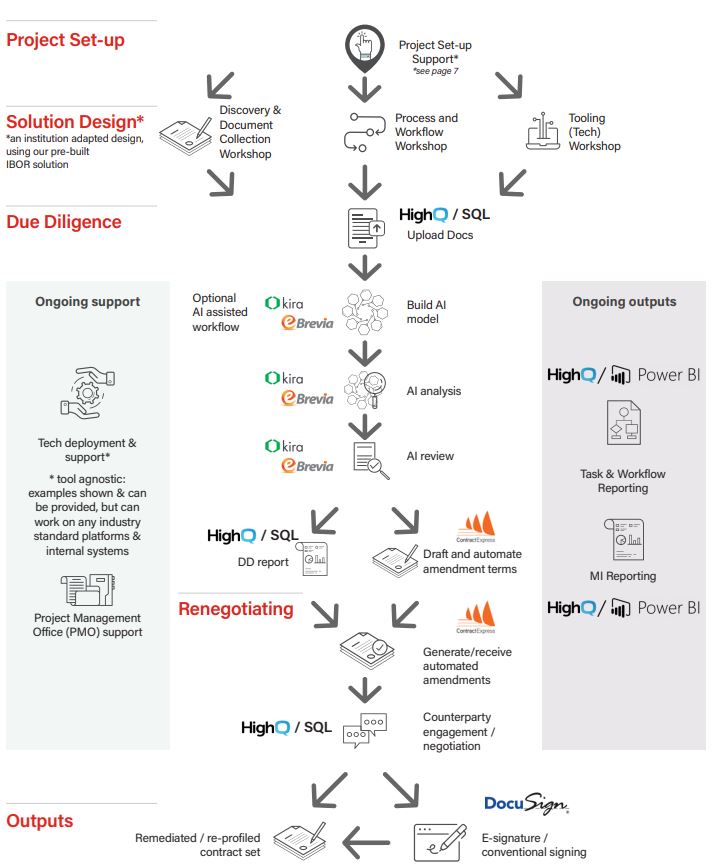

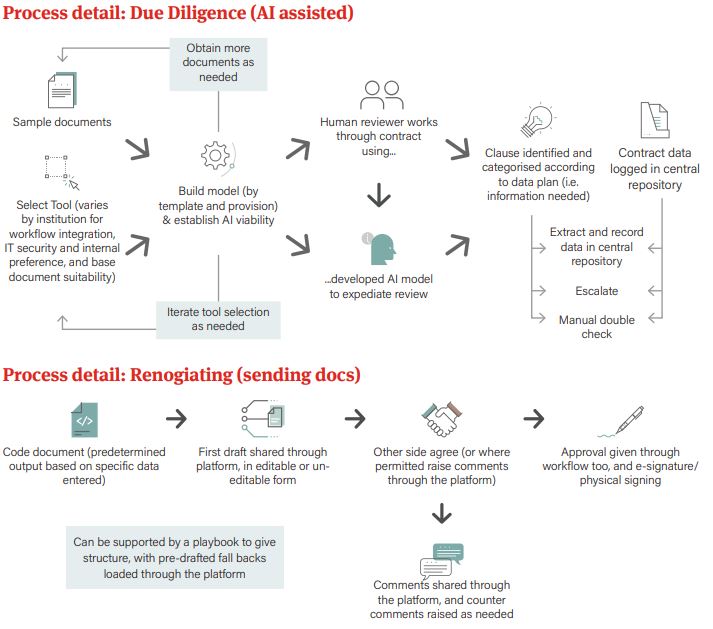

We have developed a solution for both of these steps, which is overseen by senior lawyers, but much of the work is completed

by associates and a closely supervised paralegal team. We use machine learning tools to extract the relevant information on

current exposure more rapidly, efficiently and accurately than would otherwise be possible, as well as automating documents and

managing negotiations through central platforms. A team of technologists, who have developed the process, adapt it for each

client and provide support throughout each project. The process works as follows:

Step 1 – understanding institutional exposure

Understanding exposure to IBOR is challenging. It is likely to

be incorporated across a wide range of agreements. Typically

information about where IBOR is incorporated into agreements

is not held centrally, or cross referenced to other pertinent

information like type of contractual counterparty and risk

weighting. Gathering this information therefore requires an

extensive due diligence process.

Depending on an insurer’s subsequent role in initiating

amendments to these agreements, due diligence may feel more

or less urgent, but it is always recommended. Sometimes an

insurer needs to request amendments, for example where it has

made an investment on a quasi-loan basis referencing IBOR,

requiring a contractual update to reference a functional interest

rate. In other cases, an insurer has bought a bond referencing

IBOR and another party requests the amendment.

In the former case, there is little choice but to complete a wide

ranging due diligence, to decide what form of amendment

agreement to propose. However, if responding to amendment

requests, an insurer has a choice. It can proactively review

relevant agreements and decide on a consistent position in

advance. Alternatively it can wait and respond piecemeal as

requests come in. The total effort required is likely to be less

(and quality of decision making greater), if a proactive review is

completed, before amendment requests arrive.

In other scenarios, insurers may be exposed to other parties,

on whom it is incumbent to complete similar processes. Again,

assessing where this situation arises can enable an insurer to

consider the risk and decide what action to take.

Our solution*

- All documents are uploaded to a central repository (we can

support with locating documents internally if needed).

- This central repository includes an IBOR designed

“workflow”, which will take every document through the

whole lifecycle of its review.

- This allows structured data to be attached to the relevant

agreement, as well as a consistent and efficient approach

to be taken to each document, providing oversight and

reporting to the project team and senior management.

- As the data is structured, it can be presented in easy to

digest formats, with data profiled and presented in whatever

way is useful to the client.

- The first step is to triage the documents, remove those

which are not relevant or duplicative, and to group them so

that families of contracts and amendment agreements can

be reviewed holistically.

- Based on institutional preferences or positions, a set of data

points is agreed, to be extracted from all agreements.

- If we have already developed a machine learning model for

the contract type, a team member can use this to locate

the relevant provisions quickly and log them in the system,

across a large number of documents. If a machine learning

model does not yet exist for the relevant documents,

then where justified by volume, a new one is developed,

in combination with a manual review of the first wave of

contracts (this typically takes 30 – 50 sample agreements).

- This information builds the base information for a digital

due diligence report, behind which sits a database with all

relevant agreements, and identified data points. Analysis

and recommendations are then built on this, in the

usual way.

*See annex for flow diagram.

Step 2 – implementing a plan to remediate exposure

This depends on whether the insurer is requesting contract amendments themselves, or responding to requests from others. All

work is again managed and tracked through a central workflow, allowing ongoing oversight and reporting.

Our solution – requesting amends*

- Amendments will either be completed by notice alone or by

amendment agreements which will need countersignature.

Templates are prepared for these scenarios, and each of the

various contract types or scenarios for amendment.

- The templates are coded for document automation, tailoring

these for each underlying contract and counterparty. Individual documents are then generated automatically

from the structured data, already gathered during the due

diligence phase.

- Where notice is sufficient a record is logged and this

completes the process.

- Otherwise, the agreement is set up for countersignature in

two ways: either a PDF is sent by email together with an

e-signature link, that allows counter signature; or an online

platform is used to share all documents, which can facilitate

centralised and trackable amends to the documents and

negotiation if permitted, as well as e-signature.

- In either case, a playbook guides paralegals and junior

lawyers through the approaches and responses to clients,

with escalation points built into the process for final checks

on documents, to raise queries, and to develop new

responses as unanticipated scenarios come up, or policy

changes.

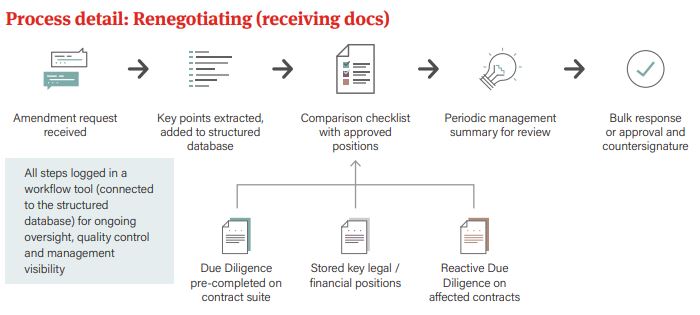

Our solution – receiving requests for

amendments*

- Amendments are received into a central location and loaded

into a central database.

- Key points extracted and added to a management summary,

together with a comparison against preferred positions.

These could be based on a due-diligence as in phase 1,

already held central records, or a case by case review

of internal documents, completed in response to each

amendment request.

- A consolidated approval pack (sent periodically, according

to volume) is presented to central management for sign off,

and bulk countersignature or response. Where there are

responses other than agreement, these are tracked through

the workflow in the same way as when amendments are

requested.

Flow charts setting out the steps and tools involved are

attached in the Annex.

Whilst this is aimed primarily at your own contractual

arrangement, in terms of underwriting we can also utilise

the same capability in considering underlying contracts that

may be on your underwriting files or in conjunction with your

insureds as a form a risk management exercise.

*See annex for flow diagram.

Conclusions

If you would like to discuss any aspect of this in more detail, please feel free to approach your usual contact at Norton Rose

Fulbright, or one of the individuals on the contacts page at the end of this booklet.