Publication

Global Asset Management Review: Issue 4

Welcome to the third issue of Global Asset Management Review.

Global | Publication | February 2016

From January 1, 2016, financial institutions1 established in EU member states are required under article 55 of the EU Banking Recovery and Resolution Directive (2014/59/EU) (BRRD), to include contractual terms in any agreements governed by the laws of non-EU Member States3, which create certain payment and other liabilities specifying that those liabilities may be subject to bail-in under the BRRD. ‘Bail-in’ refers to powers exercisable by resolution authorities in the relevant EU Member States to rescue troubled European banks by writing-down their debt or converting bonds into equity.

The rationale is to ensure counterparties contracting with EU financial institutions under third country law (i.e. not the law of an EU Member State), acknowledge and agree to the bail-in powers exercisable in the EU.

Generally speaking, the requirement will apply to all liabilities of EU financial institutions governed by the law of a third country and issued or entered into as at the date national law transposing the BRRD gives effect to the article 55 BRRD requirement (January 1, 2016 at the latest, and as of February 1, 2016, 27 out of 31 member states had implemented). This is subject to an exception for those liabilities set out in article 44(2) and 55(1)(b) BRRD which are broadly:

Article 55 applies therefore to a very broad spectrum of payment and potentially other contractual and non-contractual liabilities. It includes any loan agreements, guarantees, swap arrangements, letters of credit and other similar facilities entered into by EU financial institutions and governed by a third country law, and may extend to intercreditor and security agreements where a liability on an EU financial institution may arise.

Whilst other liabilities can be excluded from bail-in by a national resolution authority under exceptional circumstances on a case-by-case basis, this does not affect the scope of the article 55 BRRD requirement so is not considered further here. Additionally, whilst it is possible for national resolution authorities to exclude liabilities from article 55 BRRD where their bail-in powers can be exercised pursuant to the law of a third country or under a binding agreement with a third country, given the early stage of international development in this area, this is currently of very limited applicability.

Member States are required under the BRRD to implement the bail-in tool and contractual recognition requirements into national law by January 1, 2016. In the UK, bail-in came into force from January 2015; however, the full scope of the contractual recognition requirements in the PRA Rulebook and FCA Handbook came into effect on January 1, 2016 (for 2015 (from February 19, 2015 onwards), the PRA Rulebook applied only to Additional Tier 1 and Tier 2 instruments as well as unsecured liabilities).

The EBA has published final draft regulatory technical standards under article 55 BRRD listing the requirements of contractual recognition provisions but example drafting has not been provided. Broadly (among other matters), the EBA requires express acknowledgement, agreement and consent by a counterparty that an EU financial institution’s liability to it may be subject to the exercise of write-down and conversion powers by the relevant resolution authority, together with a description of those powers as set out in national law and the potential effects in terms of liability under the agreement.

Various bodies are considering the contents of standard contractual recognition terms, and the Loan Market Association (LMA) and the Loan Syndications and Trading Association (LSTA) published suggested bail-in clauses in respect of loan documentation in December 2015. It is likely that as far as loan agreements are concerned, wording produced by the LMA and LSTA will be adopted by the market. In the capital markets sphere, the Association for Financial Markets in Europe (AFME) has published a model clause for use by UK-incorporated financial institutions for the issue of debt securities governed by New York Law.

In addition, the International Securities Lending Association (ISLA), International Capital Markets Association (ICMA) and International Swaps and Derivatives Association (ISDA), are considering possible protocols in respect of securities lending, repo transaction and derivatives, respectively. Whilst the requirements of article 55 BRRD relate only to transactions entered into after January 1, 2016 (subject to early implementation in particular EU Member States, such as has occurred in the UK), it may not necessarily apply to ISDA, ISLA and ICMA master agreements, since any trades entered into after that date could amount to an amendment of the entire master agreement. One view is that this could trigger a retroactive application of contractual recognition requirements to all trades under the master agreement (including those entered into before that date). ISDA, ISLA and ICMA are currently looking into this.

Drafting for article 55 BRRD in the context of documentary letters of credit and other similar trade finance instruments will be problematic given the unilateral nature of these types of letter of credit and the lack of an express governing law clause.

In the UK, the PRA has transposed Article 55 BRRD into its rules which can be found in the Contractual Recognition of Bail-in Part of the PRA Rulebook. The PRA has phased-in the requirement, making it applicable for:

The requirement applies neither to liabilities excluded from the scope of bail-in by the BRRD, nor to preferred deposits (of natural persons or micro, small or medium-sized enterprises).

On November 25, 2015, the PRA published a modification by consent which dis-applies Contractual Recognition of Bail-in rules 1.2 and 2.1 in circumstances where compliance with them in respect of a phase 2 liability is impracticable. On March 15, 2016, the PRA published a consultation paper (CP8/16) on amending the Contractual Recognition of Bail-in rules in this way. The modification was provided to delay the rules’ application to phase 2 liabilities where impracticable until the consultation is concluded. Firms wanting to take up this modification are instructed by the PRA to read the accompanying direction and then make a request to its Assessment and Monitoring Team. The modification is valid until the earlier of June 30, 2016, or when the relevant rules are amended or revoked. The consultation closes on May 16, 2016 with a view to the amended rules coming into force on July 1, 2016.

The PRA rules as modified, expect UK financial institutions to make a reasoned assessment as to whether the inclusion of contractual recognition language in the terms of a given phase 2 liability is impracticable. In the consultation, the PRA goes on to suggest some non-exhaustive grounds on which a financial institution might decide that such an inclusion is impracticable, which include:

The PRA does not consider loss of competitiveness or profitability to be grounds for an impracticability judgment, as this is not in line with the policy intent of the contractual recognition requirement.

The suggested grounds at (c) and (e) are to be particularly welcomed in, respectively, trade finance and security documents but since this only applies to UK financial institutions, issues with multinational syndicates taking non-EU law governed security will continue.

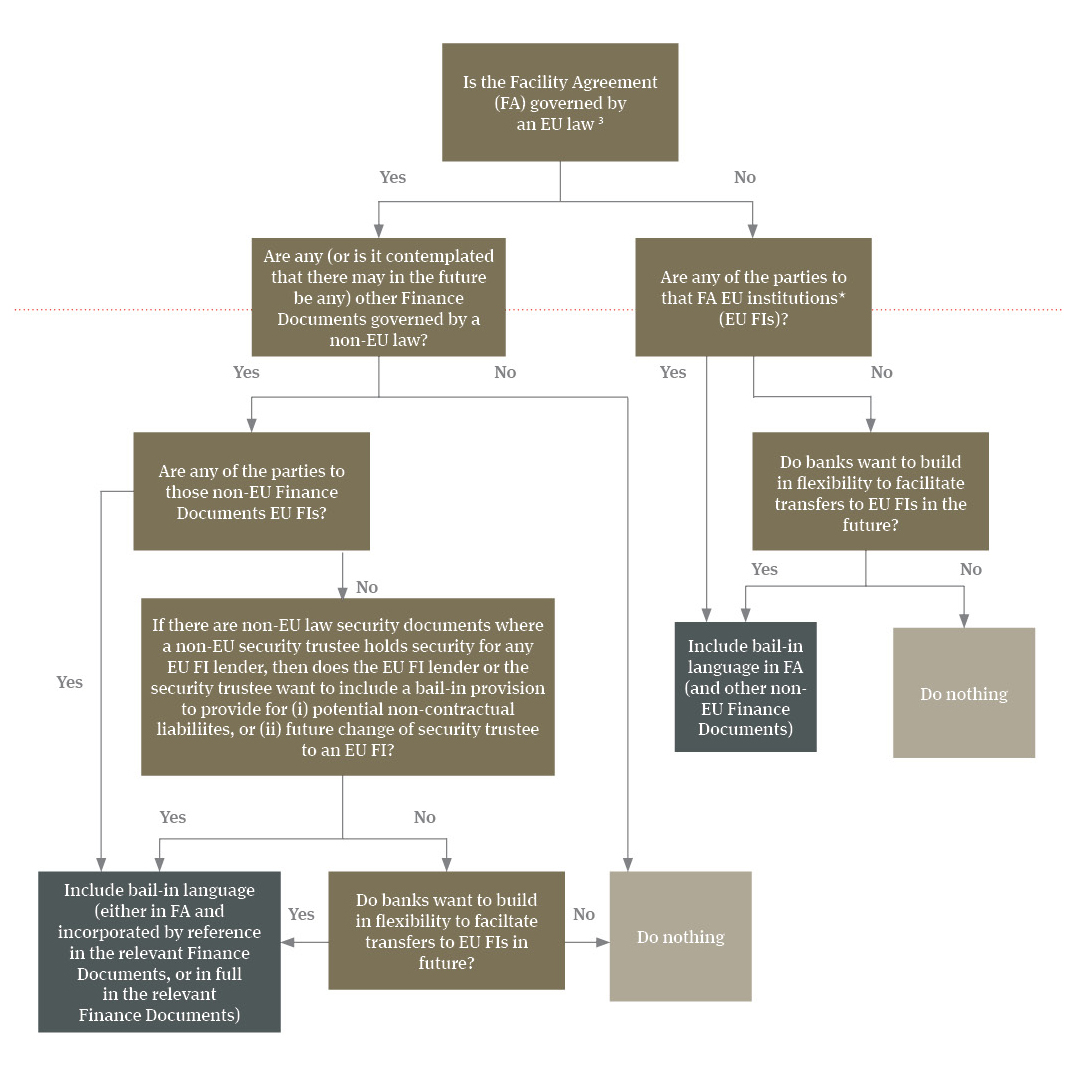

Decision tree in relation to incorporation of Article 55 BRRD bail-in language in loan transactions2

By “financial institutions” we refer to the undertakings specified at Article 1(1)(a) – (d) BRRD

The same considerations apply to a material amendment of a facility agreement, transfer of participation, or accession by a new obligor.

The EEA (which includes the member states of the European Union together with Iceland, Liechtenstein and Norway) is considering the adoption of the BRRD. As at February 2016, BRRD had not been formally implemented by the EEA Joint Committee. Pending implementation, financial institutions in those three additional jurisdictions are not affected by the BRRD and documents governed by the laws of any of those three jurisdictions should be treated as being governed by the laws of a third country and include bail-in provisions where appropriate.

Publication

Welcome to the third issue of Global Asset Management Review.

Publication

The Financial Conduct Authority’s (FCA) October 2025 Consultation, CP25/28 Progressing Fund Tokenisation, takes a clear step towards embedding distributed ledger technology (DLT) in the UK’s authorised fund regime.

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2025