Publication

Distress signals – Cooperation agreements or mergers to the rescue in times of crisis?

The current volatile and unpredictable economic climate creates challenges for businesses.

The European Investment Plan Portal gets set to launch

Global | Publication | May 2016

The European Investment Plan Portal (EIPP) is set to go live. The EIPP is the creation of the European Commission (EC) and European Investment Bank (EIB). It is a key element of the second stage of the Investment Plan for Europe.

The EIPP aims to mobilise investment in the EU economy, through an online platform that will promote projects across all regions and attract potential investors across the world. The projects will be presented in a database, with an interactive project map and project directory.

Projects listed in the EIPP must1:

In November 2014, the European Commission announced its Investment Plan for Europe, also known as the Juncker Plan. The European Investment Plan was launched in response to low levels of investment in the EU since the global financial crisis.

The aim is to facilitate investments totalling over €315 billion across the EU over the following three years, to support investment in the economy and create an investment friendly environment.

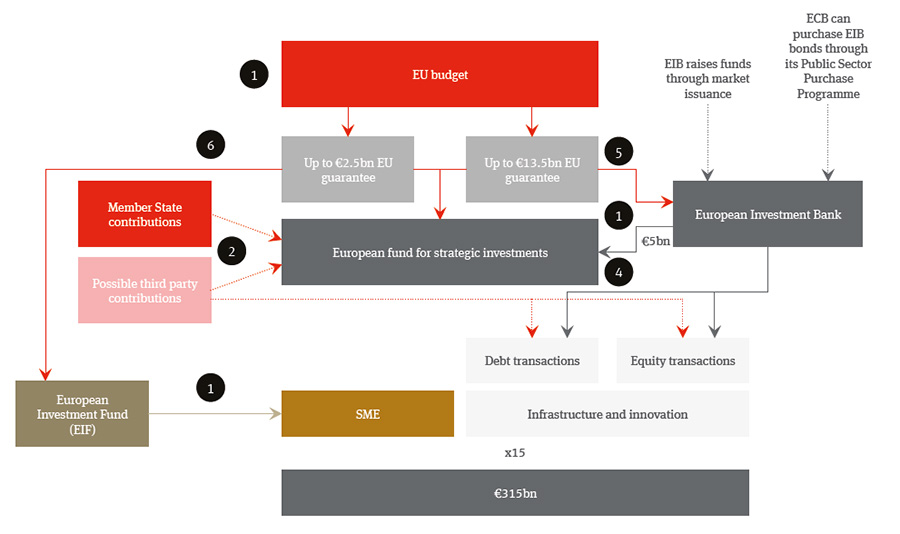

The EIB is providing €5 billion to the European Fund for Strategic Investments (EFSI) on its own risk without support from the EU budget. The EU is contributing €16 billion from its budget in the form of an EU guarantee, which, in aggregate and with a multiplier of 15, aims to facilitate more than €315 billion of investments over the next three years.

The EFSI was the first pillar of the plan in 2014. It regulates the fund and aims to finance both infrastructure and innovation projects, as well as SMEs and Mid-Caps.

The European Investment Advisory Hub (EIAH), in 2015, and the EIPP, in 2016, are the second pillars of the plan. They were set up to support the goals of the EFSI and improve the market’s functioning for investors.

The EFSI Investment Committee was established to help manage the fund and approve proposed projects. The following table2 shows the projects which are currently approved, with a large proportion of the €315 billion yet to be invested.

By December 2015, nine projects had already been financed by the committee, including:

| Project | Country |

|---|---|

| Arvedi Modernisation Programme | Italy |

| Äänekoski Bioproduct Mill | Finland |

| Capenergie 3 Fund | France |

| Smart meters | UK |

| Abengoa research, development and innovation | Spain |

| Copenhagen Infrastructure | Denmark |

| Galloper offshore | UK |

| Grifols | Spain |

| Nobelwind offshore | Belgium |

Other projects approved to date include:

| Project | Country |

|---|---|

| Third Beatrix Lock | The Netherlands |

| Primary Care Centres | Ireland |

| Midland Metropolitan Hospital PF2 | UK |

| Impax New Energy Investors II | UK |

| Redexis Gas Transmission and Distribution | Spain |

| TI-accelerated high speed broadband rollout | Italy |

| Nord Pas de Calais high-speed broadband | France |

| SaarLB renewable energy project finance guarantee | Germany and France |

| Autovia Venete widening | Italy |

| D4/R7 | Slovakia |

| Beatrice Offshore wind | UK |

| London energy efficiency | UK |

| HBOR risk-sharing | Croatia |

| Energy efficiency in residential buildings | France |

| Alsace high-speed broadband | France |

| A355 Grand Contournement Ouest de Strasbourg | France |

There are a number of different financial products which are available under the EIP.

In addition to financing projects, the EIP also provides finance to companies which are fast growing and/or engaged in research and development.

This map shows the location of projects in January 2016.

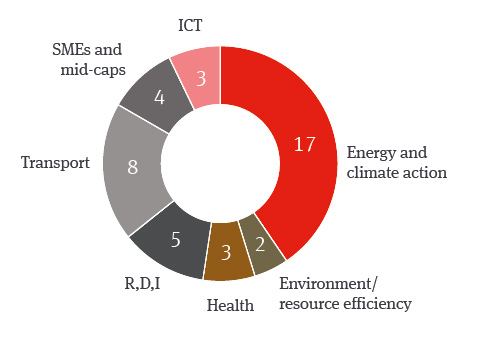

The EFSI funds a variety of projects and businesses across a wide range of industry sectors including:

Almost by definition, the EFSI is targeted at those projects and businesses that are struggling to raise more traditional forms of finance. Hence they are likely to be more complex and challenging to bring to financial close.

COMMISSION IMPLEMENTING DECISION (EU) 2015/1214, July 22, 2015

Source: EFSI investment committee members emerge, Project finance and infrastructure journal

Publication

The current volatile and unpredictable economic climate creates challenges for businesses.

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2025