Global asset management quarterly - Europe

UK and European overview

Author: Richard Sheen

Introduction

The political rollercoaster that is Brexit continues. With the date set for the UK’s withdrawal (March 29) rapidly approaching, there is considerable and increasing concern about the possible impact of a no-deal exit on the industry. Asset managers are worried that no deal will harm their ability to access investors and materially impact upon their current business and operational models. A number of asset managers have already activated their contingency planning.

Brexit

Where are we in the Brexit process more generally? After the Prime Minister’s Withdrawal Bill was defeated by a record majority, she returned to Parliament on January 29 with the Commons debating her neutral motion designed to allow discussion of the next steps on Brexit, with MPs tabling amendments. The key amendment put forward by Conservative MP Sir Graham Brady called on Parliament to require the backstop to be replaced with "alternative arrangements to avoid a hard border" but would otherwise support the Prime Minister's deal. This amendment was approved – 317 votes for; 301 votes against. This vote does not change the fact that the UK will leave the EU by automatic operation of law on March 29, 2019 unless there is an Act of Parliament amending the “exit date” in the European Union (Withdrawal) Act 2018 and unanimous agreement from the EU to extend Article 50.

Following the vote, the Prime Minster has sought to revisit the backstop with the EU, although, at the time of writing, she is not yet in a position to bring back a revised deal upon which a further “meaningful vote” could be held.

In her statement to the House of Commons on February 26, 2019 the Prime Minister said that she would put the draft Withdrawal Agreement, including any changes agreed with the EU, to a second meaningful vote on March 12, 2019. If the Government loses that vote, MPs will be offered two separate votes

- The first on March 13, 2019 on whether MPs support a no-deal Brexit so the UK would ‘only leave without a deal on March 29, 2019 if there is explicit consent in the House of Commons for that outcome’

- If that vote fails, MPs will get a vote the following day on requesting an extension to the two-year Article 50 negotiation process to delay EU withdrawal beyond March 29, 2019.”

Turning to the impact of this continued political uncertainty, as we have previously mentioned in this publication, Brexit presents a number of key implications for the UK and wider European asset management industry which are heightened in the event of a no-deal scenario. I thought it would be useful to rehearse a few of these again here as follows.

A key issue remains delegation. The management of a large number of EEA-based funds have historically been delegated to UK-based managers. Whilst some noises have been made, it remains, at least in part, unclear how this delegation model will continue to function post-Brexit, although it is interesting to note that HM Treasury suggests that “asset management firms can continue to plan on the basis that the delegation model will continue.”. There have been some media reports that the FCA is currently negotiating new cooperation agreements with certain EEA jurisdictions (notably Ireland and Luxembourg) to allow the present system of delegation to continue.

Marketing is also a major consideration. At present, under the Alternative Investment Fund Managers Directive (AIFMD) an EU-based alternative investment fund manager (AIFM) may market its alternative investment funds (AIFs) cross-border into other Member States. Post-Brexit this so-called marketing passport will no longer be available; UK based AIFMs will therefore be required to market funds under the existing National Private Placement Regimes (NPPR). However, given that UK managers will not be able to apply to market their funds in a Member State until Brexit has occurred and that it can in some cases take several months or longer to be granted permission to market under the NPPR, there will potentially be a period of several months (or potentially considerably longer if the necessary cooperation agreements are not yet in place with the Member State in question) immediately post-Brexit where UK-based managers will need to suspend the marketing of their funds.

There is also a potential impact on asset allocation by funds. Professional investors may be bound by certain investment restrictions. As UK financial instruments and markets will no longer be EEA financial instruments and markets, investment managers may need to rebalance their holdings in order to meet their investors’ asset allocation requirements. Similarly, interests in UK funds would themselves no longer be considered EEA financial instruments, which could trigger redemptions.

There are a number of other issues that investment managers will be watching very carefully. These include the impact on UK nationals working within the industry in certain European jurisdictions and vice versa. Other areas that are being examined include tax (how will post-Brexit VAT arrangements work and will there be an impact on the process for tax treaty claims?) and data processing (how will data routing work under the General Data Protection Regulation post-Brexit?).

My colleagues, Simon Lovegrove and Imogen Garner address some of the Brexit-related regulatory developments further below.

Regulatory developments

Despite Brexit casting a long shadow over asset managers, regulatory reform marches on. In this issue Simon and Imogen also take a look at the FCA’s recent policy statement which introduces further remedies concerning fund disclosure rules following last year’s asset management market study. Other regulatory developments include the ESMA consultation paper issued in December relating to the requirement to address environmental, social and governance (ESG) factors into the investment management process which could significantly increase the bureaucratic burden on European asset managers.

In January this year, the Association of Real Estate Funds (AREF) responded to the FCA’s consultation on illiquid assets and open-ended funds. The FCA’s consultation arose out of the suspensions in dealing that a number of open-ended property funds had to impose following the market fall-out of the 2016 Brexit referendum result. Amongst the concerns that AREF expressed was in relation to the proposal that there be mandatory suspensions for funds holding more than 20 percent. in properties when the standing independent valuers have declared “material uncertainty” in the property market. All of this is very topical as the Brexit journey unfolds.

Fundraising and capital funds

With the new year, I thought it would be useful to include a brief update on the listed fund sector and capital raising for both listed and private funds.

The Association of Investment Companies (AIC) reported that the trend for fee reductions by managers of listed investment companies continued in 2018: 21 investment companies lowered fees, 9 abolished performance fees (noting also that most recent investment company IPOs have not included performance fees) and 15 introduced tiered management fees where percentage charges fall as assets grow.

In relation to new fundraising, despite Brexit and market uncertainty, there were a very respectable 19 new investment company IPOs In London raising approximately £3bn, although activity tailed off towards the end of the year. Amongst new launches, energy, real estate and infrastructure strategies were well represented, but there was a significant emphasis on funds investing in equities. The largest IPO was Smithson Investment Trust PLC, which was established to invest in global smaller companies and which raised an eye-watering £823m. Other interesting transactions included the launch of activist fund, Trian Investors 1, which raised approximately £270m and music royalty fund, Hipgnosis Songs, raising £200m. For listed fund structures, we are continuing to see the trend towards establishing investment trusts, typically on-shore UK vehicles.

The theme of strong secondary fundraising activity for listed investment companies continued from the previous year with approximately £4.7bn raised in such transactions. A significant portion of this was for alternative asset funds most notably those investing in infrastructure, property and debt.

The total amount raised on private funds launches in 2018 fell from 2017, although appetite remained strong for certain strategies including those tailored towards the specific requirements of large institutional investors such as insurers and pension funds.

More generally, funds flows into asset managers slumped during the year with a number of the big managers, including Aberdeen Standard and Pimco, suffering significant asset outflows. Many listed asset management firms have seen modest increases in assets under management but recent research suggest that such increases have not been accompanied by improvements in profitability as margins have continued to fall due to increasing costs, compliance burden and fee competition and pressure. This is a trend that we have been seeing here for some time and is a well-publicised driver for expected further M&A activity in the sector.

United Kingdom

Brexit: Financial Services Contracts Regime

Author: Simon Lovegrove

What is the FSCR?

For some time now, the UK Government has been implementing plans for a no-deal Brexit scenario, where the UK leaves the EU without a ratified Withdrawal Agreement. These plans have essentially involved amending the UK statute book to onshore EU legislation so that it can continue to function immediately after exit day. Another important component of the UK Government’s no-deal contingency planning is dealing with the significant number of EEA firms that currently passport their services into the UK. For these firms, the UK Government is proposing two important regimes which will allow them to continue conducting business for a limited period of time

- A temporary permissions regime (TPR) which allows EEA firms to continue to operate in the UK after Brexit while they seek authorization

- A financial services contracts regime (FSCR) that allows EEA firms to run down their UK contracts

By introducing the TPR and the FSCR the UK Government has adopted a pragmatic approach to reducing the impact of a no-deal Brexit on EEA firms. However, such regimes are UK centric; the European Commission has not replicated these regimes for UK financial institutions operating in the EU.

What is the statutory basis of the FSCR?

The statutory basis of the FSCR is The European Union (Withdrawal) Act 2018 (EUWA 2018). Under the EUWA 2018 HM Treasury has published, among other things, two draft statutory instruments relevant to the FSCR

- The Financial Services Contracts (Transitional and Saving Provision) (EU Exit) Regulations. These Regulations make amendments to the regulations that implement in the UK the TPR for investment firms and credit institutions, The EEA Passport Rights (Amendment, etc. and Transitional Provisions) (EU Exit) Regulations 2018

- The Financial Services Contracts (Transitional and Saving Provision) (EU Exit) (No.2) Regulations 2019. These regulations make amendments to the regulations that implement in the UK the TPR for payment institutions and eMoney institutions, The Electronic Money, Payment Services and Payment Systems (Amendment and Transitional Provisions) (EU Exit) Regulations 2018

Which firms can enter into the FSCR?

The FSCR is designed for those EEA firms that passport into the UK immediately before exit day which: (i) do not make a notification to enter into the TPR; or (ii) make a notification to enter the TPR but exit that regime without full UK authorisation. The FSCR automatically applies to these firms.

A condition of entry into the FSCR is that a firm is regulated by its home Member State regulator and continues to be supervised by that regulator while in the regime. If home state authorization is cancelled, a firm will cease to be in the FSCR.

What activities are permissible under the FSCR?

The activities permitted under the FSCR are limited to those required to service pre-existing contracts and

- Reduce the financial risk of parties to pre-existing contracts and third parties affected by the performance of pre-existing contracts

- Transfer the property, rights or liabilities under a pre-existing contract

- Comply with legal and regulatory requirements

Importantly, the FSCR will not allow firms to undertake any new business in the UK post-exit day.

Is the FSCR time limited?

Yes. Firms falling within the scope of the regime will be expected to run-off, close out, or transfer obligations arising from contracts that exceed the time limit of the regime (15 years for insurance contracts and 5 years for other contracts).

HM Treasury has the power to extend the length of the FSCR by statutory instrument if it considers it necessary to do so following the submission of a joint assessment by the UK regulatory authorities as to the effect of extending or not extending the regime.

What are the SRO and CRO mechanisms?

The FSCR establishes two mechanisms.

The first mechanism is supervised run-off (SRO). The types of firm that may enter into SRO include those

- With a UK branch (operating under a freedom of establishment passport immediately before exit day) that does not enter the TPR

- That enter the TPR but exit it without UK authorisation in respect of some or all of their regulated activities (operating under either a freedom of establishment or freedom of services passport immediately before exit day)

- That hold top-up permissions before the UK’s exit from the EU and were operating under a freedom of establishment or freedom of services passport immediately before exit day and do not enter the TPR

The second mechanism is contractual run-off (CRO). This covers firms without a UK branch (operating under a freedom of services passport immediately before exit day) that do not hold a top-up permission and do not enter the TPR.

Firms may find it useful to review Chapter 2 of the FCA’s consultation paper on the FSCR (see below) as it discusses in further detail which types of firm are eligible for the SRO and CRO.

Firms can move from the SRO to the CRO and vice versa.

Are there PRA and FCA requirements?

Yes, there will be PRA and FCA requirements.

The PRA has set out its proposals in Consultation Paper 32/18: UK withdrawal from the EU: further changes to – PRA Rulebook and Binding Technical Standards – Resolution Binding Technical Standards (PRA CP32/18). The deadline for comments on PRA CP32/18 was January 21, 2019.

The FCA has set out its proposals in Consultation Paper 19/2: Brexit and contract continuity (FCA CP19/2). The deadline for comments on FCA CP19/2 was January 29, 2019.

Tell us more about the PRA’s approach to SRO firms

EEA firms operating in the UK under a freedom of establishment or freedom of services passport that enter the SRO will become, and be treated as, third country firms.

Subject to certain modifications to its rules, the PRA will expect SRO firms with a branch in the UK to comply with the same rules that apply to third country branches. For cross-border service providers in the SRO without a branch, the PRA proposes to apply a more limited set of rules. These will include rules that could apply, as currently written, to a PRA-authorized third country firm without a UK branch.

Interestingly, the PRA is proposing a streamlined approach to the Senior Managers and Certification Regime (SM&CR) that focuses on the specific objective of an orderly run off of the firm’s UK regulated activities. SRO firms will be required to have at least one individual approved to perform the Head of Overseas Branch function (SMF19). The PRA proposes to direct firms in the SRO to use a specific form for SMF approval applications. The regulator also proposes that SRO firms will have a grace period of 12 weeks from their date of entry into the regime in which to obtain deemed (or full) approval for an SMF19. A deemed approval will last up to 12 months. Within 12 months of receipt of a notice of deemed approval, the relevant individual will need to undergo a full fit and proper assessment. The fit and proper assessment will focus on whether the relevant individual is fit and proper to deliver the objective of orderly run off of the firm’s UK activities within the SRO. The usual prescribed responsibilities for third country branches will not, however, apply to SRO firms. Instead, the SMF19 will be subject to a standard, single responsibility to “oversee the orderly run-off of the firm’s UK – regulated activities'. The PRA also proposes that the SM&CR will apply to the extent that it currently does pursuant to FCA rules (to firms currently operating in the UK as a branch via an establishment passport but not to any other firms).

Significantly the PRA also proposes that SRO firms provide it with a run-off plan which will describe the firm’s plans to run off its business before the mechanism expires. Firms will be required to provide at least annual updates on progress and any unexpected divergence from it. This requirement will apply to firms operating under either a freedom of establishment or freedom of services passport.

Tell us more about the FCA’s approach to SRO firms

The FCA’s proposed approach to SRO firms is similar to that for TPR firms. In respect of their UK business, the FCA proposes that SRO firms comply with

- All FCA rules which currently apply to them

- All FCA rules which implement a requirement of an EU Directive which are currently reserved to the SRO firm’s home state and which the FCA does not currently apply to EEA firms (home state rules). Importantly, the FCA intends to accept ‘substituted compliance’ for these rules. If firms can demonstrate they continue to comply with the equivalent home state rules in respect of their UK business (including where this is on a voluntary basis if the relevant rules cease to cover UK business) they will be deemed to comply with the FCA’s rules

- Certain additional FCA rules which the regulator believes are necessary to provide appropriate consumer protection or relate to funding requirements

The FCA states in CP19/2 that it proposes to apply the rules to SRO firms by simply extending the definitions it uses for the TPR and TPR firms to include firms in the SRO. This means that the rules set out in Appendix 1 of Consultation Paper 18/29: TPR for inbound firms and funds and the rules relevant to TPR firms in Appendix 3 of Consultation Paper 18/36: Brexit: proposed changes to the Handbook and Binding Technical Standards – second consultation, will also apply to SRO firms.

Tell us more about the approach to CRO firms

While SRO firms will continue to be authorized persons for the purposes of UK law, CRO firms will have a limited exemption to the general prohibition in section 19 of the Financial Services and Markets Act 2000. However, the PRA and FCA may vary or cancel the exemption of a firm in certain circumstances, such as where they consider it necessary to advance their statutory objectives.

Notwithstanding the exemption, there are certain requirements applicable to CRO firms. For example in FCA CP19/2 the FCA mentions that whilst there is no notification requirement firms must notify it as soon as practicable after entry into the CRO that they are carrying on a regulated activity in the UK. In addition, as mentioned above, both SRO and CRO firms must maintain their home state authorization. If their home state authorization is varied or cancelled, the relevant UK regulator must be notified.

The FCA also states in FCA CP19/2 that CRO firms will remain subject to any existing or future product intervention rules. In terms of future intervention the FCA is currently consulting on rules that

- Ban the sale, marketing and distribution of binary options to retail consumers

- Restrict the sale, marketing and distribution of contracts for difference and similar products to retail customers

CRO firms will not have cover under the Financial Services Compensation Scheme.

Status disclosure

The FCA is proposing different wording for SRO firms to the wording which it proposed for TPR firms. This wording should be included in letters (and electronic equivalents) to retail clients explaining their authorization status. This is to reflect the different regime and purpose of the regime. Firms which enter the SRO on exiting the TPR will need to update their status disclosure to reflect this wording at that point. This will give consumers the opportunity to find out about the scope of a SRO firm’s permission, and that it cannot enter into new regulated business.

Fees

The FCA is proposing that SRO firms will pay periodic fees on the same basis as those proposed for TPR firms. The regulator is not proposing periodic fees for CRO firms, but instead a special project fee will be charged in instances where the regulator’s costs in carrying out its functions exceed a £5,000 threshold.

United Kingdom

Brexit: EU Level 3 measures

Author: Simon Lovegrove

Introduction

In this note we review the approach proposed by the UK regulatory authorities (the PRA and FCA) to incorporating EU Level 3 measures into their rules and guidance.

“EU Level 3 measures” relate to the specific regulatory process to financial services which was first introduced in 2001, when the EU endorsed the proposals of the Lamfalussy report. That report recommended the adoption of a regulatory approach consisting of four levels

- Level 1: The European Parliament and the Council adopt the basic laws proposed by the European Commission (Commission), in the traditional co-decision procedure. This would be in the form of a Directive or a Regulation and would set out framework principles.

- Level 2: The Level 1 measures contains empowerments for the Commission to adopt and update technical implementing measures that add further detail to the framework principles. The Level 2 measures are based on advice from the three European Supervisory Authorities (ESAs). These are the European Banking Authority (EBA), the European Securities and Markets Authority (ESMA) and the European Insurance and Occupational Pensions Authority (EIOPA).

- Level 3: The ESAs issue non-legislative material consisting of guidelines, recommendations and opinions on the Level 1 and Level 2 measures that are designed to enhance Member State competent authorities (NCAs) interpreting the Level 1 and Level 2 measures in a similar way (this is known as supervisory convergence). NCAs, firms and financial market infrastructures are currently under an obligation to “make every effort to comply” with them although NCAs do have the option of non-compliance but must inform the relevant ESA of this, stating their reasons. In the last couple of years the ESAs have added a further element to Level 3 measures being Questions & Answers documents (Q&As).

- Level 4: Enforcement of the above levels by the EU institutions.

Withdrawal agreement

If the draft Withdrawal Agreement is ratified by both the UK and the EU, then EU law will continue to apply in the UK up until the end of the transitional / implementation period. Given the continuance of EU financial services law during this period, it is expected that the UK will continue to comply with non-binding EU Level 3 material unless it has otherwise informed the EU previously. The transitional period starts on the date of the Withdrawal Agreement and will end, unless extended, on December 31, 2020.

No-deal scenario

The UK Government has passed the European Union (Withdrawal) Act 2018 (EUWA 2018). To provide legal continuity, the EUWA 2018 provides for the transposition of directly-applicable EU law (existing on the date prior to the UK leaving the EU) into UK law. In doing this, a new category of domestic law is created for the UK, retained EU law. The EUWA 2018 also gives powers to the UK Government to make secondary legislation to address deficiencies in UK domestic legislation and retained EU law by virtue of the UK leaving the EU. In the financial services sector, HM Treasury is expected to publish over 60 statutory instruments that deal with remedying deficiencies in the onshoring of EU Level 1 and Level 2 measures. At the time of writing this note, the majority of these statutory instruments have been published.

The EUWA 2018 does not cover EU Level 3 material and HM Treasury has previously stated that it intends to delete the obligation to make every effort to comply with them. However, the UK regulatory authorities are conscious that EU Level 3 material would continue to be relevant to firms’ and financial market infrastructures’ compliance with onshored EU Level 1 and Level 2 measures.

To this end, the UK regulatory authorities have published proposals setting out how they intend to onshore EU Level 3 materials. The PRA has set out its proposals in a joint consultation paper with the Bank of England (the Bank) (see, The Bank’s approach to amending financial services legislation under the EUWA 2018 (CP18/25)) and the FCA has set out its proposals in a consultation paper (see, Consultation Paper 18/28: Brexit – proposed changes to the Handbook and Binding Technical Standards – first consultation (CP18/28)).

PRA proposals

The Bank and the PRA have stated that they will expect firms and financial market infrastructures to continue to make every effort to comply with any ESA guidelines and recommendations that they are currently expected to comply with, to the extent that they remain relevant after the UK’s withdrawal from the EU. The Bank and the PRA also expect to continue to comply with ESA guidelines and recommendations directed at them, except where they have previously explained to the relevant ESA of their intention not to comply. Appendices 1 to 3 of a draft Statement of Policy (see below) contains a non-exhaustive list of guidelines produced by each of the ESAs that are currently complied with in the UK. However, when reviewing the list of guidelines produced by ESMA some caution is needed as the list does not relate to those guidelines that apply to those firms that are only regulated by the FCA.

In terms of interpreting ESA guidelines and recommendations that remain relevant, the position is slightly more tricky in that the Bank and the PRA have stated that they do not propose to reproduce or make amendments to them prior to the UK leaving the EU but instead firms and financial market infrastructures should interpret them in light of the changes being made to the EU Level 1 and Level 2 material when onshored. To provide some limited further assistance the Bank and the PRA have jointly published a draft Statement of Policy. Chapter 3 of this document sets out a non-exhaustive list of onshoring changes that are proposed to be made by the UK Government under the EUWA 2018 which are relevant to firms’ and financial market infrastructures’ interpretation of EU Level 3 materials.

In terms of guidelines and recommendations produced after the UK leaves the EU (or existing guidelines and recommendations that are subsequently amended), the Bank and the PRA have said that they will not automatically apply. Both the Bank and the PRA will consider their approach and may issue further statements in due course.

The PRA’s and the Bank’s proposals focus on ESA guidelines and opinions, leaving the reader wondering what will happen to the Q&As and opinions that the ESAs produce. These form an important component of EU Level 3 materials. The answer to this question is hidden away in a table that appears on page 33 of Consultation Paper 26/18: UK withdrawal from the EU: Changes to PRA Rulebook and onshored Binding Technical Standards. Here, it states that non-binding materials such as Q&As produced by the EBA and EIOPA should be read as a reference to the definitions or materials as they stand at the date of the UK’s withdrawal from the EU.

FCA proposals

Unsurprisingly, the FCA has adopted a similar position to the PRA. The FCA expects firms and market participants to continue to apply applicable ESA guidelines and recommendations to the extent that they remain relevant immediately before the UK’s exit from the EU. Firms and market participants are expected to interpret such ESA guidelines and recommendations in light of the UK’s exit from the EU and to interpret them in light of the changes made when onshoring EU legislation. The FCA will continue to apply ESA guidelines and recommendations in respect of its own functions in the same manner as immediately before the UK’s exit from the EU.

Unlike the Bank and the PRA, the FCA has not so far set out a list of existing EU Level 3 material that will continue to be applicable once the UK leaves the EU.

In relation to ESA Q&As and ESA opinions, the FCA states that it will “continue to have regard to other EU non-legislative material where and if they are relevant, taking account of Brexit and ongoing domestic legislation. Firms, market participants and stakeholders should also continue to do so.”

The FCA sets out certain exceptions to its expectations and these also follow a similar line taken by the Bank and the PRA. For example, the FCA states that one exception is where it has informed the relevant ESA that it would not comply with all or part of a guideline. The FCA helpfully gives some examples concerning the ESMA short selling guidelines, the EBA guidelines on sound remuneration policies, the EBA’s guidelines on internet payment security and the ESAs’ guidelines on the Acquisitions Directive.

The FCA also states that due to the UK’s exit from the EU it has made certain changes to the application of the EBA’s guidelines relating to the applicable notional discount rate for variable remuneration. This is on the basis that the formula for the discount rate is dependent on figures published by Eurostat which may cease to be produced for the UK following its withdrawal from the EU.

The FCA has also confirmed that it will maintain its view on the approach to the ESMA MiFID Q&As on ‘Appropriate / Complex Financial Instruments’. The ESMA Q&As states that shares in non-UCITS collective investment undertakings explicitly excluded under point (i) of Article 25(4) of MiFID II cannot be deemed non-complex financial instruments for the purposes of the appropriateness test. The FCA is of the view that investment trusts and non-UCITS retail schemes are neither automatically non-complex nor automatically complex, but must be assessed against the criteria set out in the MiFID II delegated regulation. The FCA has also said that when firms apply these criteria, they should adopt a cautious approach if there is any doubt as to whether a financial instrument is non-complex. This remains the FCA’s view of how this part of MiFID II should be interpreted and how firms should apply these rules.

In terms of interpreting existing applicable EU Level 3 material, the FCA has taken the same route as the PRA. It has not reproduced updated materials and has instead told firms that it expects them to “sensibly and purposively interpret EU non-binding material, taking into account the UK’s withdrawal from the EU, the provisions of the Act [the EUWA 2018] and amendments made to relevant legislation in the withdrawal process, including the FCA Handbook.”

In terms of EU Level 3 material produced by the ESAs after the UK leaves the EU (or existing EU Level 3 material which changes after the UK’s exit) the FCA states that where it considers it appropriate to do so it will set out its expectations as to how it should be treated.

United Kingdom

London financial services team client briefing: Buy-side focus

Authors: Imogen Garner, Iona Wright and Jonathan Herbst

On February 6, 2019, the London financial services team, held their latest client breakfast briefing. This briefing focused on the following key issues for the buy-side

- Brexit

- Senior managers and certification regime

- AIFMD review

- Omnibus regulation

- FCA asset management market study

- Social impact investing.

The Webex recording of the briefing is here.

Further information concerning the London financial services team’s client briefings can be found on the Regulation tomorrow blog.

United Kingdom

FCA Asset Management Market Study: FCA tightens the rules further

Authors: Simon Lovegrove and Imogen Garner

Introduction

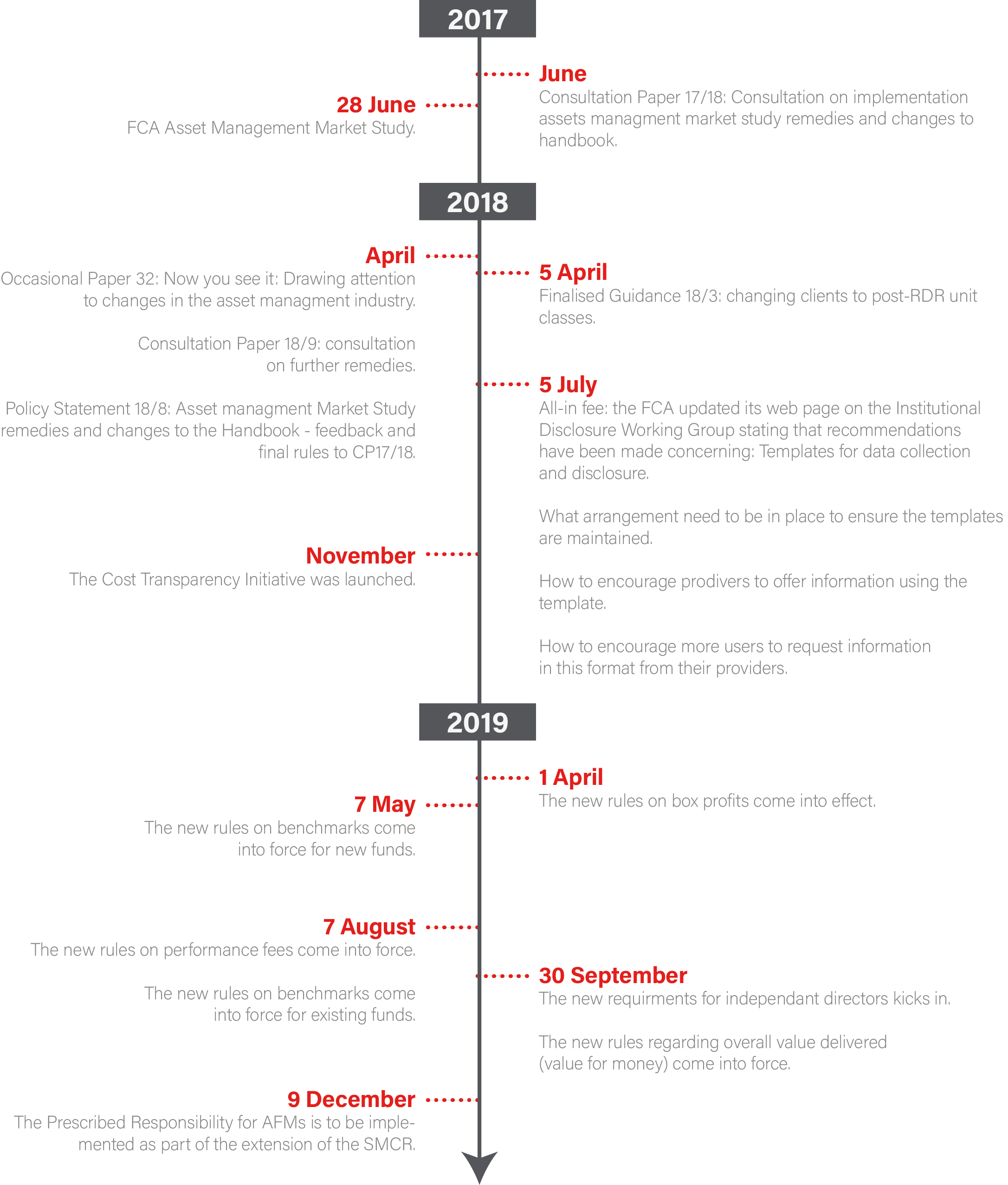

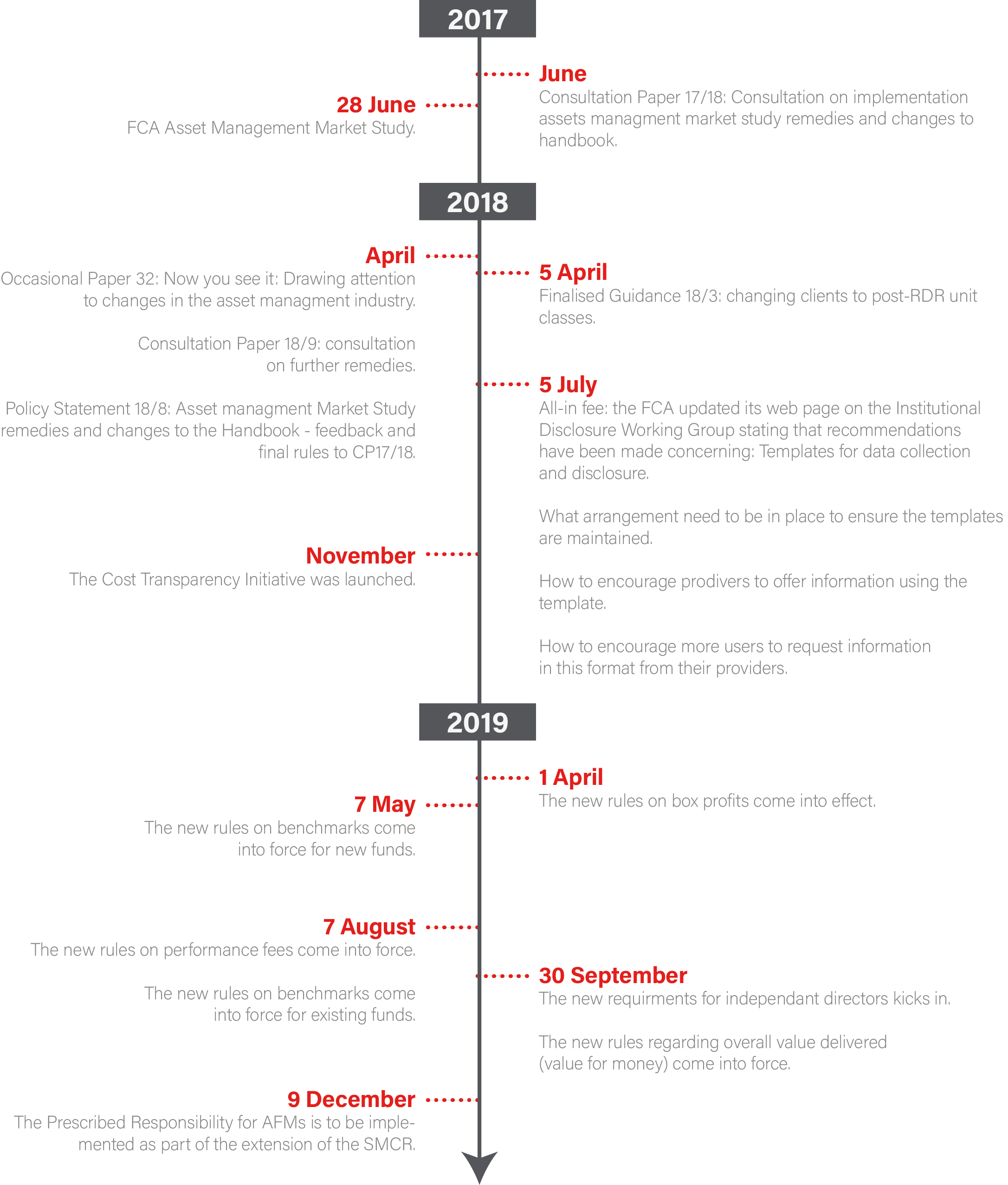

In November 2015, the FCA published the terms of reference for an asset management market study (AMMS). The intention behind the AMMS was to understand how asset managers compete to deliver value to both retail and institutional investors. The FCA published an interim report in November 2016 which was followed up by a final report in June 2017. In the final report, the regulator proposed a package of remedies which were intended to make competition work better in the asset management market and protect those least able to actively engage with their asset manager.

The first set of final FCA rules and guidance implementing the AMMS remedies was published last April (Policy Statement 18/8: Asset Management Market Study remedies and changes to the Handbook – Feedback and final rules to CP17/18 (PS18/8)) and was reported on in the May 2018 issue of Global Asset Management Quarterly. Essentially the changes focused on governance issues (value for money, independent directors and the senior managers’ regime), conversion (fund investors being converted to cheaper but otherwise identical classes of the same fund) and box profits.

At the same time the FCA issued a further consultation implementing more of the AMMS remedies (Consultation Paper 18/9: Consultation on further remedies – Asset Management Market Study). These remedies related to transparency, focussing on measures to improve the quality, comparability and robustness of information available to investors. Key FCA proposals included

- New non-Handbook guidance to remind authorized fund managers (AFMs) how they should describe fund objectives and investment policies to make them more useful to investors

- Requiring AFMs to explain why their funds use particular benchmarks or, if they do not use a benchmark, how investors should assess the performance of a fund requiring AFMs that use benchmarks to reference them consistently across the fund’s documents;

- Requiring AFMs that present a fund’s past performance to do so against each benchmark used as a constraint on portfolio construction or as a performance target

- Amending rules to require that where a performance fee is specified in the prospectus, it must be calculated on the basis of the scheme’s performance after the deduction of all other fees

The consultation closed last summer (July 5, 2018).

New rules and guidance

On February 4, 2019, the FCA followed up on its consultation by publishing final rules and guidance in Policy Statement 19/4: AMMS – further remedies (PS19/4). As was the case with PS18/8, PS19/4 is relevant to UK AFMs who manage authorized funds (open-ended collective investment schemes). However, it will also be of interest to other firms in the asset management industry including those acting as delegated portfolio managers, depositories of authorized funds and financial advisers.

What is changing?

The new FCA rules and guidance set out in Appendices 1 and 2 of PS19/4 don’t appear to significantly deviate from those that were consulted on. The FCA reports that where amendments have been made, they were introduced to improve clarity and ensure that the policy intention was achieved.

Fund objectives and investment policies

As per the consultation, the FCA remains of the view that its existing rules on objectives (broadly, fund objectives and investment policies) and their disclosure is adequate and are not changing.

However, non-Handbook guidance has been published which sets out the FCA’s expectations of how firms might comply with the existing requirements in practice. In addition, the non-Handbook guidance sets out that non-financial objectives must be explained to consumers in a way that is fair, clear and not misleading. The FCA agrees that environmental, social and governance objectives can be financial as well as non-financial.

The FCA has rejected calls from some respondents to introduce in the non-Handbook guidance, examples of good and bad practice, nor has it published a glossary of consumer-friendly terms. The regulator states that fund managers “will need to consider whether consumers can reasonably understand the objectives they set.”

But the FCA has amended the final guidance around the disclosure of investment strategies in order to clarify its expectations. Fund managers are expected to disclose in key information documents (KIDs) the features of the investment strategy that are a fundamental feature of how the product is managed.

Benchmarks

The background to these rules is that the FCA found that fund managers seldom explain why or how they are using particular benchmarks. The new rules and guidance does not require or encourage fund managers to use benchmarks but will require them to explain why they have chosen a particular benchmark.

The FCA has confirmed that the three benchmark categories set out in the earlier consultation to capture the different ways fund managers use benchmarks in practice. These are a

- 'Constraint' — an index or similar factor that fund managers use to limit or constrain how they construct a fund’s portfolio

- 'Target'— an index or similar factor that is part of a target a fund manager has set for a fund’s performance to match or exceed, which includes anything used for performance fee calculation

- 'Comparator'— an index or similar factor against which a fund manager invites investors to compare a fund’s performance

New rules have been introduced requiring fund managers to explain in a fund’s prospectus and consistently in other consumer-facing communications that include fund-specific information, why they have used any constraint, target or comparator benchmark. This does not, however, apply to general “brand only” adverts or communications (image advertising). Non-Handbook guidance has also been introduced for dealing with the instance where a fund manager doesn’t explicitly manage a portfolio in line with a benchmark but other factors such as internal restrictions mean that the fund is effectively managed with reference to a benchmark.

For funds that use more than one benchmark, the FCA has amended the text that appears in Conduct of Business sourcebook (COBS) 4.5.14R so that it is clear that they should show past performance against the different benchmarks.

The new rules do not apply to the UCITS KID or the Key Investor Information Document (KIID) equivalent for a non-UCITS retail scheme (NURS). The new rules on Chapter 4 of COBS do not impose obligations on firms to add further information to the UCITS KID (or the NURS equivalent). This is because legislation already sets out the form and content of the UCITS KID in an exhaustive manner.

Performance fees

New rules have been introduced per the consultation that implement best market practice, which provides that where a performance fee is specified in a prospectus, it must be calculated on the basis of the fund’s performance after all other charges have been deducted.

Timing

The new Handbook rules and guidance concerning benchmarks come into force on May 7, 2019 for new funds and on August 7, 2019 for existing funds. The new rules and guidance on performance fees come into force on August 7, 2019. The new provisions clarifying how COBS 4 applies to the key investor information document came into force on February 4, 2019. The FCA expects AFMs to take the non-Handbook guidance on objectives into consideration when reviewing fund documentation.

Unit-linked and with-profits business

PS19/4 is potentially relevant to unit-linked and with-profits business. The FCA states that it is carrying out a diagnosis of with-profits and unit-linked products which will be concluded later this year.

Other initiatives

The FCA has established a Fund Objectives Working Group (FOWG). As part of the working group, the Investment Association (IA) is working with its members, to promote the use of consistent terminology in communications from fund managers about their funds. The IA published its guidance on fund communication on February 20, 2019

The FCA has also established an Institutional Disclosure Working Group (IDWG) which has recommended the use of five templates for data collection and disclosure by asset managers to institutional investors. Last November 20, the Cost Transparency Initiative was launched to take the recommendations of the IDWG forward, supported by the Pensions and Lifetime Savings Association, the IA and the Local Government Association.

In December 2018, the Competition and Markets Authority (CMA) published its findings that there is an adverse effect on competition in the investment consultancy market and the fiduciary management market from which substantial customer harm may result. The CMA’s Investment Consultants Market Investigation Final Report introduced a package of remedies to address the negative effects on competition they identified.

Comment

The new rules and guidance are a good illustration that one of the big issues facing the UK asset management industry is the assimilation of regulation change whilst managing the uncertainties around the shape of any Brexit deal. Whilst Brexit is taking all the headlines it is easy to forget that the rules and guidance of the AMMS are coming into effect this year.

FCA Asset Management Market Study

VAT: Apportionment of a single supply between exempt and non-exempt activities

Authors: Dominic Stuttaford and Greg Branagan

The VAT treatment of investment funds has been the subject of protracted litigation because VAT is an absolute cost for the fund. In BlackRock Investment Management (UK) Ltd v HMRC [2018] UKUT 415 (TCC), the Upper Tribunal (UT) considered whether services (comprising the provision of hardware, software and human input) provided through a financial technology platform could benefit from the VAT exemption for the management of special investment funds (SIFs) contained in article 135.1(g) of the Principal VAT Directive (the Directive).

The UT confirmed the decision by the First Tier Tribunal (FTT) that such services were supplies of management services for VAT purposes and could therefore fall within the VAT exemption under the Directive if provided to SIFs. However, the UT refused to rule on the question of whether an apportionment of such services between the management of SIFs (which would be exempt) and non-SIFs (which would be subject to VAT) is possible where they are provided by the supplier as a single supply and instead elected to refer the question to the Court of Justice of the European Union (CJEU).

The facts

BlackRock manages a series of collective investment schemes, some of which are SIFs, but the majority of which are non-SIFs. BlackRock received a single supply of certain financial technology services through a platform known as Aladdin (the Aladdin Services). The Aladdin Services supplement the work of the portfolio managers through functions including portfolio analysis, trade modelling, and compliance and risk modelling. These functions span the whole of the investment cycle and the portfolio managers use the Aladdin Services to manage both SIFs and non-SIFs.

The issues

The UT re-examined the two issues before the First Tier Tribunal

- The Exemption Issue: Whether the single supply of Aladdin Services received by BlackRock amounted to the “management” of SIFs within the meaning of that term for the purposes of the exemption in Article 135.1(g) of the Directive

- The Apportionment Issue: If the Aladdin Services were supplies of “management”, whether the consideration for those services could be apportioned between the management of SIFs and non-SIFs, which would lead to the consideration being partially subject to VAT

The exemption issue

The UT reviewed key decisions in relation to the scope of the VAT exemptions for financial services, particularly the CJEU decisions in SPC (Case C-2/95), Abbey National (Case C-169/09) and GfBk (Case C-275/11). In considering the various functions of the Aladdin Services, the UT found that the performance of these functions was

- Supplementary to those activities undertaken by BlackRock

- Intrinsically connected to the activities of BlackRock

- The types of service that were characteristic of the activities of an investment management company

- Specific and essential to the management of a SIF

Accordingly, the Aladdin Services were “in principle” capable of being exempted under article 135.1(g) of the Directive.

The apportionment issue

Since it was common ground that the Aladdin Services were provided as a single supply for the management of both SIFs and non-SIFs, it was accepted that absent apportionment, that supply would be taxed according to its principal element, which, on the facts, would lead to the whole of the supply being subject to VAT under the reverse charge mechanism. The taxpayer argued that apportionment would be appropriate by reference, for instance, to the percentage of assets under management comprised in the SIFs/non-SIFs.

The UT considered the CJEU’s decision in Stadion Amsterdam (Case C-463/16) which affirmed the decision in Card Protection Plan (Case C-349/96) by holding that a single supply comprising of a principal element and an ancillary element (which, if supplied separately, would be subject to different rates of VAT) must be taxed solely at the rate of VAT applicable to that supply, that rate being determined according to the principal element. However, applying the Talacre (Case C-251/05), French Undertaker (Case C-94/09) and Luxemburg (Case C-279/15) cases, the UT considered whether different rates could be applied to different elements of the single supply, and held that this would depend on the proper construction of article 135.1(g). The UT noted that nothing in the article itself excluded apportionment, and repeated that the purpose of the article was to maintain fiscal neutrality between direct investment in securities and investment through undertakings for collective investment.

The UT concluded that the position remained unclear, and referred the question of apportionment to the CJEU for a preliminary ruling.

What this means for asset managers

- The UT upheld the decision that the services provided by a financial technology platform could constitute the supply of “management” of SIFs. As a result, depending on the relevant facts, the supply of such services can be properly viewed as exempt from VAT.

- In spite of the decision in Stadion Amsterdam, ambiguity remains in the potential application of different rates of VAT to different elements of a single supply.

- Due to this uncertainty, it would be prudent to ensure that any part of a supply which may qualify for a VAT exemption is supplied separately. If this is not possible commercially, keep a record of any apportionment, in case BlackRock is successful.

- Similarly, consider making protective claims, in case BlackRock is successful.

Ireland update

Donnacha O’Connor from Dillon Eustace

Markets in Financial Instruments Act 2018

On October 29, 2018, the Markets in Financial Instruments Act 2018 (the 2018 Act) was enacted. The 2018 Act sets out the maximum sanctions available for certain offences under the European Union (Markets in Financial Instruments) Regulations 2017 (as amended) (the MiFID Regulations) where a person is convicted on indictment. The sanctions set out in the 2018 Act are higher than those provided for under the European Communities Act 1972 (as amended) (the 1972 Act).

Summary proceedings for offenses under the MiFID Regulations may be brought and prosecuted by the Central Bank, whereas the Director of Public Prosecutions is responsible for prosecuting indictable offenses.

Firms should be aware that breaches of the MiFID Regulations also fall within the remit of the Central Bank’s Administrative Sanctions Procedure and that administrative sanctions can also be applied to entities which are not “regulated financial service providers” in certain circumstances.

The 1972 Act provides that where an offense is committed under regulations made pursuant to the 1972 Act, the maximum sanctions available on conviction on indictment shall be a fine of €500,000 and a prison term of up to three years.

The 2018 Act lists various provisions of the MiFID Regulations, a contravention of which will constitute a “relevant offense.” The 2018 Act states that a person who is guilty of a “relevant offense” shall be liable, on conviction on indictment, to a fine not exceeding €10m and/or to a prison term not exceeding ten years. This is a continuation of the criminal sanctions regime that existed in Irish law under the MiFID I regime. The maximum available sanctions for a conviction on indictment for a “relevant offense” are therefore significantly greater than the maximum sanctions for indictment, provided for under the 1972 Act.

The 2018 Act also seeks to make an amendment to the definition of "long-term contract" under the Financial Services and Pensions Ombudsman Act 2017, as well as seeking to amend certain definitions provided for under the Credit Reporting Act 2013.

A copy of the 2018 Act can be found here.

Central Bank publishes Consultation Paper 126 on the Central Bank’s Approach to Resolution for Banks and Investment Firms

On December 6, 2018, the Central Bank published a Consultation Paper entitled ‘Consultation on the Central Bank’s Approach to Resolution for Banks and Investment Firms (First Edition)’ (CP 126).

CP 126 sets outs the proposed approach of the Central Bank in respect of the mandates and discretions provided under the Single Resolution Mechanism Regulation (EU No 806/2014) (the Single Resolution Mechanism Regulation) and the European Union (Bank Recovery and Resolution) Regulations 2015 (as amended) (the BRR Regulations).

By way of background, the Central Bank acts as the national resolution authority for credit institutions and certain investment firms under the BRR Regulations and for the purposes of the Single Resolution Mechanism Regulation within the Banking Union Area Single Resolution Mechanism.

CP 126 outlines the Central Bank’s resolution mandates, powers and intended approaches for

- Banks and building societies that are less significant institutions (LSIs) and do not have a subsidiary within the Banking Union Area, or a parent entity which is subject to consolidated supervision by the European Central Bank (ECB)

- Investment firms (that are not themselves subsidiaries of credit institutions subject to the direct oversight of the Single Resolution Board SRB)) subject to the €730,000 initial capital requirement in Regulation 26(2) of the European Union (Capital Requirements) Regulations 2014 (as amended) (the CRD Regulations)

CP 126 is broken down into four parts, which are detailed below

- Part I: Provides an overview of the resolution framework within which the Central Bank operates;

- Part II: Details the Central Bank’s general perspectives on resolution planning

- Part III: Sets out the Central Bank’s intended approaches towards setting the minimum requirement for own funds and eligible liabilities (MREL) and related issues

- Part IV: Illustrates how the Central Bank would generally expect to conduct resolutions

The deadline for responses to CP 126 closes on January 17, 2019, and the Central Bank has highlighted that stakeholders should note that there will be limited scope for change in areas where the Central Bank proposes to align with the SRB guidance.

A copy of CP 126 can be accessed here.

Central Bank letter to Irish Funds on authorization procedures relating to UCITS and AIFs

On October 8, 2018, the Central Bank of Ireland (Central Bank) published revised guidance (the Guidance) on the use of financial indices by for undertakings for the collective investment of transferable securities (UCITS). The purpose of the Guidance is to clarify the Central Bank’s requirements where a UCITS intends to use a financial index for investment or efficient portfolio management purposes.

In particular, the Central Bank has introduced a new certification regime for UCITS funds under which the responsible person must certify in writing to the Central Bank prior to gaining exposure to a financial index that the relevant index complies with the requirements of the UCITS Regulations, the CBI UCITS Regulations and the Guidance.

The Central Bank has confirmed that a submission is required where the UCITS fund intends to replicate or track the composition of the relevant financial index. It has also advised that such a submission is also required where a UCITS intends to gain exposure to the relevant financial index for either investment purposes or efficient portfolio management purposes.

Consequently any UCITS which intends to gain exposure to an index which contains a constituent which represents more than 20 percent of that index (up to a maximum of 35 percent of the relevant index) must make a submission to the Central Bank prior to gaining exposure to the relevant index setting out why the exposure of up to 35 percent for a single issuer is justified by exceptional market conditions.

The Central Bank has stated that it is only possible for a UCITS to gain exposure to an index which is comprised of derivatives on commodities, notwithstanding the generic reference to “commodity indices” in Regulation 9 of the CBI UCITS Regulations.

The Central Bank has also confirmed that the disclosure obligations set down in Regulation 54(2) of the CBI UCITS Regulations only apply in the case of an index replicating UCITS fund which intends to avail of the increased diversification limits set down in Regulation 71 of the UCITS Regulations.

UCITS will now need to ensure that, prior to gaining exposure to a financial index for investment or efficient portfolio management purposes

- The responsible person can confirm to the Central Bank that the relevant index is eligible for use by the UCITS, taking into account the specific criteria identified in the Guidance

- The responsible person will be in a position to provide the Central Bank with a submission (together with supporting documentation) as to why this is the case “immediately upon request”

The Central Bank issues letter announcing certain amendments to its authorization procedures for UCITS and RIAIF

On October 9, 2018, the Central Bank issued a letter addressed to the Irish Funds announcing certain amendments to its authorization procedures, in the context of applications for UCITS and retail investor alternative investment funds (RIAIF).

The Central Bank has announced that with immediate effect, the preauthorization of the following will no longer be required by the Central Bank

- The establishment of new Share Classes

- Depositary Agreements

- Trust Deeds or Deeds of Constitution

- Investment Limited Partnership Agreements

Central Bank publishes the 24th edition of the UCITS Q&As

On November 20, 2018, the Central Bank published the 24th edition of its “UCITS – Questions and Answers”, which has been updated as follows

- ID 1030: This question clarifies that the Central Bank will permit different dealing cutoff times for hedged and unhedged share classes in an Exchange-Traded Fund (ETF)

- ID 1088: This question has been added to clarify that a UCITS can be established which has both a listed share class and an unlisted share class. The Central Bank notes that this is possible, but such UCITS must be identified as a UCITS ETF. The listed share class must be identified as a listed share class. The unlisted share class must be clearly identified as an unlisted share class. The Responsible Person for a UCITS ETF must ensure the prospectus discloses the implications for investors depending on whether they are invested in the listed or unlisted share class.

Central Bank publishes reporting requirements for UCITS Management Companies

On November 20, 2018, the Central Bank published its reporting requirements for UCITS Management Companies.

Annual audited accounts of UCITS Management Companies must be submitted to the Central Bank within four months of the relevant reporting period end and must be accompanied by the Minimum Capital Requirement Report.

UCITS Management Companies are also required to submit certain financial information to the Central Bank, including half-yearly accounts of the management company twice in every financial year within two months of the end of the relevant half-year, along with the Minimum Capital Requirement Report. UCITS Management Companies may be required to submit additional monthly or quarterly financial information. The appropriate reporting interval is advised to a UCITS Management Company on an individual basis.

The document also details the reporting requirements in respect of returns that are to be submitted through the Central Bank's web-based Online Reporting ('ONR') system.

The Central Bank’s reporting requirements for UCITS Management Companies can be found here.

Central Bank publishes new application forms for AIFs

Between October 1, 2018 and 31 December, 2018, the Central Bank updated its application forms for RIAIFs, Qualifying Investor Alternative Investment Funds (QIAIF), and Money Market Funds (MMF). The updates are contained in the following sections of the relevant forms

- RIAIF Application Form – Section 1

- RIAIF Authorization Day Checklist – Section 14

- Money Market Fund Regulation – Information, Section 1

The revised application forms can be accessed here.

The Central Bank publishes guidance note for AIFMs and UCITS Management Companies on the Minimum Capital Requirement Report

On November 16, 2018, the Central Bank published its guidance note for AIFMs and UCITS Management Companies on the Minimum Capital Requirement Report (the Report).

The Report must be submitted to the Central Bank by a management company holding an authorization as an Alternative Investment Fund Manager (AIFM) and/or as a UCITS Management Company and must be signed by a director or a senior manager of the AIFM/UCITS Management Company. It should be submitted along with the half-yearly and annual audited accounts at the applicable reporting intervals.

The Central Bank’s guidance note provides commentary on each of the following sections of the Report

- The initial capital requirement amount

- The expenditure requirement

- Professional liability risks

- The minimum capital requirement

- The own funds that a management company is required to have

- The calculation of eligible assets

- Previous guarantees agreed with the Central Bank

- The requirement to disclose if a firm hold professional indemnity insurance

- The compliance test

- Additional conditions applying to the use of redeemable subordinated loan capital

The Central Bank’s guidance note can be found here.

Central Bank publishes notice of intention to make provision for entities to act as depositaries to AIFs as set out under Regulation 22(3)(b) of the AIFM Regulations

On November 19, 2018, the Central Bank published a notice of intention (the Notice) which sets out the Central Bank’s plans to permit entities to seek authorization under Regulation 22(3)(b) of the AIFM Regulations to act as a depositary for specific AIF types which generally do not invest in assets that must be held in custody.

The Central Bank proposes to require an entity which applies to be a Real Asset Depositary to

- Seek authorization under the Investment Intermediaries Act 1995 (as amended)

- Comply with the majority of conditions and obligations set out in Chapter 5 of the AIF Rulebook (Depositary Requirements).

The Real Asset Depositary would be permitted to safe-keep title documents considered to be “other assets” under Regulation 22(8)(b) of the AIFM Regulations, where they do not constitute “financial instruments that can be held in custody.” Where the Real Asset Depositary does not intend to delegate safekeeping of these financial instruments and to enter into agreements with its subcustodian in order to discharge the related liability, the Central Bank intends to impose a condition of authorization requiring that the Real Asset Depositary holds sufficient financial resources to cover the value of the financial instruments.

The Central Bank also proposes to prohibit a Real Asset Depositary from providing for the safekeeping of assets other than documents of title unless and until such time as satisfactory evidence of capacity to do so is accepted by the Central Bank. It is also proposed that a Real Asset Depositary will not be able to act for retail AIFs.

In addition, the Notice sets out the Central Bank’s intention to

- Require disclosure to investors on the status of the Real Asset Depositary and the limited nature of the activities and related liability which applies

- Require applicants to possess professional indemnity insurance for loss or damage caused through the negligent performance of activities

- Limit the holding of financial instruments to those which the relevant AIF will acquire in limited circumstances (such as for cash management, due to an IPO strategy or private equity acquisitions of publically held companies)

The Central Bank’s notice can be accessed here.

The Central Bank publishes reporting requirements for AIF Management Companies

On November 27, 2018, the Central Bank published its reporting requirements for AIF Management Companies.

Annual audited accounts of AIF Management Companies must be submitted to the Central Bank within four months of the firm’s year-end and must be accompanied by the Minimum Capital Requirement Report.

AIF Management Companies are also required to submit certain financial information to the Central Bank, including half-yearly accounts of the management company twice in every financial year within two months of the end of the relevant half-year and the Minimum Capital Requirement Report. AIF Management Companies may be required to submit additional monthly or quarterly financial information.

The document also details the reporting requirements in respect of returns that are to be submitted through the Central Bank's web-based Online Reporting (‘ONR’) system.

The Central Bank’s reporting requirements for AIF Management Companies can be found here.

Prospectus Handbook: A Guide to Prospectus Approval in Ireland

On November 19, 2018, the Central Bank published the published the latest version of its Prospectus Handbook (the Handbook), which provides a practical guide for market participants as to the procedures and practice of the Central Bank in order to provide the market with a clear, transparent and comprehensive overview of the prospectus review, approval and publication process.

The Handbook is relevant for issuers of transferable securities which are subject to the Prospectus Directive and certain law firms, listing agents, stockbrokers and investment banks who act as service providers to those issuers.

The Handbook is effective from November 19, 2018.

A copy of the Handbook is available here.

Central Bank publishes discussion paper on outsourcing

On November 19, 2018, the Central Bank published its discussion paper on outsourcing (the Paper). The Paper provides a summary of the key outsourcing issues and risks specifically identified in the Central Bank’s review which require urgent attention.

Part A of the paper sets out the Central Bank’s findings and focuses on the Central Bank’s minimum supervisory expectations on how firms should manage outsourcing risks. The Paper’s findings outline particular weaknesses in the implementation by regulated firms of relevant outsourcing regulatory requirements in the areas of governance, risk management and business continuity management.

Part B discusses a number of key evolving risks and trends which are arising and outlines key issues that regulated firms must consider in order to mitigate these risks effectively. It sets out a number of key questions which must be considered and actioned by the risk management functions of regulated firms on the issues of sensitive data risk, concentration risk, offshoring and chain outsourcing risk and substitutability risk. The Central Bank expects regulated firms to

- Take appropriate action to address the issues outlined in the Paper and to be in a position to evidence same to the Central Bank if necessary

- Ensure that the risk management function in the regulated firm conducts a review of outsourcing arrangements already in place and where relevant, assess any potential new arrangements

- Implement appropriate policies, procedures and controls or update their existing risk management frameworks to ensure that the findings have been addressed

- Maintain comprehensive and universal risk registers to enable the regulated firm to understand the key threats to their organization and to ensure appropriate risk assessments and monitoring is performed regularly and routinely

The Central Bank’s discussion paper on outsourcing can be accessed here.

Central Bank publishes speech on the impact of Brexit on the asset management sector

On December 3, 2018, the Central Bank published a speech made by its Director of Asset Management & Investment Banking, Michael Hodson, titled “Brexit and the evolving landscape of the asset management sector.”

In the speech, Mr. Hodson discusses the potential impact of Brexit on the asset management sector and outlines the Central Bank’s expectations of firms should there be a transitional period. In the event of a hard Brexit, the following cliff effects are identified as being most relevant to the asset management sector

- There is a risk of UK fund managers losing their passport, which enables them to act on behalf of Irish funds: The Central Bank recommends that boards of underlying funds put in place contingency plans for this in the event of a hard Brexit.

- The loss of the ability of Irish AIFMs, UCITS management companies and Irish funds to delegate their portfolio management to UK investment managers: The Central Bank believes that the required level of work is ongoing to ensure that the necessary Memoranda of Understanding will be in place by the end of March 2019, which should give the industry comfort.

- Ireland presently has no indigenous securities settlement systems infrastructure, with all Irish equity transactions and a proportion of ETFs settled through the CREST Central Securities Depository which is operated out of the UK: The Central Bank states that it will continue its work in this area, but responsibility ultimately rests with each individual firm to ensure they can continue to operate in compliance with applicable EU laws.

Mr. Hodson also references the potential transitional period which the sector could be presented with from March 2019 until the end of December 2020 and notes that this would give the industry more time to prepare for Brexit. However, Mr. Hodson stresses that engagement with the Central Bank will still be required early in the transitional period and there will be little sympathy from regulators if firms have not made the necessary arrangements to continue to service EU27 clients by December 2020.

A full copy of the speech is available here.

Central Bank issues updated Brexit FAQ for financial services firms

On December 10, 2018, the Central Bank issued an updated Brexit-related FAQ document providing general information to financial services firms considering relocating their operations from the UK to Ireland. The Central Bank’s FAQ addresses a number of topics including

- The Central Bank’s approach to authorization, its timelines and requirements

- The impact of Brexit on existing Irish-authorized firms

- The Central Bank’s proposed approach to issues concerning a firm’s substance in Ireland

- The Central Bank’s approach to outsourcing to the UK firms

It also deals with other questions such as whether Ireland has a similar regime to the UK’s Senior Managers Regime and Certification Regimes. In addition, the document addresses the Central Bank’s views on centralized risk management in the UK or elsewhere and whether a firm’s key employees can hold more than one position before the entity goes live.

The FAQ provides links to the Central Bank’s relevant web-site application documentation as well as explanatory material on the authorization processes for the different regulatory regimes.

A copy of the Central Bank’s updated FAQ document can be found here.

France

Spot controls by the Autorité des marchés financiers

Authors: Roberto Cristofolini and Louis Soleranski

Introduction

In 2018, the Autorité des marchés financiers (AMF) started a new type of controls, called SPOT, which are thematic, conducted on a sample of market participants (usually 5 players per theme) and in a shorter timescale than standard inspections. In 2018, the SPOT controls covered the following themes

- Asset valuation: Valuation procedures used by private equity investment companies (a report was published by the AMF in December 2018)

- Capital: Compliance with regulatory capital requirements and investment of capital (a report was published by the AMF in November 2018)

- Efficient portfolio management techniques: Practices for securities financing transactions and information to investors (on-going)

- Socially responsible investment management (ongoing)

For 2019, the AMF announced that the SPOT controls will notably cover

- Cybersecurity: Monitoring and supervisory actions will aim at assessing the status of the French players in terms of organisation, procedures and the effectiveness of arrangements in place for the governance and security of information systems

- Alternative Investment Fund Manager (AIFM) reporting: SPOT controls on data quality will be carried out, focusing in particular on fund risk indicators and the consistency of data transmitted

- Asset valuation: As the AIFM Directive introduced specific requirements in relation to independent valuation and the justification and traceability of methods used and valuations. SPOT controls will focus on valuation procedures for complex products

- Outsourcing of certain real estate services within a group and associated potential conflicts of interest: SPOT controls will be carried out to identify good practices for selecting and monitoring such external providers

MiFID II: Implementation of reporting and record keeping, transparency and market structure, and best execution provisions

The AMF has announced that it will continue to closely monitor transaction reporting to ensure the completeness and quality of reports submitted to it, the compliance with post-trade transparency requirements, compliance with the obligation to trade on organized and regulated trading venues for equities and certain derivatives and monitoring transactions carried out on organized trading facilities and by systematic internalizers.

Also, the AMF will continue to monitor measures put in place by intermediaries to adapt their execution arrangements and comply with best execution requirements, with a particular focus on certain practices known as “payment for order flows”.

Distribution

MiFID II provides for new requirements relating to the identification of a target market and distribution strategy. The AMF explained that these new requirements must not prevent open-architecture distribution but these requirements must allow participants to find the best way to distribute products to the right clients, including, where appropriate, for the purposes of diversifying client portfolios. The AMF will continue to carry out mystery shopper visits in 2019 to obtain an indication of the evolution in the products offered by advisers based on client profiles.

The AMF will also continue the analyses started in 2018, particularly on compliance of investment management agreements and fees to evaluate the implementation of the new provisions introduced by MiFID II, in particular the provisions in relation to the notification to clients when the value of their portfolio depreciates by 10 percent, changes in the management report and the end of inducements.

EU/UK Quarterly Roundup

Author: Simon Lovegrove

A Quarterly Roundup of regulatory developments in the EU and UK. To receive daily updates on regulatory developments subscribe to our blog, Regulationtomorrow.com

| Title |

Date |

Comment |

| Draft EU Exit SIs for investment funds and their managers |

Ongoing |

HM Treasury has published the following EU Exit statutory instruments in preparation for a no-deal Brexit scenario. These statutory instruments directly impact the asset management sector and are, at the time of writing, draft instruments

- The Alternative Investment Fund Managers (Amendment) (EU Exit) Regulations 2018

- The Collective Investment Schemes (Amendment etc.) (EU Exit) Regulations 2018

- The Venture Capital Funds (Amendment) (EU Exit) Regulations 2018

- The Social Entrepreneurship Funds (Amendment) (EU Exit) Regulations 2018

- The Long-term Investment Funds (Amendment) (EU Exit) Regulations 2018

- The Money Laundering and Transfer of Funds (Information) (Amendment) (EU Exit) Regulations 2018

- The Money Market Funds (Amendment) (EU Exit) Regulations 2019

|

| Draft The Collective Investment Schemes (Amendment etc.) (EU Exit) Regulations 2018 – sub-funds |

December 12, 2018 |

To ensure that UK investors have continued access to EEA UCITS that are currently marketed in the UK, the UK Government announced on December 20, 2017 that it would put forward legislation to establish a “temporary permissions regime” enabling EEA funds and sub-funds that have notified the FCA of their intention to market in the UK via a passport before exit day to continue to access the UK market for a limited period after exit day.

An amendment to the draft Collective Investment Schemes (Amendment etc.) (EU Exit) Regulations 2018 means that new sub funds of an umbrella fund will be permitted to notify the FCA to enter the temporary permissions regime (TPR) after exit day. New sub-funds of an umbrella fund are those which become authorized in accordance with the UCITS Directive by their EEA home state regulator on or after exit day. For those new sub-funds to enter the TPR after exit day, at least one other sub-fund of the new sub-fund’s umbrella fund must have notified to enter the TPR before exit day.

|

| FCA consults on cryptoassets guidance |

January 23, 2019 |

The FCA has published Consultation Paper 19/3 (CP19/3) concerning guidance on cryptoassets. Within the UK Cryptoasset Taskforce’s report of October 2018, the Taskforce set out a commitment to provide extra clarity to firms about where current cryptoasset activities are regulated. The FCA is consequently consulting in CP19/3 on guidance to fulfil that commitment. CP19/3 targets firms trading, exchanging, holding and creating crypto assets such as coins or tokens, and individual investors.

The guidance focuses on where cryptoassets interact with the FCA’s perimeter. In particular, it looks at where cryptoassets would be considered ‘Specified Investments’ under the Financial Services and Markets Act 2000 (Regulated Activities) Order 2001 (RAO), “Financial Instruments” such as “Transferable Securities” under the Markets in Financial Instruments Directive II (MiFID II), or captured under the Payment Services Regulations (PSRs) or the E-Money Regulations (EMRs). It also covers where cryptoassets would not be considered ‘Specified Investments’ under the RAO.

In Chapter 2 of CP19/3, the FCA sets out the wider context of the consultation, explaining the key concepts related to cryptoassets and the cryptoassets market. The perimeter guidance is set out in Chapter 3.

Within the Chapter 3 guidance, the FCA uses the framework developed by the Cryptoasset Taskforce for different types of cryptoassets, explaining whether they are within the FCA’s regulatory remit, and if so, what this means for market participants. A Q&A section is provided setting out the common questions that the FCA is asked with regards regulation and specific cryptoassets. The key cryptoassets addressed within CP19/3 are: exchange tokens; security tokens; and utility tokens.

With regards Brexit, if a Withdrawal Agreement is ratified, then an implementation period is intended to operate from March 29, 2019 until at least the end of December 2020. During this time, EU law will still apply in the UK. Obligations derived from EU law will continue to apply and firms must continue with implementation plans for EU legislation that is still to come into effect before the end of December 2020. The FCA notes that while important for all firms, including those carrying on cryptoasset activities, upcoming legislation such as the transposition of the Fifth Anti-Money Laundering Directive (5AMLD) is relevant – especially for firms using exchange tokens.

The impact of CP19/3 is that currently unregulated crypto-related businesses will need to seek authorization under such regimes as MiFID II, while some of those that will remain unregulated after the review, such as crypto exchanges, will still have to comply with 5AMLD once transposed into UK law. Later this year the FCA will consult on banning the sale of derivatives linked to certain types of cryptoassets to retail investors. The Government is planning to consult on whether to expand the regulatory perimeter to include further cryptoasset activities. The deadline for responses to the CP19/3 is April 5, 2019.

|