Fast-track dispute resolution

NRF Resolve, an NRF Transform product, is a new mechanism to resolve small commercial disputes fairly, quickly and simply. When negotiation has faltered and traditional dispute resolution methods are too slow, burdensome and costly, keep your business moving and control costs by resolving disputes within 2-6 weeks via an easy to use, secure online platform and a panel of expert mediators and arbitrators. Limited documentation and a streamlined process ensures a faster outcome.

The process can be used for disputes between or within companies operating in both civil law and common law jurisdictions, and its fixed price allows users to effectively plan and control their budgets. The catalyst for this solution was the high volume of disputes arising from the COVID crisis, but it can be used for all types of disputes.

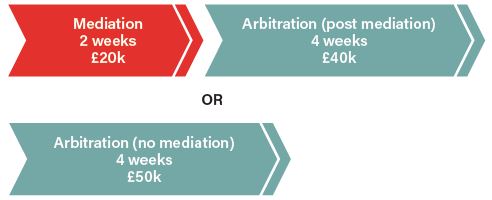

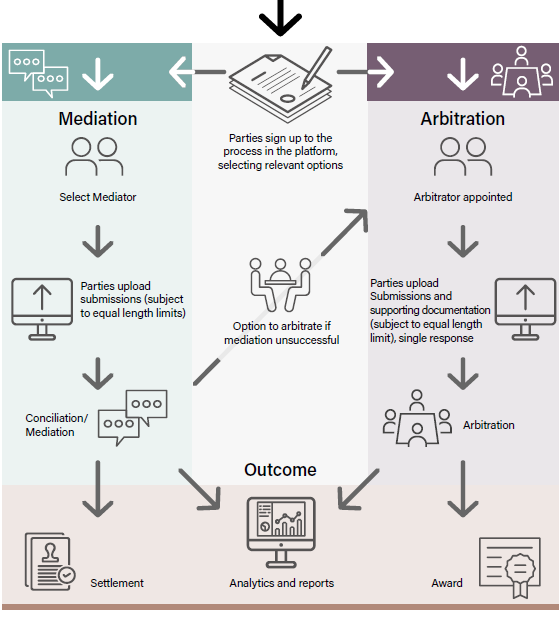

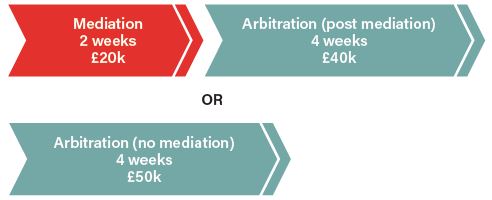

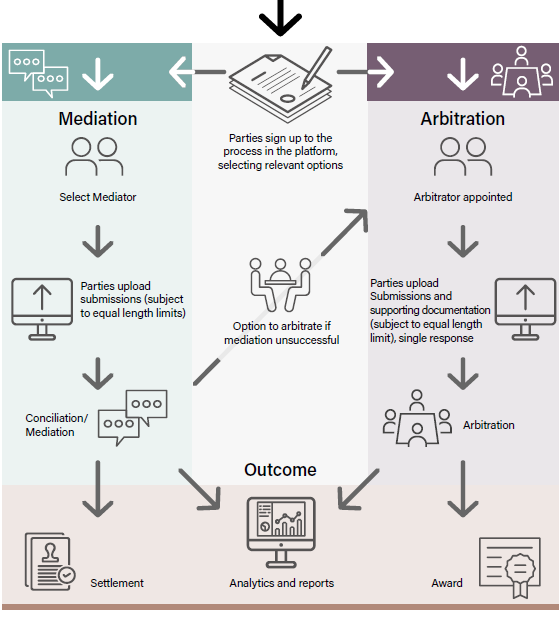

Parties may opt for a mediation process only, a mediation process followed by binding arbitration or an arbitration only. Impartiality is guaranteed through independent mediators and arbitrators which can be selected from a pre-agreed panel of independent sector specialists available through the platform, or you may appoint your own.

- Protect valuable relationships by expediting resolution to maintain business continuity

- Achieve the best resolution in the shortest time

- Simple, clear process and a platform that guides you through every step

- Fixed, competitive pricing

- Industry leading mediators, and third party arbitrators, appropriate to the sophistication of the issues at hand

- Resolve disputes from your ‘home office’ with no requirements to instruct external counsel, meet in person or travel, saving you both time and money

“This is for when counterparties are business partners, are willing to remain business partners and it’s a simple issue. We could save money, it will be quick and uncomplicated.” Client feedback

Register to find out more and arrange a demo of the platform free of obligations.

Register your interest

Managed through an intuitive and secure online platform

We are committed to helping you get back to business as usual as soon as possible. NRF Resolve offers an online legal process to achieve an outcome in up to 6 weeks by combining:

- A disciplined set of legal mechanics, created and managed by NRF; with

- An accompanying process and purpose-built technology platform, developed and supported by NRFs legal design and product teams.

Clear process

A solution which is (i) fast (ii) low burden (iii) fair (iv) at a market

beating fixed price (v) based on purpose built technology & best

in class legal and industry expertise

| Protect business relationships |

Protect valuable relationships by expediting resolution to maintain business continuity |

| Efficient |

Resolve disputes from your ‘home office’ with no requirements to instruct external counsel, meet in person or travel, saving you both time and money |

| Fast result |

The solution has a tight timetable and a limit on length of submissions

and supporting documents, to enable a rapid resolution |

| Low burden |

A simple, clear process and a platform that guides you through every step - from agreeing the terms to making submissions - the volume of work for in-house teams is significantly reduced |

| Fair |

The underlying rules and process ensure fairness between the parties |

| Fixed price |

By placing tight parameters around the process, and automating

administrative steps, the solution is available at a fixed price that delivers

value to in-house teams at a time of pressure on spend |

| Data insights |

Because all information is captured in a structured way, clients have

access to portfolio reporting and data insights across their claims |

| Experienced

Lawyers |

Access a panel of industry leading mediators, and third party arbitrators, appropriate to the sophistication of the issues at hand |

| Avoids conflicts

issues |

The process is designed to be undertaken by in-house legal teams

without the need to instruct external counsel, and because NRF is not

offering legal advice to the parties, the delay in running conflict checks is

largely avoided. |

| Jurisdiction

agnostic |

Fully suitable to common law and civil law jurisdictions. Initially designed

for French and English law, but portfolio to be expanded rapidly |