This article was co-authored with Amelia Martin.

A further step towards enacting the Consumer Data Right (CDR) in the energy sector is being taken, with further detail now revealed on how data sharing amongst energy retailers and the Australian Energy Market Operator (AEMO) will occur.

Background

Treasury has recently released how it proposes to implement the CDR in the energy sector. Last year we alerted industry participants of the Treasury’s consultation process for the draft designation instrument to extend the CDR to the energy sector. On 30 June 2020, the final designation instrument came into effect, specifying the energy data holders and data caught by CDR obligations.

On 17 August 2021, Treasury released the Exposure Draft of the Competition and Consumer (Consumer Data Right) Amendment Rules (No. 2) 2021 (Cth) (version 4) (Proposed Rules), which can be found here. This establishes a peer-to-peer (P2P) data access model for the energy sector, where energy retailers assume responsibility for disclosing all CDR data to accredited data recipients for their eligible consumers, including by obtaining data from AEMO.

Key Updates

What is the P2P model?

Whilst a “gateway model” spearheaded by AEMO was previously favoured for the energy industry, the P2P model determines that the primary responsibility to enable data sharing for consumers ultimately falls to energy retailers, but with heavy involvement by AEMO.

Under the P2P model, energy retailers, as primary data holders, are responsible for responding to CDR requests. This responsibility extends to not only facilitating the disclosure of CDR data in accordance with the Proposed Rules, but also complying with the data standards and privacy safeguards, which set out obligations to:

- protect the privacy of consumers’ data, including through seeking consent to disclose (with a failure to do so being subject to civil penalty provisions); and

- keep comprehensive records and conduct reporting (including in relation to metrics such as timing of responses).

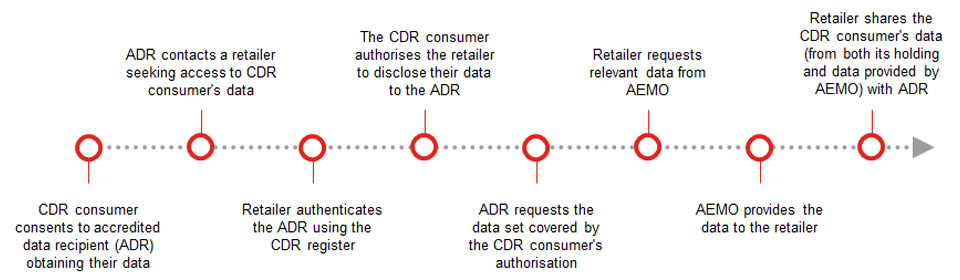

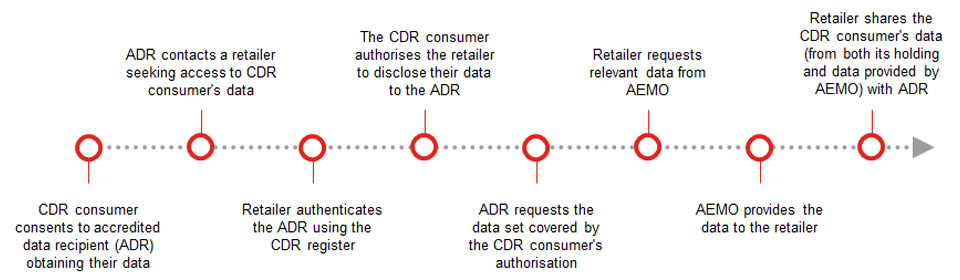

We illustrate the CDR data flow in the P2P model for the energy sector below.

This means that where a retailer (as primary data holder) receives a CDR request that captures data held by AEMO1 (being the secondary data holder), the retailer must request the data from AEMO. Although potentially burdensome, the Proposed Rules require that retailers request any responsive data from AEMO, even where the retailer already holds the data themselves.

Who is a retail data holder in the energy sector?

A retailer is a data holder of energy sector data where it:

- retails electricity to connection points in the National Energy Market; and

- either holds a retailer authorisation in respect of the sale of electricity issued under the National Energy Retail Law or is a retailer within the meaning of Electricity Industry Act 2000 (Vic).

Who are eligible CDR consumers in the energy sector?

A CDR consumer must be:

- an individual 18 years or older, or a non-individual; and

- an account holder or secondary user for an account that is held with a data holder; and

- a customer of the retailer in relation to an eligible arrangement2, where their account relates to that arrangement.

What energy sector data can be accessed under the Proposed Rules?

There are two categories of energy sector data that retailers have responsibility for disclosing – required consumer data and voluntary consumer data, which include as follows:

| Required Consumer Data |

Voluntary Consumer Data |

- is:

- customer data; or

- billing data or account data; or

- AEMO data in relation to any such account; or

- tailored tariff data in relation to any such account; and

- is held by the data holder in digital form.

|

- is not “required consumer” data.

|

| |

|

These definitions of required and voluntary consumer data build upon and provide detail of the broader classes of information specified in the designation instrument for the energy sector.

When will the Proposed Rules come into effect?

The application of the Proposed Rules to the energy sector will be implemented in two stages. The first stage is proposed to commence on 1 October 2022, from which time certain participants, including retailers AGL Energy Group, Origin Energy Group and Energy Australia Group, will be required to comply with CDR obligations. It is proposed other retailers will need to comply with these obligations 12 months after the commencement of the first stage.

Next steps

Treasury has opened the Proposed Rules for consultation until 13 September 2021 and interested parties can make submissions up until that date.

Energy retailers that will be caught by CDR obligations under the Proposed Rules should evaluate their ability to comply with these obligations having regard to their data retention policies and the technological capabilities of their systems.