Introduction

The following guide brings together summaries of the top legal concerns for insurers from a number of different regions. This summary has been put together with the support of lawyers from across our practice. Some developments are concerns only in a specific market while other topics appear to be common across several jurisdictions.

We hope that this guide helps identify the main legal concerns for the year ahead.

Please contact our team for further information about any of the topics raised.

What are the top legal concerns in the insurance market in 2019?

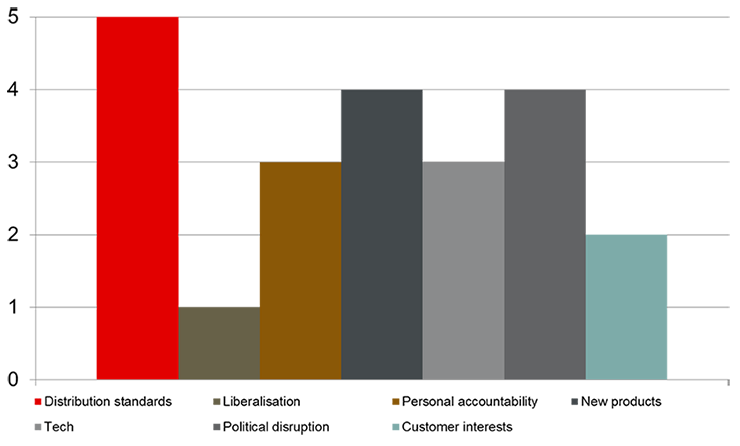

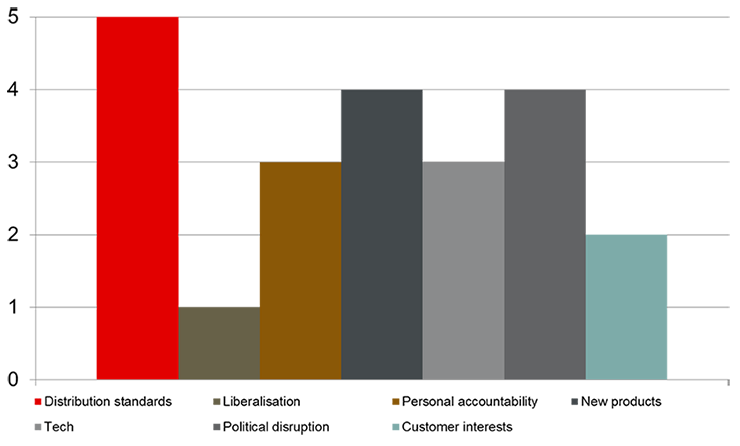

Increasing focus on personal accountability, greater oversight of distribution chains and the protection of customer interests and the adaptation of products to new technologies are the global themes our lawyers identify.

New products are emerging as part of the digital transformation of the market. A number of jurisdictions are considering how vehicle automation will impact motor liability lines as self-driving vehicles move closer to becoming a feature on our highways. The industry is having to swiftly adapt products for other new technologies such as drones which are increasingly being applied in commercial environments.

The legalisation of cannabis has made insurance companies in both Canada and South Africa consider how the use and propagation of cannabis affects existing insurance products and new business opportunities. This change in acceptance of cannabis means that existing products must adapt.

An increasing professionalization of the distribution chain is something that can be seen across jurisdictions. We observe that greater oversight of distribution chains, whether through increasing licencing requirements, greater professional standards and conflict management rules are likely to bring brokers into the regulatory spotlight in the coming year.

The increasing liberalisation on the Chinese insurance market is likely to be an important factor in many strategic considerations over the next year.

Table 1 – frequency of issues mentioned by our contributors. Each unit on the x axis represents a measure being taken in one of our jurisdictions.

Australia

Insurance after Hayne – the impact of the Royal Commission for the insurance industry

The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, led by Commissioner Kenneth Hayne, has resulted in 15 recommendations specific to the insurance industry and 76 recommendations in total across the banking, superannuation and financial services industries.

Included in the recommendations for insurers are the introduction of a ban on hawking (unsolicited meetings or calls to sell insurance), the introduction of a deferred sales model for add-on insurance and reforms to commission arrangements, all of which are expected to impact both the insurance and broker markets. Commissioner Hayne has also supported the implementation of the unfair contract terms regime to contracts of insurance as well as an amendment to group life policies to ensure arrangements are in the best interests of members.

The Commission has recommended that the current duty of disclosure in the Insurance Contracts Act 1984 be replaced for consumers by a duty not to make a misrepresentation. Insurers will have to ask questions they wish to know the answer to.

Culture, governance and remuneration in financial services firms were key components of the Commission findings. Organisational structures had allowed, and incentivised, the pursuit of profit at the expense of proper conduct. Hayne’s recommendations will require sweeping reviews to be conducted by financial services entities, including insurers, to modify their risk management frameworks and assess and continually improve their culture.

Claims handling will require regulation with the result that insurers and third party claims administrators will become subject to the general obligation to provide services ‘efficiently, honestly and fairly’. Provisions of industry codes of good practice will become enforceable by the Australian Securities and Investments Commission (ASIC), effectively turning self-regulation into law.

The Commission has recommended that the Banking Executive Accountability Regime (BEAR), which currently exists for banks, be extended to insurers. BEAR creates a class of accountable persons including directors and senior executives of the organisation, who have to take reasonable steps in conducting their responsibilities to prevent matters from arising that would affect the organisation’s prudential standing or reputation; and exposes those individuals to greater regulatory obligations and liability.

Up in the air – drone regulation

New drone insurance policies continue to be introduced in the Australian market. The insurance covers damage or loss to the drone itself, being the Unmanned Aerial Vehicle (UAV), and the software and ground control system, together comprising the Unmanned Aerial System (UAS). Policies may also include liability cover and protection from cyber threats which may cause data loss. Businesses are constantly finding new commercial applications for drones to reduce cost and risk in their operations. Insurers are already using drones to remotely assess damage during the loss adjusting process.

Currently, Australia’s Civil Aviation Safety Authority (CASA) oversees drone safety rules and licensing of commercial operators where the drone weighs over 2kg. However, CASA proposes to implement a mandatory registration and accreditation scheme in 2019. The registration scheme will apply to all remotely piloted aircraft (RPA), which will include all UAVs that weigh over 250g whether used recreationally or commercially. In order to obtain accreditation to operate any RPA, individuals will need to complete an online education course. The proposals are seen as a way to ensure the safety of the public, RPA pilots and other airspace users. Non-compliance will attract a penalty and CASA will be responsible for enforcement action.

According to CASA’s policy paper, industry estimates suggest that there are over 150,000 RPAs in Australia. Insurers should monitor this market and consider whether any changes to their policy wordings are required once the new registration and accreditation scheme is put into place.

Canada

Mandatory Liability Insurance for Commercial Vessels now in Force

Following over 15 years of consultation, Federal Regulations requiring liability insurance for commercial and ‘public purpose’ vessels that carry passengers came into force on very short notice on January 11, 2019. The definition of passengers is very broad and includes almost everyone other than crew so the regulations apply to many commercial vessels and even some pleasure craft when used for a commercial purpose.

Under the new rules, operators of the these vessels will have to carry a minimum of $250,000 in liability insurance for every passenger the vessel has the capacity to carry on board. This minimum does not fully cover owners’ limited liability under domestic legislation incorporating the Athens Convention relating to the Carriage of Passengers and their Luggage by Sea, 1974 as amended by the Protocol of 1990, so higher limits are encouraged.

There are limited exemptions for certain classes of vessels, including vessels used for ‘adventure tourism’, ferries operating internationally, and pleasure craft used exclusively for pleasure purposes with no business aspect.

Operators who did not have liability insurance when the regulations came into force on January 11, 2019 must comply by no later than March 12, 2019. Operators who currently have insurance will need to comply with the Regulations upon renewal, modification, or cancellation of their existing policy. Proof of insurance in a specified form must be carried on board the vessel at all times.

Failure to comply with the requirements of the regulations could result in either the detention of the vessel or a fine up to $100,000.

The Regulations are an opportunity for underwriters to significantly expand this line of business in Canada: the Federal Government estimated that the insurance industry would make nearly $25 million more in premiums over the next 10 years than it would have in the absence of these Regulations.

Legalization of recreational cannabis creates challenges for insurers’ risk assessments and disrupts due diligence protocols

On October 17, 2018, Canada legalized the use of recreational cannabis with the Cannabis Act. The Cannabis Act establishes the framework for the legal cannabis industry, with the federal government instituting licensing and authorization requirements for production and packaging of cannabis products, and the provincial and territorial governments managing distribution and retail sales. This new legal framework brings both risks and opportunities for insurers.

On the one hand, given the lack of data available on past claims, insurers may have a hard time accurately assessing exposure and setting premiums. Providers of home, automobile and life insurance will also need to consider the effects of legalization on specific provisions within their policies. For instance, home policies may require adjustments to openly charge premiums or deny coverage to individuals who wish to grow cannabis in their homes. Automobile insurance policies will need fine-tuning to account for cannabis impairment, and life insurers need to consider whether cannabis smokers are "smokers".

On the other hand, the creation of a new legal industry also creates opportunities for insurers. The cannabis industry will require specialized coverages. For example, licensed producers will require specialized property and equipment breakdown coverage, and eventually product liability insurance for the production of cannabis edibles and derivatives. Retail dispensaries may need coverage for commercial host liability, premise liability and stock loss specific to their cannabis products and operations.

In the short term, insurers will presumably shoulder the brunt of the risk should they choose to test the deep waters of the cannabis insurance industry. In the interim, insurers should heighten their normal due diligence and require more thorough risk assessments during the underwriting process.

China

Relaxation of foreign ownership restrictions on life insurance companies

The most significant development for the Chinese insurance market is the decision to lift foreign ownership restrictions imposed on life insurance companies from 50 per cent to 51 per cent, with a view to removing all foreign ownership restrictions by 2021. This has attracted significant public interest. Since 2003, when foreign investors were first permitted to set up wholly owned property and casualty insurance companies in China, foreign investors have made significant efforts to lobby the Chinese government to remove the remaining limitations on foreign ownership.

The market restrictions have meant that foreign investors have had to find suitable local partners in China with whom they can form a joint venture in order to provide life insurance products in the Chinese market. Foreign investors in China rely upon the extensive distribution channels of their local partners; in return, foreign investors share their home market life insurance experience with their Chinese partners. Because of the respective strengths of each of the partners, there have been concerns about corporate governance arrangements.

Foreign investors seeking greater control (often because they have an established presence in the Chinese market and already have established distribution channels) enter into joint ventures with weaker local partners. Such investors seek to maximize their contractual rights in the joint venture. This must be negotiated carefully with the cooperation of local partners.

The decision to open up the Chinese life insurance market to foreign controlling interests from 2021 has naturally been welcomed by foreign investors, in particular to those who already have a strong relationship in joint ventures. It is anticipated that in the next few years, foreign investors will consider buying out weaker local partners to control fully their relevant life insurance companies.

Foreign investors with stronger local partners may use measures being introduced to open-up the intermediary sector to establish their own distribution channels before 2021 prior to buying out their local Chinese partners for those foreign investors having strong local partners.

Liberalization of the insurance intermediary sector

Historically, foreign investors have not been permitted to hold more than a 25% stake in an insurance intermediary in China. As they can only hold a minority state in Chinese joint-venture intermediaries and have limited influence, foreign investors have little incentive to set up intermediary businesses.

However, it is permissible for foreign investors to establish wholly owned foreign invested insurance intermediaries in China, although such firms are only permitted to provide brokerage services relating to large scale commercial risks, reinsurance, international marine, aviation, and transport insurance and related reinsurance only. Distribution of almost all life insurance products are excluded. These restrictions currently restrict foreign investors from structuring insurance distribution networks in China.

The new policies, effective from April 27, 2018, have changed the market and released firms from such restriction in the lines they can distribute. Qualified foreign investors, subject to China Banking and Insurance Regulatory Commission (CBIRC) approval, can now set up wholly owned insurance intermediary firms to distribute insurance products on behalf of insurance companies. It is therefore a good time for foreign investors (in particular those who have established life insurance joint ventures with strong local partners) to consider establishing wholly owned insurance intermediary businesses where their existing Chinese partners exercise a majority influence.

Qualified foreign investors, subject to CBIRC approval, may now establish wholly owned insurance intermediaries covering the same scope of business as their domestic peers, including

- Working out a business plan, selecting insurers and handling formalities for effecting contracts.

- Assisting policyholders or beneficiaries with claims.

- Engaging in reinsurance brokerage.

- Providing disaster prevention, loss prevention or risk assessment, risk management consulting services for clients.

- Conducting other business permitted by the CBIRC.

Any existing foreign-invested intermediaries may apply to update the scope of business in their operating permits and expand their business in China.

For foreign investors, it is a good time to consider entering into the Chinese market. With the availability of both insurance and intermediary markets with no foreign ownership or business operating restrictions, it is now feasible for foreign investors to set up operations in China. The abolishment of the requirement to establish representative offices of a period of at least two years prior to the establishment of insurance companies is also expected to speed up new foreign investors’ accession to Chinese insurance market.

France

France enacts a new legal regime for insurance contracts entered into before Brexit in the event of a no-deal

On February 7, 2019, the French Ministry of Economy and Finance passed an Ordinance no 2019-75 introducing a contingency plan for the financial institutions sector in connection with the withdrawal of the United Kingdom (UK) from the European Union (EU) (the Ordinance).

The Ordinance notably amends the provisions of the French Insurance Code and will enter into force as from the date of exit of the UK from the EU in the event of a no-deal.

The new provisions aim at ensuring legal certainty for French policyholders and insureds who entered into an insurance contract with a UK risk carrier before Brexit, whilst encouraging UK risk carriers to transfer to EU licensed risk carriers their insurance business in respect of risks located in France.

Pursuant to the Ordinance

- UK insurers will be entitled to continue performing post-Brexit insurance contracts validly entered into pre-Brexit notwithstanding the loss of their passporting rights and, as a result, French policyholders and insureds who entered into an insurance contract pre-Brexit with a UK insurer which has lost its permissions will remain covered under their insurance contract and entitled to the benefits or compensation payable thereunder.

- However, UK insurers which will lose their passporting permissions as a result of Brexit will no longer be entitled to renew, extend, or modify their existing policies, or to write new policies, and the Ordinance provides for an obligation for the relevant insurers to inform their French policyholders and insureds of their situation. In this respect, a decree is expected later this year in order to detail the format and content of information to be delivered.

Any person carrying out insurance activities in France without complying with these new provisions will be subject to a three-year prison sentence and a EUR 75,000 fine (or EUR 375,000 for legal entities).

Insurance brokerage: towards the self-regulation of the profession

On September 11, 2018, the Treasury Department of the French Ministry of Economy and Finance agreed to the creation, for the first time in France, of new professional associations representing brokers and their agents, aimed at monitoring and regulating the profession.

The details of this reform are currently being examined by Parliament, for implementation on January 1, 2020.

These new professional associations will impact the brokerage landscape in France, since they will carry out, through public service delegations, significant responsibility for (i) mediation between professionals and policyholders, (ii) professional competence and training support, (iii) verification of conditions for registering as a broker, (iv) as well as assistance in the monitoring of the conditions under which the (re)insurance distribution activities are conducted.

Brokers (and their agents), whether incorporated in France or operating in France under the freedom of establishment or of services, will have to become members of one of these professional associations.

In addition, these associations will have disciplinary power over their members and will be empowered for instance to issue a warning, a reprimand or even a withdrawal of membership of the association to a broker no longer meeting the conditions of membership or the commitments to which its membership was subject.

Although supported by a majority of the profession, which see these associations as shock absorbers vis-a-vis the French Regulator (ACPR) – in the sense that an alert process would be put in place to limit/avoid the sanctions of the APCR – some believe that the responsibilities entrusted to these associations will overlap with those of the ORIAS (the registrar of intermediaries) and the ACPR.

Consequently, market players expect Parliament to provide guarantees in a near future, particularly as regards the existence of counter-powers against these future associations and their scope of intervention.

Guidance from the French regulator (ACPR) on the implementation of continuing professional training for insurance distributors

From February 23, 2019, insurance intermediaries and employees of insurance companies carrying on insurance distribution activities must regularly update their professional skills. In addition to the initial training already required for professional competence, the provisions implementing article 10 of the Insurance Distribution Directive (IDD) now provide for an obligation relating to continuing professional training and development of at least 15 hours per year.

In this context, the ACPR issued guidance in February 2019, aimed at clarifying the scope of its control, particularly towards insurance companies distributing insurance products.

French insurers are now required to set up procedures for monitoring continuing training and to appoint a person responsible for its follow-up. Furthermore, while the French implementing provisions of IDD have not provided for an obligation to validate the skills acquired during continuing training, the ACPR implicitly invites stakeholders to do so, considering such validation to be a “virtuous practice”.

In addition, the ACPR confirms that during its 2019 inspections, it will pay particular attention to the steps taken by professionals to comply with these new training obligations. For example, the regulator expects insurance distributors to be able to present a list of persons or categories of persons to be trained for 15 hours through 2019. This list should be kept up-to-date with internal transfers.

Particular attention will also be paid by the regulator to the coherence of training with regard to the nature of the products distributed, the distribution methods and the position held within the entity.

Eventually, the ACPR specifies that it will not validate the content, organisations or training programs. Therefore, all references such as "ACPR training", "training validated/requested by the ACPR" are to be prohibited by insurance distributors.

EU insurers passporting into France to gain credibility as they now benefit from the protection of the French Compensation Scheme

In the wake of recent liquidations of insurers such as Elite, Alpha, Gale or CBL and following a formal notice of the European Commission, the French Compensation Scheme applying to mandatory insurances (in French the FGAO) has recently seen its operational scope modified by the Government (Ordinance n° 2013-544).

With respect to insurance contracts entered into or renewed since July 1, 2018, the FGAO now operates for the benefit of policyholders of motor third party liability (MTPL) and construction insurance contracts, against the consequences of the withdrawal of license of an insurance company covering specific risks related to these mandatory insurances located “on the French territory”.

Before that date, the FGAO operated for the benefit of policyholders of insurance contracts which subscription was made mandatory by “any law or regulation” (including, but not limited to, MTPL and construction) but only in the event the failing insurance company was “licensed in France and subject to the control of the State”.

Therefore, its operational scope has been simultaneously (i) refocused on these two mandatory insurances but also (ii) broadened to include insurers licensed in an EU Member State and providing cover in France under the European passport (either freedom of services or freedom of establishment).

This new regime creates more equality between French insurers and EU insurers passported in France – which were notably complaining of this uneven treatment in the context of tender processes – and allows them to gain credibility vis-a-vis their insureds by providing them additional security in the event of a withdrawal of license due to the insurer’s inability to meet its financial obligations. Consequently, the financing of the FGAO has been overhauled and, in particular, contributions of insurers have increased.

In any case, the protection of the FGAO still remains limited as it does not benefit persons having subscribed to the insurance in the context of their professional activities.

Hong Kong

A new statutory licensing regime for the insurance intermediaries market

In mid-2019, the Hong Kong Insurance Authority (the IA), an independent statutory body, is expected to take over regulation of insurance intermediaries from the three existing self-regulatory organisations (the Hong Kong Confederation of Insurance Brokers, the Professional Insurance Brokers Association, and Insurance Agents Registration Board) and administer a new statutory licensing regime. The new statutory licensing regime will capture a broader scope of regulated activities than under the existing regime. The IA also released a consultation paper in September 2018 on two draft guidelines concerning the ‘fit and proper’ criteria and continuing professional development for licensed insurance intermediaries, both of which are expected to be finalised upon the commencement of the new regime. The draft ‘fit and proper’ guidelines propose more onerous criteria than exists under the current regime (including proposing higher education requirements and professional qualifications for responsible officers). In assessing the professional competency of insurance agencies and broker companies, the IA will have regard as to whether the relevant entity has effective policies and procedures in place to ensure compliance with legal and regulatory requirements. The CPD guidelines also propose a higher number of CPD hours for individual licensees. The more onerous requirements in respect of licensing and continuing obligations are likely to result in increased overall compliance costs for intermediaries, which may result in some consolidation within the intermediaries market going forward.

Hong Kong’s first virtual insurer licence

As one of the initiatives to promote Insurtech development in Hong Kong, the IA launched a ‘Fast Track’ scheme in October 2017 to expedite and streamline the authorisation process for new applicants that operate and sell insurance products solely using digital distribution channels (i.e. without the use of intermediaries such as agents, banks or brokers). Following significant interest from the market after its initial launch, the IA granted the first licence to a virtual life insurer in December 2018. Whilst the scheme has had a slow start, now that the first license has been granted and given the rise of Insurtech, we expect to see more interest from the market in the coming year.

The Netherlands

Autonomous vehicles might completely change auto insurance as we know it

According to the KPMG’s 2019 Autonomous Vehicles Readiness Index1, the Netherlands is the country most ready for a future including autonomous vehicles. But before these cars hit the road, a change in law and insurance policies will be necessary.

Various law academics, insurers and carmakers have indicated that autonomous vehicles might change the nature of motor insurance completely. The biggest change seems to be in who (or what) will be held liable. Instead of holding the individual driver liable in case of an accident with an autonomous vehicle, insurers might now have to get their money from the manufacturer or software provider.

While there is a call for a change in the legal environment, allowing the vehicles to be held liable, there are no new Dutch legislative proposals yet that deal with the liability of autonomous vehicles. The Dutch government, however, has paved the way for test driving with these new kind of cars (Experimenteerwet zelfrijdende autos). Moreover, the Minister of Infrastructure and Water Management, has stated that a legal framework for automated driving will presumably be created soon, including a driving license for self-driving cars. Also, the European Commission reported recently that it will introduce legislative proposals for automated driving during 2019.

Several insurers have already thought about these developments and see new opportunities. While less individual drivers might need insurance in the future, large insurance policies could be offered to manufacturers, fleet owners and operators. They are currently investigating different insurance schemes for autonomous vehicles, like "direct insurance", where the insurer immediately deals with the damage for the insured, without having to determine his liability. Overall, (motor) insurers should follow the development of autonomous vehicles closely and think about designing new insurance policies for this kind of cars. Also, new legislative proposals should be monitored to consider whether any changes to their policies will be needed accordingly.

Poland

New legislation on insurance distribution – first results to come in 2019

2018 year was a busy year for legislation relevant to the Polish insurance sector (with the new Act on Insurance Distribution entering into full force on October 1, 2018) but the first practical effects of the this new legislation will only be felt in the current year.

The Polish legislature believes that the failure of insurance intermediaries to provide appropriate information to customers is one of the main causes of customer complaints and mis-selling. Accordingly, the recent legislative changes relevant to distribution concern the imposition of a number of new obligations for intermediaries operating in the Polish market including the obligation to provide reliable and comprehensive information about the products sold, their suitability, management of conflicts of interest and information on how intermediaries are remunerated.

The purpose of all these measures is to effectively eliminate mis-selling, that is the intentional presentation by intermediaries to their clients of products not suitably for customers’ needs, motivated by the desire to obtain the highest possible commission.

The first practical results of the new regulations are yet to come later in 2019.

Insurance contracts vs Brexit – a new legal regime in the event of a no-deal Brexit

On March 11, 2019, the Polish Council of Ministers adopted draft legislation regarding activities by financial services businesses in the event that the UK leaves the EU without a withdrawal agreement.

Under the proposed legislation, insurance companies established in the UK or in Gibraltar will be able to continue to perform life insurance contracts concluded in Poland on the same terms as entities from EU Member States for a period of 24 months after Brexit. The same period of time will also apply to the reinsurance activities of UK or Gibraltarian insurers operating in Poland. In the case of non-life insurance contracts such firms have only an additional 12 months after Brexit in which to continue to perform obligations under existing contracts.

Insurance companies will be prohibited from concluding new insurance contracts, extending cover under existing contracts or providing additional cover in respect of new risks under existing contracts. Furthermore, increasing sums insured under existing insurance contracts and making changes to such contracts resulting in the increase of an insurance company’s risk exposure will also be prohibited.

Singapore

Alternative Capital for Asian insurers

It has been slow in its development, but we are starting to see the use of alternative capital instruments to provide capital support to Asian insurers. Both Singapore and Hong Kong recognise collateralised reinsurance/ retrocessions as effective to reduce balance sheet liabilities. In December 2018 Peak Re (Hong Kong) entered into a reinsurance sidecar arrangement covering Asian catastrophe risk with a Bermuda SPV with US$75 million of capital support from a range of high quality global investors.

Singapore also recognises subordinated debt as eligible capital and has established a regime to support the issuance of insurance linked securities. In March 2019, taking advantage of this scheme, IAG issued, through a SPV, A$75 million of insurance linked securities in Singapore. The bonds provide three years of aggregate catastrophe protection.

Hong Kong has indicated that it will consider legislation to allow for the establishment of special purpose vehicles that would issue ILS.

South Africa

Proposed new conduct rules

The Insurance Act deals with the prudential side of insurance. The South African authorities have published a draft Conduct of Financial Institutions Act which will be the framework legislation that governs the conduct of insurers and other financial institutions in relation to their customers. The Act will repeal previous acts of parliament that relate to financial institutions and introduce conduct standards which must be complied with. It is anticipated that the conduct standards will mainly be a re-enactment of the existing laws but with special emphasis on treating customers fairly, including in respect of products, premiums, benefits, claims, marketing and complaints management.

The laws relating to intermediary services for financial institutions (currently the Financial Advisory and Intermediary Services Act 2002) will also form part of the new structure and be governed by conduct standards. The emphasis is on ensuring that intermediaries provide intermediary services that are in the best interests of customers. Remuneration is regulated to prevent excessive remuneration prejudicial to customers.

New products

South Africa has a sophisticated insurance market driven by highly competent insurers and brokers who drive innovation. The South African market is moving ahead into the electronic and digital world. There is an increasing number of products available to cover cyber security losses. The Protection of Personal Information Act is due to come into force under which privacy will be protected by statute. The risks of those processing personal information will be increased and they will need insurance backing. Directors and officers insurance is playing a bigger role because of the increasingly onerous obligations on directors, particularly directors of financial institutions.

Insure Tech is a growing focus of attention. There are many young innovative insurance geeks who are bringing ideas into the market. The electronic market for insurance is still relatively small amongst the general South African population.

The standard insurance market is also increasingly relying on the internet to deal with underwriting, premium collection and efficient claims management. For instance, immediate service is being offered to motor claimants.

Political and geographical development

Political developments will affect the insurance market in the year ahead. It is anticipated that there will be a national election in May 2019. Promises will be made in the first half of the year that are not kept in the second half of the year which potentially could lead to more social unrest. Social unrest is generally insured by the South African Special Risks Insurance Association (SASRIA). There are climate changes which are increasing losses. There have been a number of devastating fires in South Africa causing significant but not unmanageable claims.

The economy has slowed down and this has affected the attempts of insurers to get the middle and lower-end market to embrace insurance for personal risks by buying householders and house owners and small business cover. The government’s proposals for land expropriation redistribution has caused a nervousness in the market, particularly the property market. The draft Expropriation Act published in December 2018 makes it clear that this is not going to be an uncontrolled process. However, this remains a major source of uncertainty in the economy and a potential source of conflict.

The onerous regulatory regime coupled with the uncertain economic state of the country is likely to lead to smaller insurers leaving the market or being absorbed by others in the market.

Interaction with the rest of Africa remains the aim of South African insurers many of whom have established branches in countries with compatible insurance regimes and this trend will continue.

Medical malpractice claims

Medical malpractice claims have increased due to claimants becoming more aware of their rights. There is a worldwide trend to institute action where patients suffer complications or die unexpectedly.

A recent study funded by the National Research Foundation and conducted in private healthcare institutions towards the end of 2018 revealed that claims were instituted due to medical complications arising as a result of alleged nursing malpractice.

The study revealed that nearly two thirds of the cases were settled while the remaining cases went to trial. One fifth of the cases resulted in the death of patients. The quality of life of seven out of ten patients was affected. The second phase of the study will focus on nursing malpractice claims in state hospitals where the number of actions instituted are much higher than those instituted in the private healthcare sector.

The study did not involve an investigation into the precise reasons as to why a large number of claims were settled. It must be borne in mind that the majority of cases are settled on a purely commercial basis with a view to avoiding unnecessary costs associated with running a matter to trial in circumstances where it is economically not viable to do so.

Healthcare institutions and professionals are encouraged to mitigate risks by complying with relevant healthcare legislation. Diagnosis and proposed treatment should be communicated to patients in a manner which will enable patients to appreciate the nature of the illness and treatment required. Patients must provide informed consent prior to procedures being carried out and treatment being administered. Healthcare practitioners and institutions must keep abreast of developments and changes in law. Policies and procedures should be reviewed regularly and employees should be given the relevant training in an attempt to reduce the number of claims instituted.

Legalisation of cannabis

The private cultivation, possession and use of cannabis has been legalised in South Africa, following the Constitutional Court’s ruling in Gareth Prince v Minister of Justice Constitutional Development and Others2. This is likely to have an impact on insurers and consumers.

Homeowners will be required to divulge cannabis related activities when taking up homeowners’ insurance or when their policies come up for renewal. Failure to do so could result in detrimental outcomes for homeowners who lodge claims without revealing the required information. Insurers must prepare for risks associated with fire, theft, damage or destruction to cannabis plants cultivated in private dwellings, and ensure that policy wordings are revised.

Cannabis users are likely to see an increase in their motor vehicle insurance premiums irrespective of whether their use of cannabis is for recreational or medical purposes. Driving under the influence of cannabis increases the risks associated with being involved in an accident. It will be difficult to determine whether a motorist is driving under the influence of cannabis, if at all, merely due to the nature of THC which can remain in the bloodstream for more than a month. It is suggested that driving while under the influence of cannabis be strictly prohibited and that insurers implement or review protocols and procedures for determining whether a motorist is under the influence of cannabis or not.

The use of cannabis is likely to affect life insurance premiums unless new legislation is implemented to stipulate how premiums should be determined.

Insurers must ensure that consumers are well-informed regarding the use of cannabis and the implications from an insurance perspective. New innovative products must be developed to deal with cannabis related claims.

United Kingdom

Increasing emphasis upon personal accountability

The UK has gradually introduced increased personal accountability standards that impact not just senior executives but apply to almost everyone working in the financial services sector. The approach to accountability is known as the Senior Managers and Certification Regime (SM&CR). It was introduced for banks in 2018 and was applied to insurance and reinsurance firms on December 10, 2018. The regime is being rolled out to all remaining financial services firms, including insurance intermediaries with effect from December 9, 2019.

The SM&CR requires that senior managers in the business are approved by the Financial Conduct Authority before they take up their role. Whether or not you must be approved will depend upon the particular role in the business, for example Chief Executive or Partner, Chair, Executive Director. These individuals will be given specific responsibilities which are captured in a "Responsibilities Map".

Other staff in the business must be "certified" fit and proper in their role. The firms must review the individuals personal competency and qualifications as well as their character. Certification will take place as part of the annual appraisal process.

Everyone else in the firm, with the exception of staff who cannot pose any risk to customers or the business (such as cleaners, canteen staff, security staff) must comply with a code of conduct.

It is hoped that making individuals responsible for specific aspects of management will improve accountability and personal conduct. In the UK, it is felt that there was insufficient personal accountability in financial services firms leading up to, and immediately after, the financial crisis.

Intermediaries have a lot to do to embed SM&CR into their day to day processes but do have the benefit of seeing how insurers have managed to implement similar procedures ahead of them.

Focus on balance sheet transactions

In the current low yield environment, the need to transfer risk from (re)insurers’ balance sheets is expected to drive (re)insurance undertakings in the UK to pursue various forms of transactions to free up capital, whether through traditional reinsurance or other forms of structured reinsurance such as loss portfolio transfers (in which losses already incurred are ceded to a reinsurer) or less conventional techniques such as transferring risk to capital markets including through ILS structures.