$name

Global | Publication |

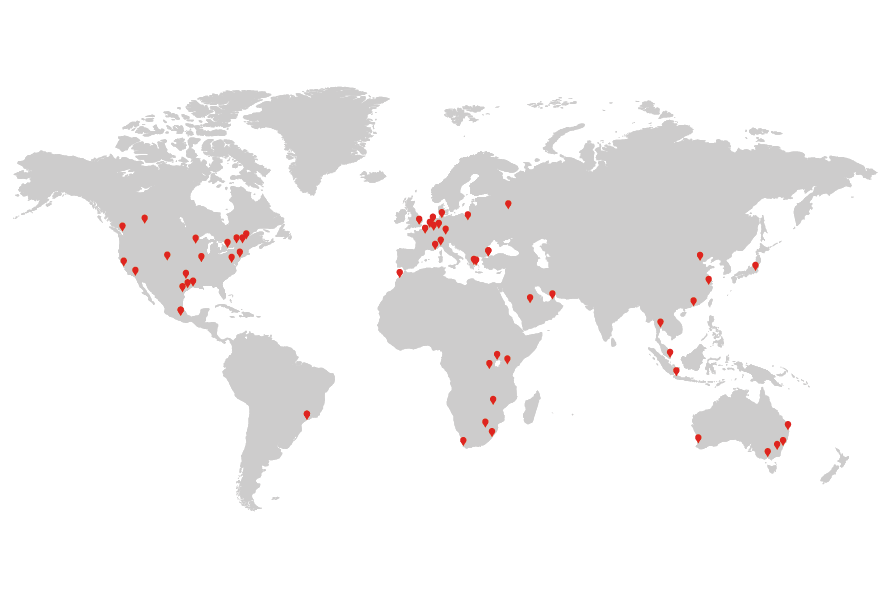

Concluding your acquisitions and divestitures across the globe

Cross-border M&A can be a complex undertaking. Challenges can take the form of opaque local conditions, regulatory concerns, counter-party issues and macro-level risks. We work with our clients to navigate uncertainty and successfully close transactions in markets around the world.

|

7000+ people worldwide |

350+ |

700+ M&A lawyers and legal staff worldwide |

50+ offices |

Cross-border M&A experience

| Barrick Gold Corporation Advised for Barrick Gold Corporation, the Canada-based largest gold mining company in the world, in the take private of Acacia Mining, for US$1.2 billion |

Medidata Advised Medidata, a market-leading clinical cloud solutions company, during its merger with French software company Dassault Systemes in a deal worth US$5.8 billion |

HSBC Advised HSBC as financial adviser to CK Asset Holdings on its £2.7 billion acquisition of Greene King, the UK’s leading integrated pub retailer and brewer |

| Agrium Inc. Advised Agrium (now Nutrien Ltd.) in connection with Agrium’s US$36 billion merger of equals transaction with Potash Corporation of Saskatchewan Inc |

Sumitomo Chemical Company Advised Sumitomo Chemical Company Limited on its A$1.188 billion agreement to purchase Nufarm South American crop protection business in Brazil, Argentina, Colombia and Chile |

Vodafone Hutchinson Australia Advising Vodafone Hutchinson Australia on it’s A$15 billion merger with TPG Telecom, one of the largest M&A deals ever in the Australian telecommunications industry |

|

China Mengniu Dairy Company |

Brookfield Infrastructure Advised Brookfield Infrastructure International and its institutional partners on its acquisition of Enbridge Inc.’s Canadian natural gas gathering and processing business in British Columbia and Alberta for C$4.31 billion |

Rothschild Advised Rothschild and other financial advisors to Melrose Industries on its £8.1 billion hostile offer for GKN |

| Barclays PLC Advised for Barclays Plc on its US$2.8 billion sell-down of Barclays Africa Group Limited, including two accelerated book builds, the largest to be conducted on the Johannesburg Stock Exchange |

Canadian Tire Advised Canadian Tire on its acquisition of Helly Hansen, a leading global brand in sportswear and workwear based in Oslo, Norway for C$985 million |

Varian Medical Systems Inc. Advised Varian Medical Systems in relation to its acquisition of all of the issued shares in ASX listed life sciences company, Sirtex Medical Limited for A$1.58 billion |

| Randgold Resources Limited Advised Randgold Resources Limited in a US$18.3 billion share-for-share merger with Barrick Gold Corporation |

Energizer Group Advised Energizer Group with the acquisition of the global battery business of Spectrum Brands Inc. anchored by the Varta® and Rayovac® brands |

I Squared Capital Advised for I Squared Capital in the US$1.3 billion acquisition of IC Power’s Latin American and Caribbean electric power generation and distribution businesses |

| BMW Advised BMW on a joint venture with Daimler AG to combine their existing global mobility offering in the areas of car sharing, ride-hailing, parking, charging and multimodal forms of transport and involved 19 jurisdictions |

Cenovus Energy Inc. Advised the underwriters on Cenovus Energy Inc’s C$17.7 billion asset acquisition from ConocoPhillips |

Bombardier Inc. Advised Bombardier in connection with an acquisition by CDPQ of US$1.5 billion of convertible shares of Bombardier Transportation (Investment) UK Ltd (BT Holdco) |

Market recognition

Over the past three years Norton Rose Fulbright advised on over 500 M&A deals globally with a total value of over US$235 billion.Mergermarket 2020

Needless to say, their technical abilities, innovation and global reach are second to none. Chambers Global 2019 - Corporate M&A

Well known for its expertise in complex cross-border transactions, including deals in Europe, the Americas and Africa.Chambers UK 2021 – Corporate/M&A

Norton Rose Fulbright has a real ability to provide crossborder support for a range of services including M&A and corporate governance.Legal 500 US 2021 – Corporate/M&A

Norton Rose Fulbright has a real ability to provide crossborder support for a range of services including M&A and corporate governance.Legal 500 US 2021 – Corporate/M&A

A strong practice, with the global nature of the firm giving it good links across the world.Legal 500 UK 2020 – Corporate/M&A

Bench strength, international reach, responsiveness, and commitment to clients.Chambers Canada 2020 – Corporate/M&A

A strong practice, with the global nature of the firm giving it good links across the world.Legal 500 UK 2020 – Corporate/M&A

Well placed to take on crossborder mandates for highprofile clients.

They are culturally sensitive and have a deep appreciation of ensuring cultural differences are bridged and well understood by the client.Chambers Asia-Pacific 2021 – Corporate/M&A

One of the top five US corporate firms in providing international legal services.Americas Top Corporate Law Firms, Forbes 2019

Top 10 global elite brand leaderAcritas Sharplegal, Global Elite Brand Index 2015-2020

Subscribe and stay up to date with the latest legal news, information and events . . .