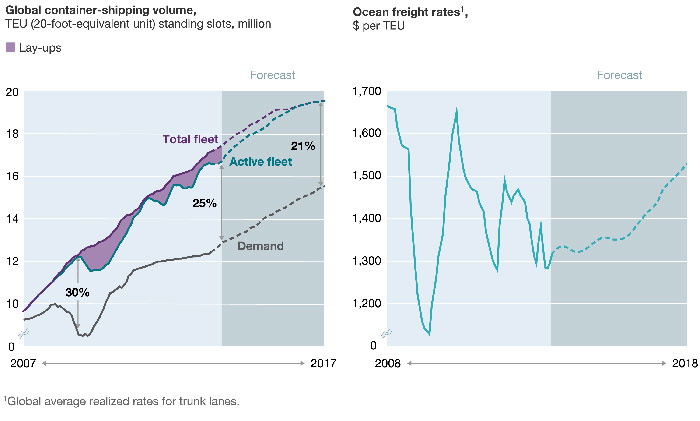

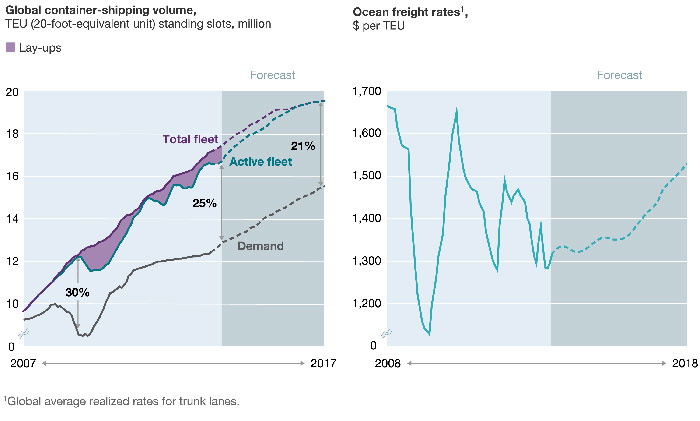

Cooperative arrangements have long been a feature in liner shipping – from liner conferences (i.e. arrangements between carriers enabling them to use common freight rates and agree capacity) to liner consortia (i.e. ship and capacity sharing agreements, and schedule coordination) – although regulatory approval of such cooperation has been subject to market share caps.1 Consortia arrangements have allowed the development of the current big four global liner alliances (2M, O3, G6, and CKYHE) without the need for fully-integrated mergers. However, while such alliances have allowed some stability in terms of liner capacity meeting global shipping demand, freight rates have continued to fluctuate wildly (see Fig 1), causing problems for certain lines – with the recent Hanjin insolvency a case in point.

Global container shipping volumes and average freight rates

Competition authorities have recognised the benefits of cooperation to ensure stability given the high fixed costs, large initial capital investments – and implications for global trade of disruption to shipping supply. However, the European Commission has been clear that competitors sharing strategic information, particularly intended future prices, is a serious breach of competition law.2

Under EU competition law rules, concerted practices which have as their object or effect the prevention, restriction or distortion of competition are unlawful – and this includes practices which reduce “strategic uncertainty”, as these can reduce lines’ incentives to compete against each other. However, there is a significant difference between lines communicating and coordinating intended price increases directly, and genuinely public price adjustment announcements intended to give customers notice of impending changes, e.g. through a newspaper. Public announcements will generally not constitute collusion, but what if there is evidence that the overriding intent in making these announcements was to “price signal” to competitors? If an announcement is followed by similar public announcements made by other competitors, could these be considered evidence of a collusive strategy? Is it illegal to follow the market leader on price? These questions were considered by the Commission in its investigation.3