Taiga Motors closes complex private placement of secured convertible debentures

Canada | April 03, 2023

Client: Taiga Motors Corporation

Our Montreal office advised Taiga Motors Corporation on a private placement of 10% secured convertible debentures maturing on March 31, 2028 in an aggregate principal amount of up to C$50.15m, consisting of an initial closing of C$40.15m of debentures and the investors having been granted an option to acquire an additional C$10m of debentures. The transaction is one of the largest private placements made in reliance on the financial hardship exemption of the Toronto Stock Exchange in recent history, which allowed the transaction to proceed without shareholder approval. The investors, being Northern Private Capital Ltd. (NPC), an existing 10%+ shareholder and related party of Taiga, and Investissement Québec, acquired significant Board representation rights, while NPC also acquired pre-emptive rights on a go-forward basis.

The private placement represented the culmination of an extensive review of various options and alternatives by Taiga, which resulted in the formation of a special committee of independent members of the board of directors to oversee the process. In the view of the Special Committee and the Board, the private placement will provide the Company with an improved financial footing going forward.

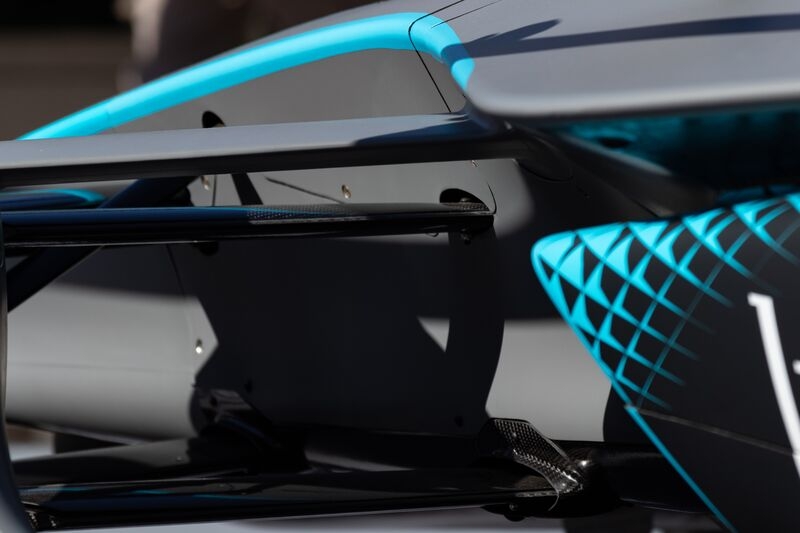

Taiga is a Canadian company reinventing the powersports landscape with breakthrough electric off-road vehicles. Through a clean-sheet engineering approach, Taiga has pushed the frontiers of electric technology to achieve extreme power-to-weight ratios and thermal specifications required to outperform comparable high-performance combustion powersports vehicles.