Event

2025 Insurathon: Pitch to win £50,000 of investment and pro bono UK legal advice

The Insurathon is a Norton Rose Fulbright event which fosters technological advancements and innovation in the insurance sector, now in its eighth year.

Author:

Australia | Publication | September 2021

This article was co-authored with Amelia Martin.

A further step towards enacting the Consumer Data Right (CDR) in the energy sector is being taken, with further detail now revealed on how data sharing amongst energy retailers and the Australian Energy Market Operator (AEMO) will occur.

Treasury has recently released how it proposes to implement the CDR in the energy sector. Last year we alerted industry participants of the Treasury’s consultation process for the draft designation instrument to extend the CDR to the energy sector. On 30 June 2020, the final designation instrument came into effect, specifying the energy data holders and data caught by CDR obligations.

On 17 August 2021, Treasury released the Exposure Draft of the Competition and Consumer (Consumer Data Right) Amendment Rules (No. 2) 2021 (Cth) (version 4) (Proposed Rules), which can be found here. This establishes a peer-to-peer (P2P) data access model for the energy sector, where energy retailers assume responsibility for disclosing all CDR data to accredited data recipients for their eligible consumers, including by obtaining data from AEMO.

Whilst a “gateway model” spearheaded by AEMO was previously favoured for the energy industry, the P2P model determines that the primary responsibility to enable data sharing for consumers ultimately falls to energy retailers, but with heavy involvement by AEMO.

Under the P2P model, energy retailers, as primary data holders, are responsible for responding to CDR requests. This responsibility extends to not only facilitating the disclosure of CDR data in accordance with the Proposed Rules, but also complying with the data standards and privacy safeguards, which set out obligations to:

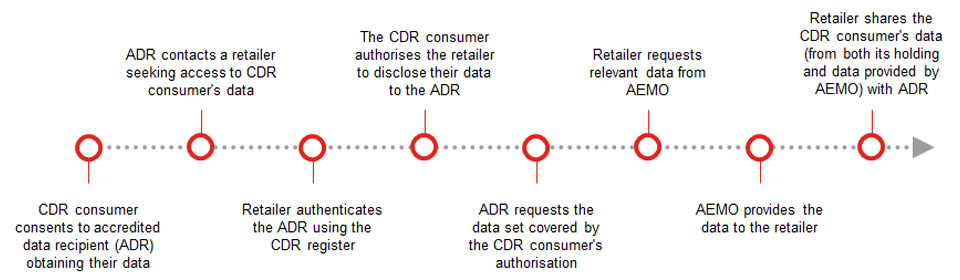

We illustrate the CDR data flow in the P2P model for the energy sector below.

This means that where a retailer (as primary data holder) receives a CDR request that captures data held by AEMO1 (being the secondary data holder), the retailer must request the data from AEMO. Although potentially burdensome, the Proposed Rules require that retailers request any responsive data from AEMO, even where the retailer already holds the data themselves.

A retailer is a data holder of energy sector data where it:

A CDR consumer must be:

There are two categories of energy sector data that retailers have responsibility for disclosing – required consumer data and voluntary consumer data, which include as follows:

| Required Consumer Data | Voluntary Consumer Data |

|

|

These definitions of required and voluntary consumer data build upon and provide detail of the broader classes of information specified in the designation instrument for the energy sector.

The application of the Proposed Rules to the energy sector will be implemented in two stages. The first stage is proposed to commence on 1 October 2022, from which time certain participants, including retailers AGL Energy Group, Origin Energy Group and Energy Australia Group, will be required to comply with CDR obligations. It is proposed other retailers will need to comply with these obligations 12 months after the commencement of the first stage.

Treasury has opened the Proposed Rules for consultation until 13 September 2021 and interested parties can make submissions up until that date.

Energy retailers that will be caught by CDR obligations under the Proposed Rules should evaluate their ability to comply with these obligations having regard to their data retention policies and the technological capabilities of their systems.

Event

The Insurathon is a Norton Rose Fulbright event which fosters technological advancements and innovation in the insurance sector, now in its eighth year.

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2025