Event

2025 Insurathon: Pitch to win £50,000 of investment and pro bono UK legal advice

The Insurathon is a Norton Rose Fulbright event which fosters technological advancements and innovation in the insurance sector, now in its eighth year.

Global | Publication | May 2019

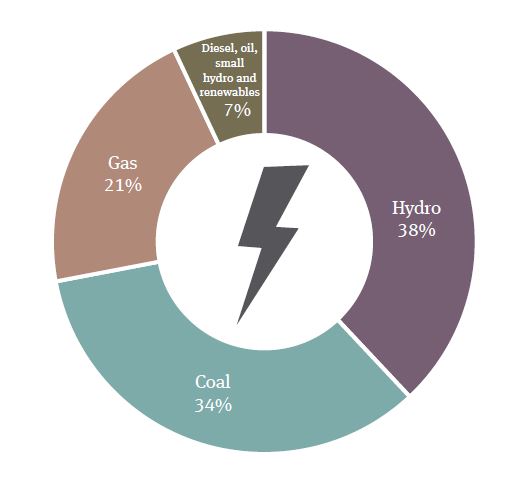

In March 2016 the Vietnamese Government issued the revised National Power Development Plan for 2011 to 2020 (known as the Power Master Plan VII). The Government has targeted that renewable energy will account for 9.9 per cent of installed capacity by 2020 and 21 per cent by 2030 as well as accounting for 7 per cent of Vietnam’s electricity production by 2020 and 10 per cent by 2030.

Wind, solar, small hydro, biomass. Small hydro makes up the majority of current renewable investment in Vietnam, but solar and wind are expected to dominate new investment.

Vietnam currently has approximately 870MW of grid connected solar projects. Reports suggest that as much as 7GW of new solar capacity has been approved and an additional 13GW awaits approval. The Government expects 2GW of solar capacity to come online by 2019, but critics doubt that this target will be achieved. Many projects are behind schedule and have not yet secured financing.

Electricity Vietnam (EVN) is the state-owned electricity utility and the sole buyer of electricity generated from renewable sources.

The Government plans to implement a competitive power market, which is intended to be implemented at the wholesale level by 2021 and at the retail level by 2023.

Consumers are allowed to own and operate power generation facilities for their own use and may sell excess power to EVN.

Sale of power direct to consumers is not currently permitted but the Vietnamese Government is planning to pilot a direct power purchase agreement (DPPA) for renewable energy in 2019. The DPPA will permit the sale of electricity from generators direct to consumers. Reports suggest that this might be in the form of a synthetic PPA, with 100 per cent of the power output to be sold through the market.

To date, projects have been procured under a feed-in tariff (FiT) scheme. However, based on Decision No. 39/2018/QD-TTg of the Prime Minister dated September 10, 2018, the Ministry of Industry and Trade (MOIT) is required to submit a policy introducing an auction process for the selection of new wind power projects and tariffs from November 1, 2021 onwards. This policy has not yet been released.

Before developers are permitted to proceed with solar projects, the project must be included within the relevant power development plan, namely the national master plan on solar power development, the approved national power development master plan, a provincial master plan on solar power development or a provincial power development master plan. MOIT has the authority to approve additions to such master plans for any solar power project with capacity of 50MW or less. For projects with capacity of greater than 50MW, MOIT must submit the project to the Prime Minister for approval and inclusion within the applicable plan.

Applicable incentives include

The current Vietnam Renewable Energy Development Strategy suggests further incentives may be introduced including a Renewable Portfolio Standard (RPS). This is expected to mandate that large power generation and distribution companies must source at least 3 per cent of their energy output from renewable sources by 2020, 10 per cent by 2030 and 20 per cent by 2050.

EVN must purchase all power generated by renewable energy projects at the 20-year FiT set by law.

The current FiTs are as follows:

On April 12, 2019, MOIT issued the third draft of a Decision by the Prime Minister in respect of solar power projects (Draft Decision). The Draft Decision proposes a new tariff structure for solar power projects achieving COD between July 1, 2019 and December 31, 2021 and applies for a 20-year period. The FiT varies based on the geographic region in which the project is situated with areas of lower irradiation receiving a higher FiT. The Draft Decision also introduces three project types, with the FiT varying based on assumed variable projects costs. The three project types are as follows:

Based on the region and project type, the proposed FiT ranges from 6.67 US cents/kWh to 10.87 US cents/kWh.

The FiT remains fixed for 20 years and is not indexed for inflation.

The FiT is denominated and paid for in Vietnamese dong but is adjusted for the Vietnamese dong / US dollar exchange rate announced by the State Bank of Vietnam on the invoice date. Availability of US dollars is not guaranteed.

On January 8, 2019, the Prime Minister issued Decision No. 02/2019/QD-TTg (Decision No. 2) revising the rooftop solar tariff scheme. Prior to Decision No.2 rooftop solar installations benefitted from a net-metering scheme. That has now given way to a scheme which separates import and export of electricity. Consumers are required to pay for power imported from the grid in accordance with the existing regulations on EVN retail tariffs.

On March 20, 2019, MOIT revised retail tariff rates, which includes a variation between industrial, commercial and residential consumers, voltages and peak/off peak hours.

Those consumers who generate power from solar rooftop installations must sell the power to EVN who pays for such power on monthly basis and at the rooftop solar tariff prescribed by MOIT. From July 1, 2019 the tariff for rooftop solar projects will vary by region based on solar irradiance levels.

On March 11, 2019, MOIT issued Circular No. 05/2019/TT-BCT (Circular No. 5) on rooftop solar projects. Circular No. 5 provides a new simplified model form of PPA for the sale of energy derived from rooftop solar projects to EVN and totally cancels the net-metering structure which combining of sale/purchase of power between the parties with effect from April 25, 2019. While the PPA makes a number of clarifications and anticipated improvements in the timing of payment, many of the risks identified by international lenders still remain.

Prior to Circular No.5, there was uncertainty in regard to the tax that applied to payments for the net energy produced from solar rooftop facilities. This uncertainty had stalled payments to generators. It was hoped that Circular 5 would clarify these uncertainties without the need for further guidance from the Ministry of Finance, but that does not yet appear to be the case.

Foreign investors can own up to 100 per cent of the equity in renewable projects.

In case of solar power projects, investors are required to maintain an equity ratio of at least 20 per cent of the total investment. The period over which the 20 per cent must be maintained is not clearly specified, but in practice tends to be the duration of the project. This limitation was recently removed for wind projects.

There has been limited lending from international banks given the bankability challenges in relation to the PPA for renewable projects. Existing lenders to renewable projects include:

The 33MW Huong Linh one wind farm achieved financial close in late 2018 based on a structured finance solution involving a local bank guarantee granted to an offshore bank, who in turn received a further guarantee from the Danish Export Credit Agency, EKF. This structure opens possibilities for future financings.

The MOIT has issued model forms of PPA for small hydro, wind, biomass, waste-to-energy and solar.

By way of Circular No. 02/2019/TT-BCT of MOIT regulating the implementation and development of wind power projects and a model power purchase agreement for wind power projects (Circular No. 2), MOIT released the final form of the wind PPA effective from February 28, 2019. Circular No. 2 also includes the procedural steps for developers to follow in order to secure a PPA with EVN.

The model solar PPA is expected to be amended and released within the next few months.

Parties may agree on limited clarifications to the model PPA but they cannot vary its basic contents, which are mandatory.

The feedback on the model PPA has been negative with many taking the view that it is unbankable from the perspective of international lenders. The key concerns are discussed below.

20 years.

To realise Vietnam’s ambitious renewable energy targets, the transmission and distribution network will require significant upgrade.

Developers are responsible for transmission and grid connection costs up to the designated point of interconnection. The developer is required to execute a separate grid connection agreement in addition to the PPA.

Renewable energy PPAs do not contain deemed commissioning provisions.

The model PPA does not contain deemed generation payments. In other words, the generator takes the risk for grid outages and political force majeure.

The risk of grid failure has been a key concern for developers. The new model wind PPA attempts to address this issue. EVN is obliged to minimise grid interruptions and must provide the generator with at least ten days' notice of the proposed interruption. Any such interruption should be "in conformity with the regulations on operation of the national power system, the regulations on the process of handling breakdowns in the national power systems and the power industry technical regulations and standards". Unfortunately, the model PPA does not go so far as to specify the relief to the generator if these requirements are not met.

EVN pays for energy delivered. There is no take-or-pay obligation or minimum purchase guarantee. EVN can curtail generation with no financial penalty.

The model PPA does not contain change in law stabilisation provisions. However, the Investment Law provides general assurances in regard to changes in law.

Usually, where the generator terminates the PPA for breach by EVN, compensation is limited to the value of electricity generated during the previous year.

This approach was modified in the new wind PPA effective from February 28, 2019, which provides restitution and expectancy damages, albeit in simplified terms. This is a positive development in that the limitation on EVN’s liability has been removed, but generators have the burden of proving the losses claimed.

If the duration of the force majeure event continues for one year, either party has the right to issue a 60 day breach notice. If the recipient party cannot remedy within the 60 days, then the notifying party may unilaterally terminate the PPA.

The generator is not entitled to a termination payment if the PPA terminates due to prolonged force majeure.

The PPA is governed by Vietnamese law.

Disputes under the PPA can be submitted to the Electricity Renewable Energy Department for mediation. If unresolved, the dispute may be escalated to the Electricity Regulatory Authority of Vietnam, the results of which are appealable to Vietnamese courts.

The model PPA allows the possibility of the parties agreeing another dispute resolution body. Recent solar PPAs have included the option for a party to select arbitration at the Vietnam International Arbitration Centre.

There is no government guarantee of EVN’s obligations under the PPA. Circular 16 precludes projects enjoying the FiT from other price support mechanisms. EVN’s creditworthiness and currency convertibility has been a key issue for prior projects.

Key challenges:

We gratefully acknowledge the assistance provided by DFDL, Vietnamese legal counsel.

Angus Mitchell

Partner; Head of Energy, Mining and Infrastructure Practice Group

angus.mitchell@dfdl.com

Dave Seibert

Senior legal adviser

dave.seibert@dfdl.com

Event

The Insurathon is a Norton Rose Fulbright event which fosters technological advancements and innovation in the insurance sector, now in its eighth year.

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2025