Event

2025 Insurathon: Pitch to win £50,000 of investment and pro bono UK legal advice

The Insurathon is a Norton Rose Fulbright event which fosters technological advancements and innovation in the insurance sector, now in its eighth year.

Global | Publication | January 2018

The IT world recently became excited by a new technology, called blockchains or distributed ledgers. The underlying technology was invented in 2008 to support the creation of the electronic currency, Bitcoin. Since then, people have seen potential for many applications for this technology, particularly in information-intensive industries. Consequently, consortia in several industries have been announced, including banking (R3 Consortium), insurance (B3i), and aviation (BC4A, led by Lufthansa).

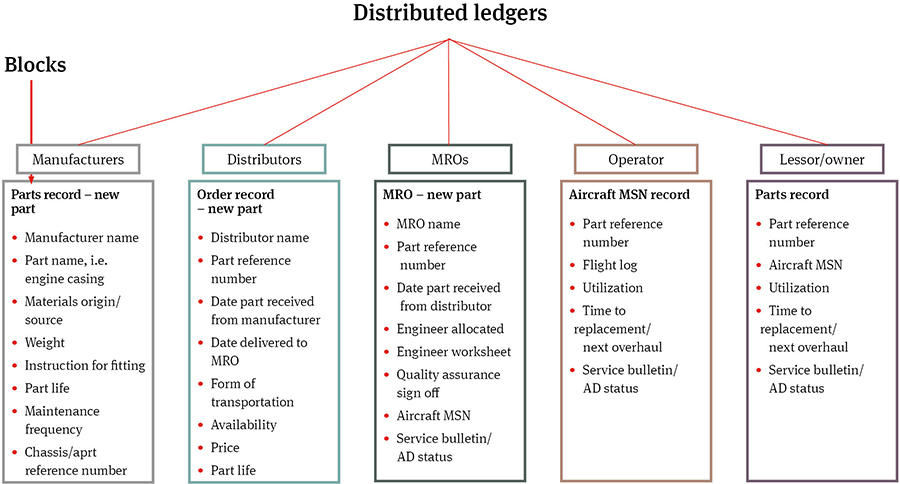

A shared or synchronized ledger is a shared database, fully replicated at multiple autonomous sites, and without anyone having central control. If any site wishes to update the database, it needs to follow an agreed multi-site decision-protocol. A blockchain is a special type of distributed ledger, where the data is collated into “blocks” before being added to the shared database, and the blocks combine to form a single sequential chain.

The excitement arises because distributed ledger technology (DLT) enables different organizations to share data in a database so that no one participant has control. Before DLT, database integrity would have only been possible by having a trusted third party control it. DLT ensures integrity by having a strict protocol for updating the database involving approval from the other participants.

Several different types of applications have emerged for DLT, including:

For many of the above applications the tasks involved can be automated, and the respective computer programs could themselves sit on a blockchain. An example would be a program which automatically pre-orders new parts when parts reach their end-of-life. Such programs are called “smart contracts”, although they do not usually incorporate any artificial intelligence.

In aviation, there are several potential applications:

If these blockchain registers were in place, then the automated scheduling of service checks and maintenance activities could also be facilitated, through the use of smart contracts. For example, the maintenance interval of certain parts can vary depending on the type of operation (e.g. high cycle, low hours) or operating environment (e.g. hot and harsh). A blockchain register combining parts installation, service history and utilization could not only support this automation for particular parts but this data could be used by an operator to optimize the serviceable life of such parts.

If such a collection of blockchains were in place, then other applications could easily present themselves. For instance, assessment of the provenance of specific aircraft and parts may greatly facilitate compliance with sanctions regulations.

Figure 1: Aircraft parts blockchain

Distributed ledger technologies still face many challenges before realizing their potential. Among these, the key technical issue is scalability. Initial use cases involve small numbers of transactions. This challenge will eventually be solved, although perhaps not for a decade. A second challenge concerns security and privacy. Blockchain was designed for a public system (Bitcoin) and its openness is inappropriate for applications internal to companies or between companies. Designing applications where the participants share only the data in common is still a design challenge for DLT projects. A final technical challenge is that the technology is still immature. Programming tools are inadequate, the technology still has constraints and the landscape is in flux.

There are also organizational challenges. Many use cases require collaboration between different organizations, e.g., along a supply chain. The first issue here is anti-collusion laws that exist in many countries. With appropriate legal advice, it is usually possible to collaborate without breaching these laws. A second organizational challenge is that of reaching stakeholder agreement. Even along a single supply chain, the companies involved may have conflicting interests, so designing a system to satisfy these interests can be difficult. The best approach is to start any DLT collaboration small, and to experiment with proofs-of-concept. Participants should first agree the goals of the collaboration, how any experiments will be evaluated, and the ownership of intellectual property.

Blockchain technologies have considerable potential in the aviation industry, with benefits in terms of greater efficiencies, new market and business opportunities, and easier regulatory compliance. Before benefits can be realized, significant technical and organizational challenges will have to be met through inter-company collaborations across the aviation industry. Undertaking these is an exciting prospect for anyone in the industry.

Event

The Insurathon is a Norton Rose Fulbright event which fosters technological advancements and innovation in the insurance sector, now in its eighth year.

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2025