Publication

Distress signals – Cooperation agreements or mergers to the rescue in times of crisis?

The current volatile and unpredictable economic climate creates challenges for businesses.

Global | Publication | October 2017

This article was originally published in PV Tech Power.

The heaving up of the drawbridge for new entrants to the UK’s Renewables Obligation (RO) scheme at the end of March signified another milestone in a global trend of shrinking government incentives for utility scale renewable energy projects. The end of the RO scheme will be followed by the phasing down of production tax credits and investment tax credits that have galvanized the US clean energy market in recent times. Removal or tightening of government support for the solar PV sector is a worldwide paradigm driven by a number of conspiring factors including economic uncertainty, low fossil fuel prices, a significant reduction in the levelised cost of solar PV energy and the success of competitive auction procurement as a method to drive down and achieve record-breaking low tariffs.

But with increasing pressure to reduce their carbon footprint, private sector companies have not stood idly by while governments ice direct support for the decarbonisation of national grid networks. Corporate and institutional electricity customers in jurisdictions around the world have together taken meaningful action to develop their own contractual structures and financial products to pursue strategic and commercial sustainability priorities and to “future-ready” themselves for the disruption affecting the energy sector. More than 40% of Fortune 500 Companies and at least 60% of Fortune 100 companies now have targets relating to renewable energy procurement, energy efficiency or cutting GHG emissions1 . The Corporate Renewable Energy Buyer’s Principles have been established to promote collaboration amongst 62 major companies when buying renewable energy. Similarly the RE100, a club of 89 of the world’s most influential businesses each committed to procure 100% renewable energy, is an example of how the private sector is working to increase the demand for, and delivery of, renewable energy. Last year, Google, a member of RE100, confirmed that it would reach 100% renewable energy coverage of its global operations in 20172. The likes of Google, Apple, Facebook and Amazon are leading the charge, however more corporate giants continue to join the movement such as Anheuser-Busch InBev who signed up in March this year with a commitment to secure 100% of its electricity (amounting to about 6 teraWatt-hours of electricity per year)3 from renewable sources by 2025.

Corporate sustainability strategies to decarbonize can involve purchasing renewable energy certificates or procuring green tariffs from utilities (if available), but companies are also looking for tangible ways to demonstrate their environmental commitment and to achieve some “additionality” by bringing new renewable energy projects online.

Captive projects can be on-site as a primary or back up source of power to mines, processing plants, warehouses, data centres, offices or shopping malls for example. In such cases, the buyer will purchase the power generated by the plant under a “behind-the-meter” power purchase agreement negotiated bilaterally with the seller. They can be built as hybrids in conjunction with conventional power engines and in some jurisdictions it may also be possible to sell on excess power that is not required by the buyer to the utility through net-metering arrangements. Target, the US department store, is currently the top installer of solar power in the US with 147MW installed across 300 stores4.

Such on-site, off-grid solar PV projects are also popular in many sun-drenched developing countries where businesses and communities are beleaguered by scheduled load shedding, unexpected blackouts, electricity price hikes, forced load curtailment or simply no local access to the national grid. Distributed generation, on-site with a reliable connection can provide cheap and clean power for the buyers; and for the developer, the negotiated tariffs are invariably better than those being secured under state procurement programs at the moment. Take for example Zambia, where policy support and low-cost finance has achieved solar PV PPA tariffs as low as USD 0.06/kWh with ZESCO.

Projects however do not need to be built on the same site as the load nor do they need to be connected to the same grid network. An alternative model that is experiencing a significant uptick in popularity, particularly in developed and deregulated markets, is the corporate power purchase agreement (corporate PPA) where companies are able to buy power from off-site centralized renewable energy projects and can claim additionality by demonstrating that the viability for the project would not have existed but for the revenue stream provided under the corporate PPA. In a Corporate Eco Forum survey conducted in 2015, the vast majority of respondents in the United States listed off-site corporate PPAs as their top policy priority with respect to renewable energy procurement. The corporate PPA, the drivers behind it and the contractual structures that are developing are the focus for this article.

5A corporate PPA is a contract governing the purchase by a corporate buyer of all or part of the energy produced by an off-site renewable energy project built, owned and/or operated by an independent or affiliated entity. The term corporate PPA actually umbrellas a number of financial and contractual structures that have evolved to promote the bilateral purchase of power between a private seller of power and a private buyer (typically across utility wires). As the negotiations are between two commercial parties and not with state-owned utilities with standardized processes and documentation, there is a great deal of flexibility and creative opportunity when structuring a corporate PPA transaction. Each will have been molded to fit the corporate buyer’s commercial strategy and any subsidies or other state support for renewable energy as well as regulatory requirements for “transporting” power across utility wires. In the last few years the corporate PPA market has been developing increasingly sophisticated models that take account of the different conditions affecting different markets around the world. For the purposes of this article we have boiled the different models down into broadly two types: synthetic / virtual PPAs and sleeved or physical PPAs.

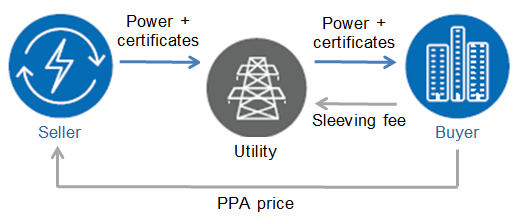

Sleeved PPA structure (example with renewable certificates)

Source: ‘Corporate Renewable Power Purchase Agreements: Scaling up Globally’ A report produced by World Business Council for Sustainable Development (WBCSD), in conjunction with Norton Rose Fulbright and EY

A “sleeved” or “physical” PPA (typically but not always) involves a direct PPA between the corporate buyer and the seller where the power plant is on the same grid network as the buyer’s offtake point and the renewable energy being generated is, notionally, directed to the corporate buyer. Hence the reference to “sleeving”. In this arrangement the buyer appoints a licensed utility to physically deliver power on its behalf in return for a fee. In some markets, such as the UK, this will typically involve two PPAs: one with the seller; and the second with the utility acting as the buyer’s agent for the management of power delivered by the generator, scheduling and balancing services. Other approaches are available though. For example, in the Netherlands, a number of corporate energy buyers actively manage their energy deliveries from the wholesale market whilst having a single corporate PPA with a generator.

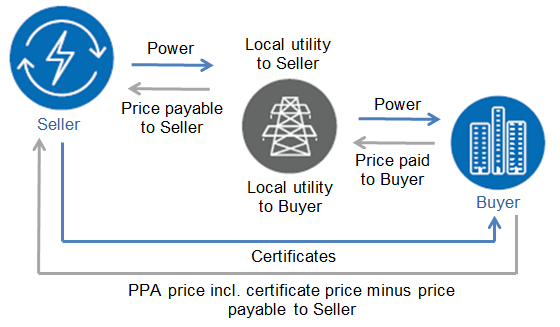

Synthetic PPA structure (example with renewable certificates)

Source: ‘Corporate Renewable Power Purchase Agreements: Scaling up Globally’ A report produced by World Business Council for Sustainable Development (WBCSD), in conjunction with Norton Rose Fulbright and EY

“Synthetic” or “virtual” PPAs are actually a financial derivative product under which the parties agree a strike price, with payment flows between the corporate buyer and the seller determined by comparing the strike price against a market reference price. There is no “sleeved” delivery of power to the buyer. In fact, unlike the sleeved PPA the seller and the buyer do not need to be connected to the same grid network (or even to be located in the same country, cross-border synthetic PPAs are some of the most innovative products being developed in the market at the time of writing). When signed for a 10 or 15 year (or longer) term, in effect they act as a long-term power price hedge and there is a wide variety of possible structures that can be adopted. As a contract for difference, if the market reference price is higher than the strike price, the seller pays the difference to the buyer. If the market reference price is lower than the strike price, the buyer pays the difference to the seller. The volume contracted can be specified in a variety of ways and need not be tied to the actual generation of the project. Synthetic PPAs can also incorporate call, put or collar options on pricing which gives the corporate buyer the opportunity to buy the right to purchase renewable energy at a certain strike price (a call) or the seller the right to sell to the buyer at a certain price (a put).

Under a corporate PPA however, there is of course no physical delivery of the power to the buyer. The connection with the power’s clean source is further severed under a synthetic PPA and the intangible nature of the transaction can raise challenges for the corporate buyer who is relying on the arrangement to support its credible environmental, reporting and marketing claims. Therefore, where available, the transaction will also include the transfer to the buyer of renewable energy certificates or “Guarantees of Origin” (in Europe) awarded to the project and/or purchased from the wider market (allowing the seller to sell the certificates issued to it). These certificates will be recorded by the buyer as evidence of the supply and use of renewable electricity and in satisfaction of the renewable portfolio commitments and the environmental impact disclosures that it has to make.

We see the following as the main drivers behind the success of corporate PPAs:

From the buyer’s side a long term corporate PPA can provide a hedge for companies against future fuel and power price volatility. Locking in or capping power prices in this way provides useful visibility over the company’s future electricity costs, particularly where uncertainty in the carbon pricing market is present.

From the seller side, a corporate buyer represents an attractive opportunity to diversify asset income streams away from traditional utility offtakers. In these uncertain times, particularly where subsidy support for renewable energy is shrinking and/or future policy is uncertain, a corporate buyer with a good tariff offers a solution that may unlock finance for a renewable energy project that perhaps would not have otherwise been accessible if the project was reliant on a single utility or risky merchant market for its long term revenue stream.

Since the COP21 summit and the adoption of Sustainability Development Goals in 2015, businesses are under increasing pressure worldwide to reduce their carbon footprint. Sourcing power from renewable projects through a corporate PPA is one extremely effective way of achieving corporate responsibility and environmental goals, decarbonisation targets and creating additionality as a core part of their sustainability strategy for the future. Against government regulations and environmental commitments, a corporate PPA can be a valuable tool for demonstrating the company’s progress towards sustainability goals related to greenhouse gas emissions reduction and renewable energy consumption. For many companies, direct procurement of renewable energy is a way to connect with an environmentally conscious customer base and, for those companies suffering from criticisms of their own labour and other market practices, it can act as a good distraction.

A corporate PPA also allows a corporate buyer to diversify its energy supply sources across multiple technologies and contractual structures to protect against energy availability concerns. It also allows companies to develop partnerships with a new pool of reliable and experienced counterparties and potentially to access regional development funding. From the seller’s perspective, it allows for diversification of revenue streams away from traditional utility offtakers and the potential to develop an investment pipeline in new and emerging markets that may not have otherwise been possible.

In general, buyers are robust and creditworthy companies and so corporate PPAs may allow sellers to access development financing and a lower cost of debt as well as streamline their own development costs through the production of standard terms and conditions for the PPA, construction and O&M documentation (rather than adopting the government or utility standard procurement documentation that will be different in every jurisdiction).

It would be remiss, however, not to mention the challenges that corporate buyers and sellers will encounter when venturing into this complex market for the first time.

On the buyer side this may be entirely uncharted territory. This may be the first time a renewable energy procurement strategy has been considered and will require due diligence into the following issues: the local regulatory landscape; the attitude of policy-makers (current and future); competition restrictions and utility protectionism; long-term power price forecasts; and the various counterparties and projects available in the market with whom a suitable partnership can be struck. Having considered all of the above, the buyer must build a strategy around its own anticipated energy demand during the term of any corporate PPA. Solar power is of course intermittent, therefore if a sleeved corporate PPA is chosen, a utility must be found that can provide services to manage the scheduling and balancing risks for an acceptable fee. There are also accounting implications of entering into a long term corporate PPA which can, depending on the structure and wording, be categorised as a lease under the International Financial Reporting Standards. The effect of this may require the corporate PPA to be recorded as a liability on the buyer’s balance sheet which can impact gearing ratios, debt covenants or other KPI’s.

For sellers there are also difficulties to be faced. Finding a suitable buyer counterparty may be easier said than done. There is a relatively small (but growing) pool of corporate buyers, finding one with a strong enough credit rating or ability to provide credit enhancements such as letters of credit or corporate guarantees, is fundamental to the bankability of the project. In fact the lenders’ and buyer’s interests are often not aligned and one of the developer’s main tasks is to find a structure and terms that work for all. Fixing a long-term tariff is naturally a risk for the seller too as unforeseen changes in the cost of a developing a project (e.g. delay, change in law, currency fluctuations) can eat into the revenue required by lenders and shareholders. Sellers will also need to have a deep understanding of the market and the applicable regulatory framework, for first movers in emerging and uncertain markets this can be risky and so careful due diligence must be undertaken.

In some markets, financing large-scale energy project development has been hampered in recent years by the effect of global financial crises, Basel III restrictions and political and regulatory uncertainty. Traditional limited recourse project finance debt tenors are typically 15 years or more. But long term equals high risk, and as a result some international commercial banks in certain jurisdictions have, at least temporarily, cooled off their appetite for long term debt and started to interrogate project economics more carefully.

Financing options have evolved to address this, a good example is the emergence of mini-perm financing as used on the recently awarded 1.1GW ADWEA Sweihan Solar PV project in Abu Dhabi. A mini-perm loan typically involves a shorter tenor of 7 to 10 years covering both construction and a period post completion with a requirement on the borrower to refinance prior to maturity to avoid an event of default, aka a “hard” mini-perm. A “soft” mini-perm may have a longer tenor but incentivises the borrower to refinance earlier on by increasing margins and applying a cash sweep in the mid-term. This puts some risk on the developer to predict the availability of favourable refinancing terms in the future before the ratchets and cash sweep are applied. A long term corporate PPA with a good tariff and strong corporate buyer(s) may work well with a mini-perm and could be structured to offer very attractive conditions for refinancing at the appropriate time.

Project bonds are another financing vehicle that developers and corporate buyers should consider when structuring partnerships and projects around a corporate PPA. Green bond issuance, particularly from the private sector, has grown rapidly (perhaps as a result of subdued appetite for traditional project finance in certain markets) in recent years. The pursuit of the private sector for climate conscious and responsible investment; the availability of robust corporate buyers offering a creditworthy, fixed revenue stream; and the (flex)ability to structure a green bond to maximise the environmental and sustainability benefits for corporate and institutional investors, makes bond financing an interesting option for forward-thinking companies looking to invest in or refinance solar PV projects with corporate PPAs.

Despite the shrinking subsidies, the falling costs of solar power and increasing pressure on companies to decarbonise (and to tell the world that they are doing so) means that corporate appetite for solar power investment will continue to grow using the methods described and undoubtedly through innovation of fresh and novel transaction models. The shifting market towards distributed generation in both developed and developing economies and the combination of solar PV with other technologies including the biggest disruptor in this sector, battery storage, will create new opportunities for tie-ups under corporate PPAs in jurisdictions where this was previously not possible.

A good example of recent innovation is the emergence of multiple buyer structures. A corporate buyer with low energy demand, little experience and/or a poor credit profile will have minimal bargaining power with a developer of a solar PV project. A club of such buyers however, by aggregating their demand and their balance sheets, present a very different counterparty risk profile to a potential seller and their lenders. Approaches using this model can involve multiple PPAs with different buyers for a single project, or the development of a buying group that will enter into a single PPA for the benefit of all members. In the case of the latter, these buyer clubs can offer a great deal more flexibility with the option for individual buyers to opt in and opt out (subject to appropriate controls and fees) during the term. In March we saw financial close for the Krammer 102MW onshore wind park in the Netherlands where Google, AkzoNobel, DSM and Phillips joined forces as buyers from the plant developed to power their Dutch operations. Even more recently, the South Australian Chamber of Mines and Energy (SACOME) won approval from the Australian Competition and Consumer Commission for 19 big industrial users to band together to negotiate low-cost long-term electricity contracts with renewable energy generators, having tired of the price hikes and short-term contracts offered by the state’s retail oligopoly.

What is clear is that in the face of these developments, utilities will also have to innovate to avoid being left behind. The success of corporate PPAs and growing demand for renewable energy is placing pressure on them to look at their business model again and find new ways to maintain market position and recover revenue streams that are being lost to off-grid or sleeved corporate buyer arrangements. Certified and competitively-priced green tariffs are one way utilities can directly service their carbon conscious customers but more green products are required. There is little doubt that in this dynamic sector there are more and more opportunities for companies and utilities alike to develop new products and transaction structures that will fuel the solar PV economy despite shrinking government support and subsidies.

Power Forward 2.0 – WWF, Ceres, Calvert Investments, David Gardiiner and Associates, 2015.

Rechargenews.

CNBC 29 March 2017

SEIA – Solar means business report 2016

In 2016, Norton Rose Fulbright co-authored with EY and the World Business Council for Sustainable Development the report “Corporate Renewable Power Purchase Agreements: Scaling up Globally”. In that, we provide a more detailed discussion of the structures and drivers discussed in this shorter article.

Publication

The current volatile and unpredictable economic climate creates challenges for businesses.

Publication

Recent tariffs and other trade measures have transformed the international trade landscape, impacting almost every sector, region and business worldwide.

Publication

In mid-March 2025, Cognia Law and Norton Rose Fulbright’s Legal Operations Consulting team co-hosted a second roundtable event that brought together senior leaders, including GCs, COO and head of legal operations, from across the legal industry to discuss how to drive meaningful change within the legal ecosystem.

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2025