Global offshore wind: Poland

Global | Publikation | Januar 2024

Information correct as of 31 December 2023.

Content

Focus on: Poland

Market overview

To date, there are no operational offshore wind projects along the Polish coast of the Baltic Sea. The first wave of offshore wind projects is in the late stage of development and pre-construction. The first projects are expected to be operational in 2026 at the earliest. Poland has set a target of 5.9 GW of installed capacity by 2030 and 8 - 11 GW in aggregate by 2040. The aforementioned objectives are subject to revision and are expected to be increased.

The main players active in the Polish offshore wind energy market include Polenergia, Equinor, PGE Polska Grupa Energetyczna, Ørsted, RWE, Ocean Winds, Northland Power, Iberdrola and Orlen.

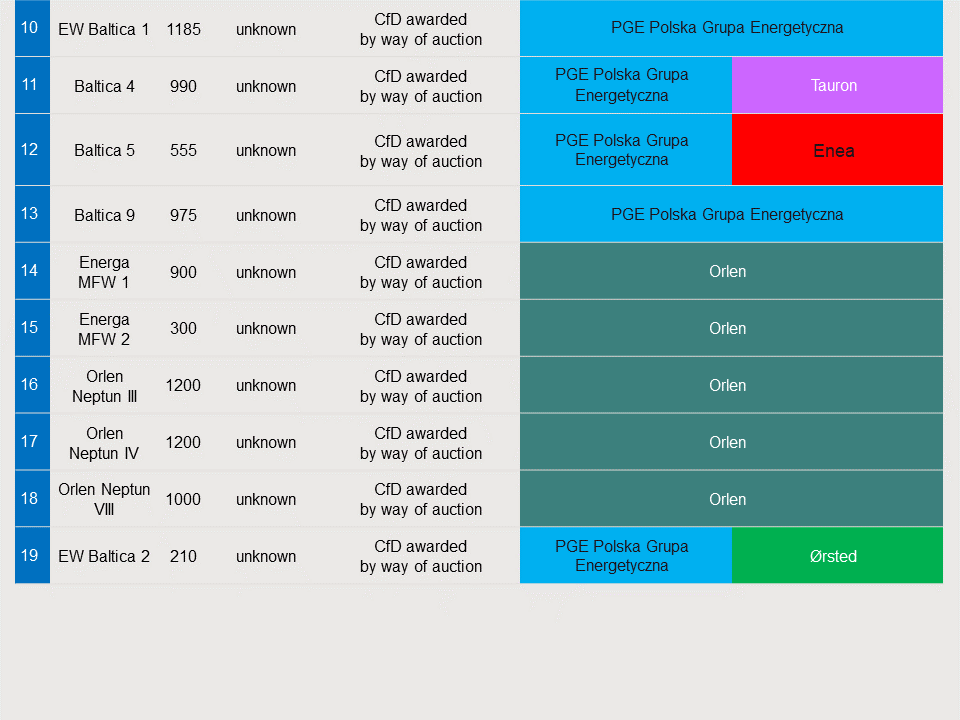

The map and the table below provide an overview of the Polish offshore wind projects under development.

Investments in offshore wind farms will give Poland the opportunity to boost economic growth and meet the EU’s pollution and carbon emissions standards. Development of only 6 GW in offshore wind farms may generate approximately PLN 17bn in tax revenues by 2030, mainly from corporate income tax and VAT receipts. Approximately PLN 2bn could flow into the national budget from personal income tax and location fees. The development of offshore wind farms will also have positive impact on the labour market with up to 77,000 new jobs, reducing the unemployment rate in coastal regions.

Poland: Offshore wind projects

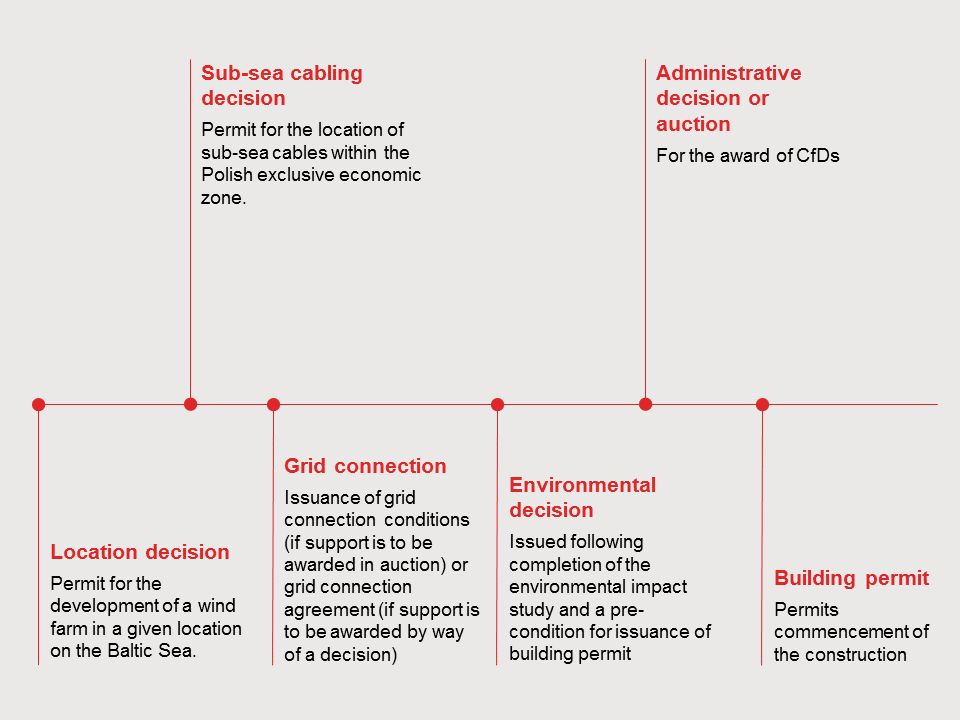

Poland: Development process

Poland: Support regime

The Act on the Promotion of Electricity Generation from the Offshore Wind Farms (Ustawa o promowaniu wytwarzania energii w morskich farmach wiatrowych, or the Polish Offshore Wind Act) of 17 December 2020 has entered into force on 18 February 2021 and has been amended on 17 August 2023. The amendment came into force on 1 October 2023. Pursuant to the Polish Offshore Wind Act, the Polish offshore wind farms can apply for support in the form of contracts for difference (CfDs), which will cover any negative balance between a strike price and the average market price of electricity. The contracts for difference will be awarded in the following manner:

- By way of an individual administrative decision issued by the President of the Energy Regulatory Office (the ERO President). This is available to the most advanced of Poland’s offshore wind projects, subject to a cap of 5.9 GW. The ERO President issued first CfD decisions by 30 June 2021 in respect of eight projects and upon acceptance of the state-aid by the European Commission, shall issue its final CfD decisions setting out final CfD strike price for each project thereafter.

- By way of auction (similar to onshore wind farms and PV installations). This is available for less advanced projects. The maximum available capacity is as follows:

| 2025 | 2027 | 2029 | 2031 | 2031 |

|---|---|---|---|---|

|

4 GW |

4 GW |

2 GW | 2 GW | If at least 500 MW of the 2.5 GW capacity available in 2031 is not awarded |

A final environmental decision and initial grid connection conditions (which constitute a basis for the execution of the grid connection agreement) are needed before support is awarded in an auction.

Hot topics

The support for the offshore wind in Poland is in the form of contracts for difference awarded for a 25-year period starting from the date when electricity is generated by the wind farm and delivered to the grid.

Throughout this 25-year support period, the guaranteed strike price will be indexed annually in accordance with the Polish consumer price index.

The offshore wind project operators will be obliged to generate electricity from the relevant offshore wind farm within seven years of the issuance of the decision or closing of the auction.

In order to be eligible under the support system, an offshore wind farm and its components cannot be manufactured later than 72 months prior to the first generation of electricity and cannot be already depreciated.

Poland: Obstacles and challenges

Currently the offshore wind sector in Poland is facing some of the typical difficulties a new industry may face:

Development challenges

Before the construction of the first offshore wind project in Poland begins, conflicts with fishermen unhappy with projects being implemented in their fishing areas will need to be resolved.

Skills

The availability of a workforce with the requisite training may be a factor slowing the development of offshore wind in Poland. Currently, employment in the Polish maritime economy is too low to support the needs of the offshore wind sector at the scale of development anticipated. Investment in intensive training and education programs will be required.

Complex permitting framework

A number of permits are required for the development to proceed. These include:

- location permit for the wind farm and underwater cables,

- environmental decision

- building permits

- occupancy permit

- electricity generation licence.

Administrative constraints

Developers face a high level of complexity and long waiting times in respect of administrative procedures. Review is needed to ensure consistency of the framework e.g. ensuring that the validity dates of different permits are aligned.

Grid connection costs

Developers are currently responsible for connecting the offshore wind farm to the onshore grid, and for the payment of the associated works costs (which may be up to 30 per cent of the total project costs). This may affect the strategic energy security of Poland, especially in the context of the future cross-border grids.

Poland investor outlook

Short-term outlook

The market outlook for Poland is positive. Domestic developers (such as Polenergia, PGE Polska Grupa Energetyczna, Orlen, TAURON Polska Energia, Energa and ZE PAK) together with international players (such as Equinor, Ørsted, RWE, EDP Renováveis / Engie, Vattenfall, TotalEnergies, Eolus, Shell, Eni and Qair) are showing interest in the development of the first offshore wind farms in the Polish exclusive economic zone of the Baltic Sea.

As domestic Polish developers generally have more limited experience in offshore wind, this may create M&A opportunities for international players with experience in more established markets to partner with the Polish developers. This has already been seen:

- In May 2018, Equinor purchased a 50 percent stake in Polenergia’s Bałtyk II and Bałtyk III offshore wind projects with aggregate capacity of up to 1,440 MW. In December 2019, Equinor bought a further stake in Bałtyk I, with a capacity of up to 1,560 MW.

- In December 2019, PGE and Ørsted have entered into a preliminary agreement for the purchase by Ørsted of a 50 percent stake in PGE’s Baltica 2 and Baltica 3 offshore wind projects with aggregate capacity of up to 2.543 MW.

- RWE entered the Polish offshore market in October 2019 by acquisition of FEW Baltic II 350 MW and 3 other offshore wind projects (all four with aggregate capacity of 1.5 GW).

- In December 2020, Iberdrola have acquired a 50 percent stake in Sea Wind to jointly develop the Polish pipeline of the early stage offshore wind projects with a capacity of 7.3 GW.

Long-term prospects

Renewable generation, notably onshore wind, have been subject to changes in law in Poland due to the perception that they are costly technologies when compared with coal-fired power plants. However, in parallel, the Polish government is looking for ways of reducing national greenhouse gas emissions and to meet electricity demand in the coming years. Offshore wind is widely considered a solution to both of these long-term policy goals.

Ones to watch in Poland: Future investment opportunities

| Planning | Future |

|---|---|

|

PGE Polska Grupa Energetyczna & Ørsted Baltica 2 Baltica 3 |

PGE Polska Grupa Energetyczna five projects (including Baltica 1) |

|

PGE Polska Grupa Energetyczna & Ørsted one project |

|

|

Orlen five projects |

|

|

Polenergia & Equinor Bałtyk II Bałtyk III |

Polenergia & Equinor Bałtyk I |

| RWE FEW Baltic II |

RWE three projects |

|

Orlen |

Iberdrola & Sea Wind |

|

Ocean Winds (EDP Renewables/Engie) |

Vattenfall & Synthos Green Energy |

Subscribe and stay up to date with the latest legal news, information and events . . .