Publication

Ontario’s Working for Workers Five Act receives royal assent

On October 28, Bill 190, Working for Workers Five Act, 2024 received royal assent.

Global | Publication | December 2017

Deployment of energy storage, especially batteries, will increase substantially in the next few years.

Three underlying trends in the energy markets will drive the growth. They are favorable federal and state regulations on energy storage, falling costs for batteries due to advances in technologies, and an improved ability by energy storage owners to tap into multiple revenue streams.

However, as with any novel technology, the array of opportunities for storage brings new types of risks. Project developers and investors need to understand the risks so that they can plan for contingencies and mitigate risks.

This article describes changes in the market that are driving deployment and improving the economics of storage and then identifies unique risks for storage projects and how participants in such projects can mitigate the risks.

The storage market is poised for exponential growth. By 2022, Greentech Media is projecting an annual market of 2,600 megawatts, which is nearly 12 times the size of the 2016 market.

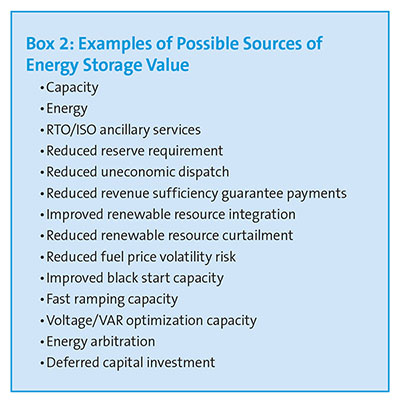

New market rules will enable owners of energy storage systems to earn revenue from a growing number of sources, such as deferred transmission and distribution upgrades, integration of intermittent resources, reduced demand or increased generating capacity to address peak load, the provision of ancillary services, and enhanced grid reliability and resiliency.

Until recently, storage was a square peg jammed into the round hole of historic regulation.

The existing federal regulation of wholesale power sales and transmission in interstate commerce was designed for a world largely devoid of any significant energy storage. Although pumped-storage hydroelectricity has been around for a long time, it has very different characteristics from modern storage technologies such as batteries, flywheels or thermal energy storage projects.

Federal and state governments are moving to encourage storage. Storage has benefited at the federal level from targeted loan and incentive programs offered by the US Department of Energy and from efforts by the Federal Energy Regulatory Commission to clear a path to wholesale market participation.

FERC has issued four orders in recent years that help energy storage. It also issued a notice of proposed rulemaking, or NOPR, in November 2016 proposing transparent market rules for energy storage facilities to participate in organized markets run by regional transmission organizations (RTOs) and independent system operators (ISOs). If the NOPR is adopted as proposed, storage would be eligible to provide all capacity, energy and ancillary services in such markets. The problem storage faces trying to participate in such markets today is the rules were developed for power plants and demand response companies and may unnecessarily limit the scope (and therefore compensation) of storage services. Most comments received by FERC in response to the NOPR were favorable — the comment window closed in February 2017 — but the proceeding was placed on hold while FERC sat without quorum for much of 2017. It remains to be seen whether the newly-reconstituted commission will pursue the NOPR.

The federal government also allows a 30% investment tax credit to be claimed on some storage facilities that are seen as part of solar and some wind projects. The key to eligibility is the storage equipment must be coupled to a renewable energy project and operated in a manner that it is considered power conditioning equipment or part of the generating equipment. At least 75% of the energy stored by the storage device should come from the renewable generator to which it is coupled. A stand-alone energy storage project would not qualify.

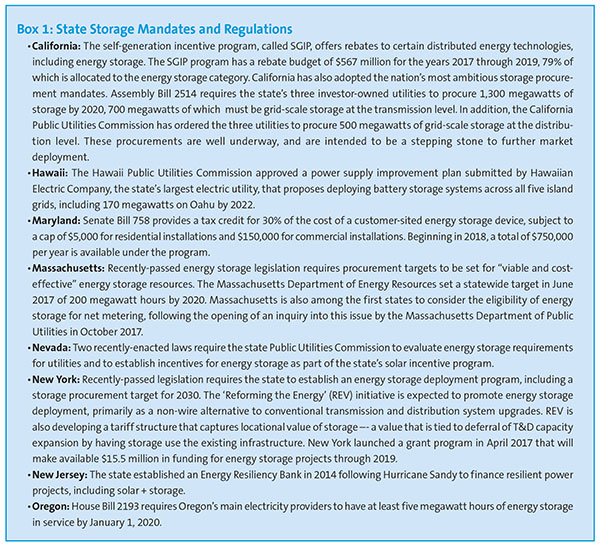

Many state governments have enacted, or are in the process of enacting, mandates or regulations to promote storage (see box 1). States will probably lead the charge on storage development in the near term since they have smaller constituencies and tend to be more nimble than the federal government in responding to market conditions. Some state and local governments also have a stronger appetite for renewable energy deployment than the current federal government. For example, the governors of 11 states and Puerto Rico and the mayor of the District of Columbia committed to comply with the Paris climate agreement after the Trump administration pulled out the United States.

Energy storage should follow the same pattern as other new technologies, such as solar.

Battery cell costs declined from $3,000 a kilowatt hour in the 1990s to $200 a kilowatt hour by 2016.

Utility-scale energy storage systems with four-hour storage capacity installed in the third quarter of 2017 had a median price of $525 a kilowatt hour. GTM Research projects this price to drop to $450 a kilowatt hour by 2019. The cost per unit capacity for these systems was in the range of $1,300 to $1,500 a kilowatt in 2017. It is expected to decline to $800 to $1,100 a kilowatt by 2020. This compares to an installed cost of $978 to $1,100 a kilowatt for a combined-cycle gas-fired power plant today.

Bloomberg New Energy Finance projected in 2015 that the installation costs of battery technologies will decline at 6% a year, meaning that the unit installation cost should, by 2025, be half of what it was in 2015.

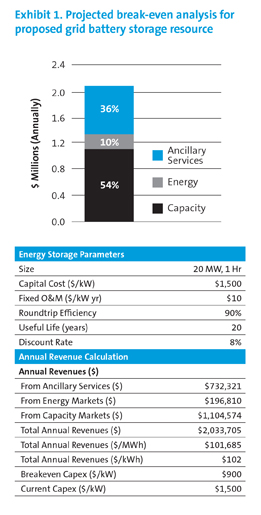

ICF recently simulated the operation of a battery storage device for a utility in the US Eastern Interconnection system and estimated that $2 million a year, or $102 per kilowatt hour, would be earned from capacity, energy and ancillary services (Exhibit 1). At a fixed charge rate of 10%, the break-even capital expenditures for the project would be about $900 per kilowatt of capacity. Considering the current installation cost for a lithium-based energy storage resources is $1,300 to $1,500 per kilowatt, the modeled application would not currently be economically viable. However, this type of storage should cross the break-even point in the next few years, even if these are the only revenue streams available to storage.

The true value of storage resources is not limited to capacity, energy and ancillary services. There are numerous sources of potential additional value (see box 2). Many regions already have markets that let energy storage owners tap into some of these additional revenue streams, and others will follow as government policies change.

Storage projects have unique risks stemming from unstable regulatory regimes, unprepared market structures, unique liability exposure, and unproven performance records. Creativity, flexibility and preparedness will help manage these risks.

There are two main types of regulatory risks.

One is the generic risk that a changing regulatory environment poses to new technologies. The other is the more specific risk that the investment tax credit may not be available or as beneficial as expected.

One need look no farther back than 2015 for an example of regulatory risk at the state level. The Nevada Public Utilities Commission terminated the state net metering policy; residential rooftop solar companies announced they were pulling out of the state. Although key aspects of the policy were later restored, the experience is a lesson to anyone trying to develop a new technology that relies on favorable government policy for support.

At the federal level, the risk currently is the lack of clarity about the regulatory treatment for energy storage. This is becoming more relevant in projects that combine energy storage with renewable power generation and make retail sales.

It is not clear under existing law whether the storage unit qualifies for regulatory exemptions typically claimed by small-scale renewable energy generators or how adding storage to a small power plant affects the generator’s own regulatory exemptions. (For a discussion of these risks, see “Solar + Storage: US Regulatory Issues” in the August 2017 NewsWire.)

For example, FERC includes storage within the definition of “generating facility” in its form small generator interconnection agreement and has proposed to do the same for its form large generator interconnection agreement.

However, energy storage is a unique animal. It is a hybrid in the sense that it shares some features in common with generating facilities and other features in common with transmission assets and load. This means it should be able to provide, in theory, a broader range of services than these other assets. The storage NOPR is one step toward integration of new storage technologies into wholesale markets, but a lot of work remains to be done to realize the full potential of storage.

One smart strategy for tackling regulatory risks is to combine energy storage with other generating assets. For example, many rooftop solar companies are deploying storage alongside solar installations. Combining storage with generating assets with stable revenue and well defined market participation rules helps mitigate the risk that changes in market rules may reduce or eliminate revenues from a specific storage service.

Another option in the face of regulatory uncertainty is to try to get certainty.

For example, one can ask for interpretive guidance or a declaratory order from FERC stating how the commission will apply its regulations to a certain set of facts. These options typically require both time and filing fees, but they could help settle important questions.

Some state regulators also offer a procedural option of requesting declaratory relief or an advisory opinion on regulatory matters. For example, in September 2017, Tesla obtained an advisory ruling from the Massachusetts Department of Public Utilities that said certain small-scale batteries paired with solar generating facilities are eligible for net metering. The ruling was issued in fewer than four months after Tesla filed a petition and prompted Massachusetts to open a general docket on eligibility of energy storage for net metering.

A third mitigation strategy is to draft storage contracts to address potential changes in the regulatory regime. This could mean including a mechanism to revisit pricing in the event of a change in law. Alternatively, the parties could be required to enter into good-faith negotiations to restore the benefit of each party’s bargain after a change in law.

The other regulatory risk is that an investment tax credit will be claimed on the cost of a storage facility, but then the mix of electricity stored changes over the first five years when the credit is exposed to full or partial recapture. The IRS requires no more than 25% of the energy stored come from other sources than the solar or wind facility of which the storage device is a part and then the percentage of other energy storage determines the amount of investment tax credit that can be claimed. For example, if 10% of the storage energy is from other sources the first year, then only 90% of the full ITC can be claimed. If the percentage of other energy stored increases in any of the next four years, the credit is subject to partial recapture.

The best mitigation method for this type of risk is thorough and accurate modeling of system operation under the full range of operating conditions, and with the system providing all anticipated energy services, to estimate the fraction of charging energy supplied by the linked solar or wind project. To the extent the offtaker has a right to control charging, the owner may want to build in a right to recover any ITC-related recapture or losses.

ISO and RTO market rules allowing “merchant” storage are often the same rules developed for conventional generators and, as such, may not adequately reflect operating capabilities or performance risks that are unique to energy storage. This may limit the ability of storage to compete in the market and make the potential revenue stream more unpredictable than it is for other market participants.

FERC regulations designed to provide fair compensation for the unique operating characteristics of energy storage would eliminate some of these risks.

FERC adoption of the 2016 NOPR would help. Until it does so, the best mitigation for this type of risk is to become intimately acquainted with the rules of the market you intend to bid into, and to write into contracts a right to renegotiate penalties and revenue allocation should market rules change.

The ISOs and RTOs also offer various working groups and stakeholder forums in which to raise issues and become involved in market design. It may be prudent to take full advantage of these opportunities if a substantial investment is anticipated.

Few utilities currently have significant experience with storage, and developers proposing novel storage projects to inexperienced utilities should expect that the interconnection process will take time.

In addition, if a proposed project will provide frequency regulation or any other service that may require on-peak charging, it is possible that the utility will require costly network upgrades that would otherwise not be necessary.

The best mitigation may be to recognize that as more utilities gain experience with storage, the duration of the interconnection agreement process will decline. Until then, developers can minimize delays by ensuring that their interconnection applications are clear and complete, by responding rapidly to utility information requests, and by maintaining frequent communication with utility personnel.

The cost of network upgrades required for interconnection may be reduced by avoiding services that will require on-peak charging, but the value of such services may exceed the incremental cost of the network upgrades. Developers can ask the utility to do an interconnection feasibility assessment early in the process. This will help identify the lowest cost interconnection location.

State programs to encourage particular types of participants in wholesale markets are at an increased risk of litigation following the Supreme Court decision in 2016 in Hughes v. Talen Energy Marketing.

The case involved efforts by two states to encourage construction of new gas-fired power plants. (For a discussion about the decision, see “Supreme Court Nixes Two PPAs” in the June 2016 NewsWire.) The decision has led to questions about exactly where the line is between state and federal jurisdiction when a state’s actions may affect wholesale power markets.

Challenges to other state subsidies are currently working their way through the courts and may provide greater clarity. (For example, see “Zero Emissions Credits Upheld” in the August 2017 NewsWire.) Any state laws or programs that favor storage may be at risk to challenge.

Energy storage is also subject to other general litigation risks, including environmental, human impact and intellectual property risks, but at a higher level due to its novelty.

The environmental risk varies greatly depending on the technology and siting. Battery leakage is one example of an environmental hazard that is unique to some storage technologies. There is also environmental risk associated with disposal after the equipment is decommissioned. New technologies have no track record.

The evolving nature of the storage market and rapid deployment of new technology makes storage a prime target for intellectual property challenges.

The parties to a storage contract can allocate litigation risks in the contract. Consideration should be given to requiring liability insurance for the various environmental, intellectual property and other risks.

New technology carries obvious performance risks. Poor performance jeopardizes contracts and could subject developers to heavy non-performance penalties in certain wholesale markets.

Manufacturer warranties and other performance guarantees and even insurance policies can help. They exist currently for rooftop solar, for example. They need to be developed for storage. Developers should make sure that adding storage to other forms of generation will not invalidate any performance guarantees attached to the generating facility.

Performance risk should be considered both in terms of initial system performance risk and long-term performance risk.

Developers usually buy batteries directly from the manufacturer and focus primarily on system integration. If the developer does not have a comprehensive understanding of battery capabilities and limitations, such as maximum charge and discharge rates, thermal requirements and cycle life, there is a strong possibility that the control room will mismanage the battery, and the overall system will be unable to satisfy power purchase agreement performance expectations, with the potential for adverse financial impacts or litigation.

The primary mitigation for this type of risk is to have a thorough understanding of battery capabilities and limitations and to design a system that will reliably provide all contracted services for the duration of the contract.

This requires accurate modeling of battery system operation. Some battery services, such as fast ramping, demand-charge reduction and spinning reserve, can be much more taxing on some batteries than others. This should be reflected in the model.

Many PPAs have terms that exceed expected battery lives.

If storage services are required for 20 years, then the developer must plan for battery replacement at appropriate intervals. Earlier replacement will be required for batteries that allow deep discharge than for storage devices that are designed primarily for backup power and frequency regulation. Developers frequently underestimate the costs of system operations and maintenance.

The main mitigation for this risk is to come up with an appropriate O&M plan based on a thorough understanding of how the battery will work. In addition to periodic battery replacement, this includes having spare power conditioning equipment (inverters, voltage converters) and service technicians available to address unplanned outages or degraded capabilities. Most energy storage systems have continuous monitoring and, to an increasing degree, developers are providing this service in-house. This enables faster detection and resolution of system performance. Independent engineers evaluating system design usually also evaluate the O&M plan.

Ken Collison and Shankar Chandramowli with ICF in Fairfax, Virginia, alongside Caileen Kateri Gamache and Deanne M. Barrow, co-authored this article.

Publication

On October 28, Bill 190, Working for Workers Five Act, 2024 received royal assent.

Publication

The Federal Court of Appeal’s 2023 decision in Canada (Attorney General) v Benjamin Moore & Co [Benjamin Moore FCA] overturned the Federal Court’s decision in Benjamin Moore & Co. v. Canada (Attorney General) [Benjamin Moore FC] that had previously established a new test for patentable subject matter in computer-implemented inventions.

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2023